Tax Reporting Attestation

ADVERTISEMENT

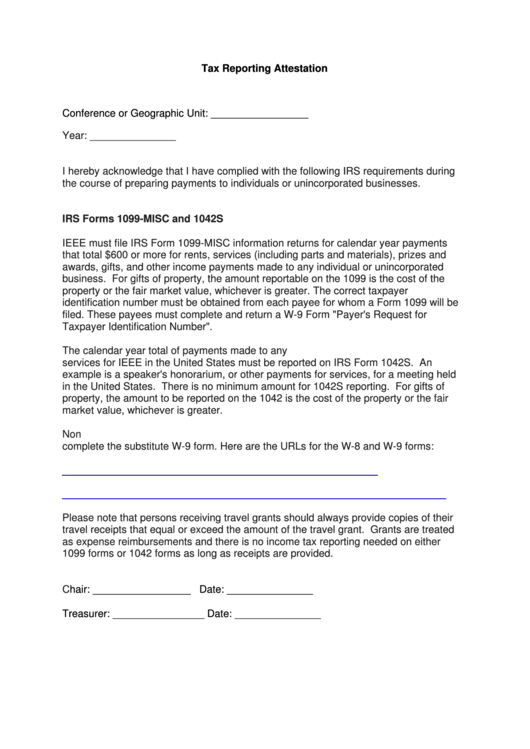

Tax Reporting Attestation

Conference or Geographic Unit: _________________

Year: _______________

I hereby acknowledge that I have complied with the following IRS requirements during

the course of preparing payments to individuals or unincorporated businesses.

IRS Forms 1099-MISC and 1042S

IEEE must file IRS Form 1099-MISC information returns for calendar year payments

that total $600 or more for rents, services (including parts and materials), prizes and

awards, gifts, and other income payments made to any individual or unincorporated

business. For gifts of property, the amount reportable on the 1099 is the cost of the

property or the fair market value, whichever is greater. The correct taxpayer

identification number must be obtained from each payee for whom a Form 1099 will be

filed. These payees must complete and return a W-9 Form "Payer's Request for

Taxpayer Identification Number".

The calendar year total of payments made to any non-U.S. person who is performing

services for IEEE in the United States must be reported on IRS Form 1042S. An

example is a speaker's honorarium, or other payments for services, for a meeting held

in the United States. There is no minimum amount for 1042S reporting. For gifts of

property, the amount to be reported on the 1042 is the cost of the property or the fair

market value, whichever is greater.

Non-U.S. students need to complete the substitute W-8 form. U.S. students must

complete the substitute W-9 form. Here are the URLs for the W-8 and W-9 forms:

Please note that persons receiving travel grants should always provide copies of their

travel receipts that equal or exceed the amount of the travel grant. Grants are treated

as expense reimbursements and there is no income tax reporting needed on either

1099 forms or 1042 forms as long as receipts are provided.

Chair: _________________ Date: _______________

Treasurer: ________________ Date: _______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1