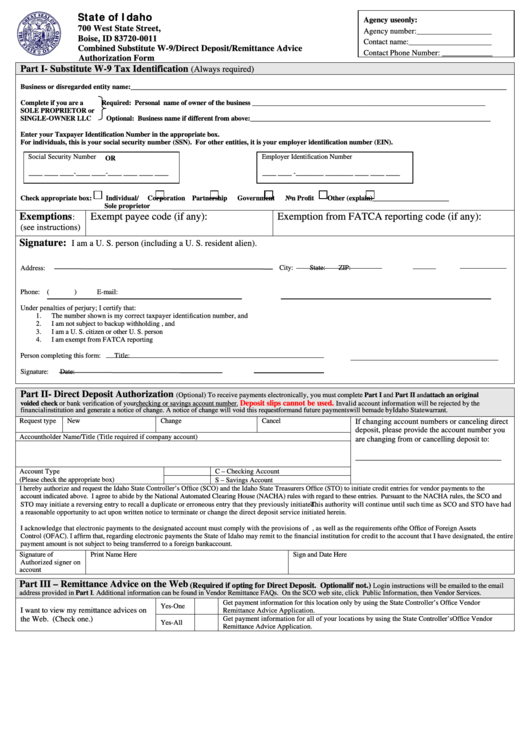

State of Idaho

Agency use only:

700 West State Street, P.O. Box 83720

Agency number: ___________________

Boise, ID 83720-0011

Contact name: _____________________

Combined Substitute W-9/Direct Deposit/Remittance Advice

Contact Phone Number: _____________

Authorization Form

Part I - Substitute W-9 Tax Identification

(Always required)

Business or disregarded entity name:____________________________________________________________________________________________________________

Complete if you are a

Required: Personal name of owner of the business ___________________________________________________________________

SOLE PROPRIETOR or

SINGLE-OWNER LLC

Optional: Business name if different from above:_____________________________________________________________________

Enter your Taxpayer Identification Number in the appropriate box.

For individuals, this is your social security number (SSN). For other entities, it is your employer identification number (EIN).

Social Security Number

Employer Identification Number

OR

____ ____ ____-____ ____-____ ____ ____ ____

____ ____ -____ ____ ____ ____ ____ ____ ____

Check appropriate box:

Individual/

Corporation

Partnership

Government

Non Profit

Other (explain)______________________

Sole proprietor

Exemptions

Exempt payee code (if any):

Exemption from FATCA reporting code (if any):

:

(see instructions)

Signature:

I am a U. S. person (including a U. S. resident alien).

Address:

City:

State:

ZIP:

Phone: (

)

E-mail:

Under penalties of perjury; I certify that:

1.

The number shown is my correct taxpayer identification number, and

2.

I am not subject to backup withholding , and

3.

I am a U. S. citizen or other U. S. person

4.

I am exempt from FATCA reporting

Person completing this form:

Title:

Signature:

Date:

Part II - Direct Deposit Authorization

(Optional) To receive payments electronically, you must complete Part I and Part II and attach an original

Deposit slips cannot be used.

voided check or bank verification of your checking or savings account number.

Invalid account information will be rejected by the

financial institution and generate a notice of change. A notice of change will void this request form and future payments will be made by Idaho State warrant.

Request type

New

Change

Cancel

If changing account numbers or canceling direct

deposit, please provide the account number you

Accountholder Name/Title (Title required if company account)

are changing from or cancelling deposit to:

_____________________________________

Account Type

C – Checking Account

(Please check the appropriate box)

S – Savings Account

I hereby authorize and request the Idaho State Controller’s Office (SCO) and the Idaho State Treasurers Office (STO) to initiate credit entries for vendor payments to the

account indicated above. I agree to abide by the National Automated Clearing House (NACHA) rules with regard to these entries. Pursuant to the NACHA rules, the SCO and

STO may initiate a reversing entry to recall a duplicate or erroneous entry that they previously initiated. This authority will continue until such time as SCO and STO have had

a reasonable opportunity to act upon written notice to terminate or change the direct deposit service initiated herein.

I acknowledge that electronic payments to the designated account must comply with the provisions of U.S. law, as well as the requirements of the Office of Foreign Assets

Control (OFAC). I affirm that, regarding electronic payments the State of Idaho may remit to the financial institution for credit to the account that I have designated, the entire

payment amount is not subject to being transferred to a foreign bank account.

Signature of

Print Name Here

Sign and Date Here

Authorized signer on

account

Part III – Remittance Advice on the Web

(Required if opting for Direct Deposit. Optional if not.)

Login instructions will be emailed to the email

address provided in Part I. Additional information can be found in Vendor Remittance FAQs. On the SCO web site, click Public Information, then Vendor Services.

Get payment information for this location only by using the State Controller’s Office Vendor

Yes-One

I want to view my remittance advices on

Remittance Advice Application.

Get payment information for all of your locations by using the State Controller’s Office Vendor

the Web. (Check one.)

Yes-All

Remittance Advice Application.

1

1 2

2