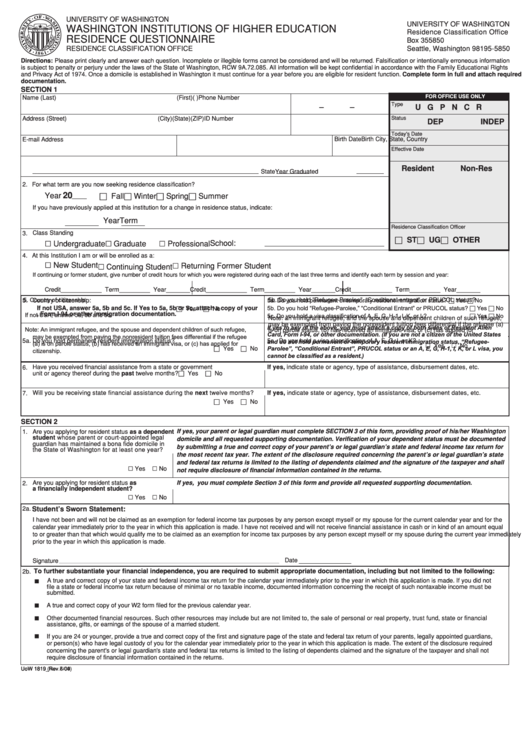

UNIVERSITY OF WASHINGTON

UNIVERSITY OF WASHINGTON

WASHINGTON INSTITUTIONS OF HIGHER EDUCATION

Residence Classification Office

RESIDENCE QUESTIONNAIRE

Box 355850

RESIDENCE CLASSIFICATION OFFICE

Seattle, Washington 98195-5850

Directions: Please print clearly and answer each question. Incomplete or illegible forms cannot be considered and will be returned. Falsification or intentionally erroneous information

is subject to penalty or perjury under the laws of the State of Washington, RCW 9A.72.085. All information will be kept confidential in accordance with the Family Educational Rights

and Privacy Act of 1974. Once a domicile is established in Washington it must continue for a year before you are eligible for resident function. Complete form in full and attach required

documentation.

SECTION 1

FOR OFFICE USE ONLY

Name (Last)

(First)

(M.I.)

Phone Number

Type

–

–

U

G

P

N

C

R

Address (Street)

(City)

(State)

(ZIP)

ID Number

Status

DEP

INDEP

Today's Date

E-mail Address

Birth City, State, Country

Birth Date

Effective Date

1. Name of Last High School Attended

Resident

Non-Res

State

Year Graduated

2. For what term are you now seeking residence classification?

20

Year

Fall

Winter

Spring

Summer

If you have previously applied at this institution for a change in residence status, indicate:

Term

Year

Residence Classification Officer

Class Standing

3.

ST

UG

OTHER

„ Undergraduate

„ Graduate

„ Professional

School:

4. At this Institution I am or will be enrolled as a:

„ New Student

„ Returning Former Student

„ Continuing Student

If continuing or former student, give number of credit hours for which you were registered during each of the last three terms and identify each term by session and year:

Credit____________ Term_________ Year_______

Credit____________ Term_________ Year_______

Credit____________ Term_________ Year_______

5.

5. Country of citizenship:

Country of citzenship:

5a. Do you hold permanent or temporary resident immigration status?

5b. Do you hold ”Refugee-Parolee”, “Conditional entrant” or PRUCOL status?

□ Yes □ No

If not USA, answer 5a, 5b and 5c. If Yes to 5a, 5b or 5c, attach a copy of your

5b. Do you hold “Refugee-Parolee,” “Conditional Entrant” or PRUCOL status? □ Yes □ No

Yes

No

U.S. Permanent Resident card, Form I-94 or other immigration documentation.

If not USA, answer 5a, 5b and 5c.

5c. Do you hold a visa classification of A, E, G, H-1, I, K, or L?

□ Yes □ No

Note: an immigrant refugee, and the spouse and dependent children of such refugee,

may be exempted from paying the nonresident tuition fees differential if the refugee (a)

If yes to any of the above, you must attach a copy of both sides of Resident Alien

Note: An immigrant refugee, and the spouse and dependent children of such refugee,

is on parole status, (b) has received an immigrant visa, or (c) has applied for U.S. citzenship.

Card, Form I-94, or other documentation. (If you are not a citizen of the United States

may be exempted from paying the nonresident tuition fees differential if the refugee

5a.

Do you hold permanent resident immigration status?

5c.

Do you hold a visa classification of A, E, G, I, or K?

and do not hold permanent or temporary resident immigration status, “Refugee-

(a) is on parole status, (b) has received an immigrant visa, or (c) has applied for U.S.

„ Yes

„ No

Yes

No

Parolee”, “Conditional Entrant”, PRUCOL status or an A, E, G, H-1, I, K, or L visa, you

citizenship.

cannot be classified as a resident.)

Have you received financial assistance from a state or government

If yes, indicate state or agency, type of assistance, disbursement dates, etc.

6.

unit or agency thereof during the past twelve months?

Yes

No

7.

Will you be receiving state financial assistance during the next twelve months?

If yes, indicate state or agency, type of assistance, disbursement dates, etc.

Yes

No

SECTION 2

If yes, your parent or legal guardian must complete SECTION 3 of this form, providing proof of his/her Washington

1.

Are you applying for resident status as a dependent

student whose parent or court-appointed legal

domicile and all requested supporting documentation. Verification of your dependent status must be documented

guardian has maintained a bona fide domicile in

by submitting a true and correct copy of your parent’s or legal guardian’s state and federal income tax return for

the State of Washington for at least one year?

the most recent tax year. The extent of the disclosure required concerning the parent’s or legal guardian’s state

and federal tax returns is limited to the listing of dependents claimed and the signature of the taxpayer and shall

„ Yes

„ No

not require disclosure of financial information contained in the returns.

Are you applying for resident status as

2.

If yes, you must complete Section 3 of this form and provide all requested supporting documentation.

a financially independent student?

„ Yes

„ No

2a.

Student’s Sworn Statement:

I have not been and will not be claimed as an exemption for federal income tax purposes by any person except myself or my spouse for the current calendar year and for the

calendar year immediately prior to the year in which this application is made. I have not received and will not receive financial assistance in cash or in kind of an amount equal

to or greater than that which would qualify me to be claimed as an exemption for income tax purposes by any person except myself or my spouse during the current year immediately

prior to the year in which this application is made.

Date

Signature

To further substantiate your financial independence, you are required to submit appropriate documentation, including but not limited to the following:

2b.

A true and correct copy of your state and federal income tax return for the calendar year immediately prior to the year in which this application is made. If you did not

{

file a state or federal income tax return because of minimal or no taxable income, documented information concerning the receipt of such nontaxable income must be

submitted.

A true and correct copy of your W2 form filed for the previous calendar year.

{

Other documented financial resources. Such other resources may include but are not limited to, the sale of personal or real property, trust fund, state or financial

{

assistance, gifts, or earnings of the spouse of a married student.

If you are 24 or younger, provide a true and correct copy of the first and signature page of the state and federal tax return of your parents, legally appointed guardians,

{

or person(s) who have legal custody of you for the calendar year immediately prior to the year in which this application is made. The extent of the disclosure required

concerning the parent's or legal guardian's state and federal tax returns is limited to the listing of dependents claimed and the signature of the taxpayer and shall not

require disclosure of financial information contained in the returns.

UoW 1819 (Rev.6/04)

UoW 1819_Rev 7-09

1

1 2

2