Form Sub W-9 (Substitute Form W9) - Ohio Reporting Form Request For Taxpayer Identification Number And Certification - Butler County, Ohio

ADVERTISEMENT

Form

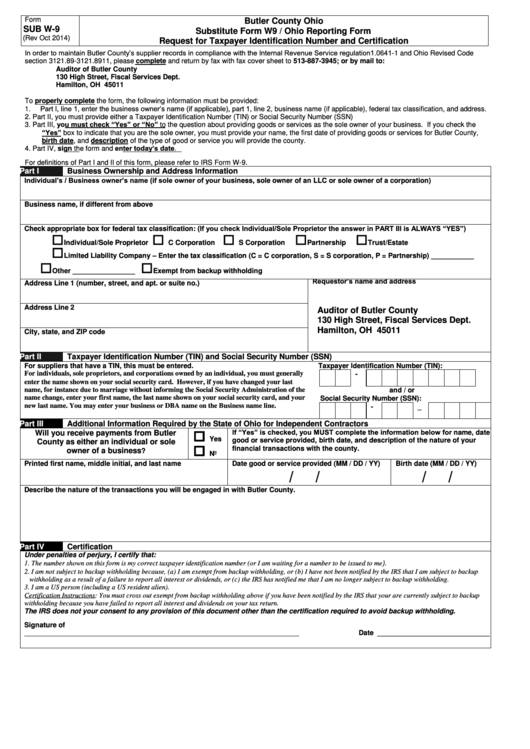

Butler County Ohio

SUB W-9

Substitute Form W9 / Ohio Reporting Form

(Rev Oct 2014)

Request for Taxpayer Identification Number and Certification

In order to maintain Butler County’s supplier records in compliance with the Internal Revenue Service regulation1.0641-1 and Ohio Revised Code

section 3121.89-3121.8911, please complete and return by fax with fax cover sheet to 513-887-3945; or by mail to:

Auditor of Butler County

130 High Street, Fiscal Services Dept.

Hamilton, OH 45011

To properly complete the form, the following information must be provided:

Part I, line 1, enter the business owner’s name (if applicable), part 1, line 2, business name (if applicable), federal tax classification, and address.

1.

2.

Part II, you must provide either a Taxpayer Identification Number (TIN) or Social Security Number (SSN)

Part III, you must check “Yes” or “No” to the question about providing goods or services as the sole owner of your business. If you check the

3.

“Yes” box to indicate that you are the sole owner, you must provide your name, the first date of providing goods or services for Butler County,

birth date, and description of the type of good or service you will provide the county.

Part IV, sign the form and enter today’s date.

4.

For definitions of Part I and II of this form, please refer to IRS Form W-9.

Part I

Business Ownership and Address Information

Individual’s / Business owner’s name (if sole owner of your business, sole owner of an LLC or sole owner of a corporation)

Business name, if different from above

Check appropriate box for federal tax classification: (If you check Individual/Sole Proprietor the answer in PART III is ALWAYS “YES”)

Individual/Sole Proprietor

C Corporation

S Corporation

Partnership

Trust/Estate

Limited Liability Company – Enter the tax classification (C = C corporation, S = S corporation, P = Partnership) ___________

Other ________________

Exempt from backup withholding

Requestor’s name and address

Address Line 1 (number, street, and apt. or suite no.)

Address Line 2

Auditor of Butler County

130 High Street, Fiscal Services Dept.

Hamilton, OH 45011

City, state, and ZIP code

Part II

Taxpayer Identification Number (TIN) and Social Security Number (SSN)

For suppliers that have a TIN, this must be entered.

Taxpayer Identification Number (TIN):

For individuals, sole proprietors, and corporations owned by an individual, you must generally

-

enter the name shown on your social security card. However, if you have changed your last

name, for instance due to marriage without informing the Social Security Administration of the

and / or

name change, enter your first name, the last name shown on your social security card, and your

Social Security Number (SSN):

new last name. You may enter your business or DBA name on the Business name line.

-

_

Part III

Additional Information Required by the State of Ohio for Independent Contractors

If “Yes” is checked, you MUST complete the information below for name, date

Will you receive payments from Butler

Yes

good or service provided, birth date, and description of the nature of your

County as either an individual or sole

financial transactions with the county.

owner of a business

?

No

Printed first name, middle initial, and last name

Date good or service provided (MM / DD / YY)

Birth date (MM / DD / YY)

/

/

/

/

Describe the nature of the transactions you will be engaged in with Butler County.

Part IV

Certification

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me).

2. I am not subject to backup withholding because, (a) I am exempt from backup withholding, or (b) I have not been notified by the IRS that I am subject to backup

withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding.

3. I am a US person (including a US resident alien).

Certification Instructions: You must cross out exempt from backup withholding above if you have been notified by the IRS that your are currently subject to backup

withholding because you have failed to report all interest and dividends on your tax return.

The IRS does not your consent to any provision of this document other than the certification required to avoid backup withholding.

Signature of

U.S. person _______________________________________________________________________

Date _____________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1