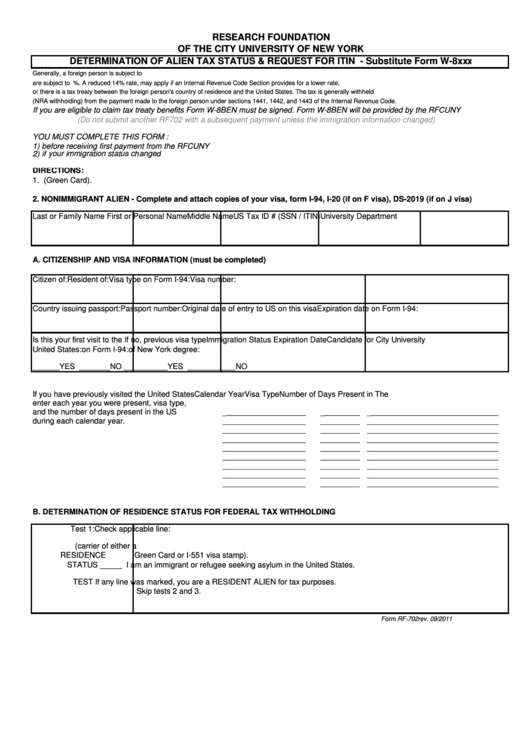

Determination Of Alien Tax Status & Request For Itin - Substitute Form W-8 - Research Foundation Of The City University Of New York

ADVERTISEMENT

RESEARCH FOUNDATION

OF THE CITY UNIVERSITY OF NEW YORK

DETERMINATION OF ALIEN TAX STATUS & REQUEST FOR ITIN - Substitute Form W-8xxx

Generally, a foreign person is subject to U.S. tax on its U.S. source income. Most types of U.S. source income received by a foreign person

are subject to U.S. tax of 30%. A reduced 14% rate, may apply if an Internal Revenue Code Section provides for a lower rate,

or there is a tax treaty between the foreign person's country of residence and the United States. The tax is generally withheld

(NRA withholding) from the payment made to the foreign person under sections 1441, 1442, and 1443 of the Internal Revenue Code.

If you are eligible to claim tax treaty benefits Form W-8BEN must be signed. Form W-8BEN will be provided by the RFCUNY

(Do not submit another RF702 with a subsequent payment unless the immigration information changed)

YOU MUST COMPLETE THIS FORM :

1) before receiving first payment from the RFCUNY

2) if your immigration status changed

DIRECTIONS:

1. U.S. PERMANENT RESIDENT - submit a photocopy of your form I-551 (Green Card).

2. NONIMMIGRANT ALIEN - Complete and attach copies of your visa, form I-94, I-20 (if on F visa), DS-2019 (if on J visa)

Last or Family Name

First or Personal Name

Middle Name

US Tax ID # (SSN / ITIN)

University Department

A. CITIZENSHIP AND VISA INFORMATION (must be completed)

Citizen of:

Resident of:

Visa type on Form I-94:

Visa number:

Country issuing passport:

Passport number:

Original date of entry to US on this visa

Expiration date on Form I-94:

Is this your first visit to the

If no, previous visa type Immigration Status Expiration Date

Candidate for City University

United States:

on Form I-94:

of New York degree:

______YES _______NO

__________YES ___________NO

If you have previously visited the United States

Calendar Year

Visa Type

Number of Days Present in The U.S.

enter each year you were present, visa type,

and the number of days present in the US

___________________

_________ ______________________________

during each calendar year.

___________________

_________ ______________________________

___________________

_________ ______________________________

___________________

_________ ______________________________

___________________

_________ ______________________________

___________________

_________ ______________________________

___________________

_________ ______________________________

___________________

_________ ______________________________

___________________

_________ ______________________________

B. DETERMINATION OF RESIDENCE STATUS FOR FEDERAL TAX WITHHOLDING

Test 1:

Check applicable line:

U.S.

_____ I am a lawful permanent resident of the United States (carrier of either a

RESIDENCE

Green Card or I-551 visa stamp).

STATUS

_____ I am an immigrant or refugee seeking asylum in the United States.

TEST

If any line was marked, you are a RESIDENT ALIEN for tax purposes.

Skip tests 2 and 3.

Form RF-702 rev. 09/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2