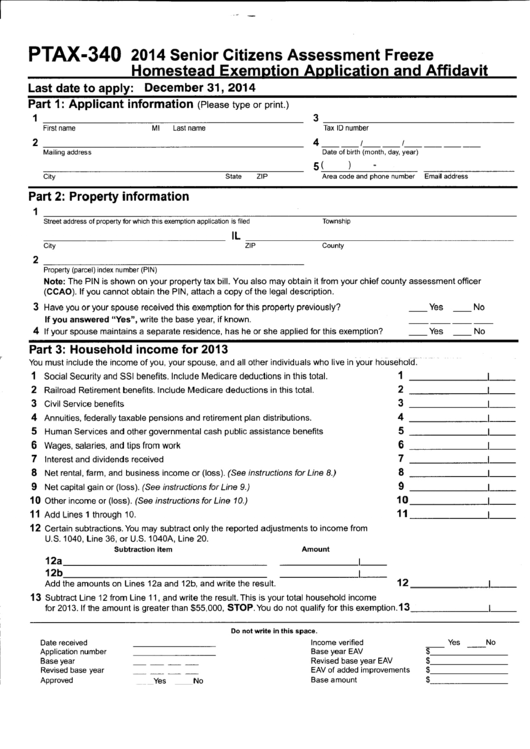

PTAX-340

2014 Senior Citizens Assessment Freeze

Homestead Exemption Application and Affidavit

Last date to apply: December 31, 2014

Part 1: Applicant information

(Please type or print.)

1

3=-=-~----------------------

First name

Ml

Last name

Tax 10 number

2 ------------------------------------------ 4 _ _ / _ _ / _ _ _ _

Mailing address

Date of birth (month, day, year)

5 _( -------------

City

State

ZIP

Area code and phone number

Email address

Part 2: Property information

1

Street address of property for which this exemption application is filed

Township

IL ------------------------------------------

City

ZIP

2

--------~--~~~-----------------------

Property (parcel) index number (PIN)

County

Note: The PIN is shown on your property tax bill. You also may obtain it from your chief county assessment officer

(CCAO). If you cannot obtain the PIN, attach a copy of the legal description.

3 Have you or your spouse received this exemption for this property previously?

Yes

No

If you answered "Yes", write the base year, if known.

4

If your spouse maintains a separate residence, has he or she applied for this exemption?

Yes

No

Part 3: Household income for 2013

You must include the income of you, your spouse, and all other individuals who live in your

household~

·

1 Social Security and SSI benefits. Include Medicare deductions in this total.

1

___________ I _ _

2

Railroad Retirement benefits. Include Medicare deductions in this total.

3 Civil Service benefits

4

Annuities, federally taxable pensions and retirement plan distributions.

5

Human Services and other governmental cash public assistance benefits

6

Wages, salaries, and tips from work

7

Interest and dividends received

8

Net rental, farm, and business income or (loss).

(See

instructions for Line 8.)

9

Net capital gain or (loss).

(See

instructions for Line 9.)

10 Other income or (loss).

(See

instructions for Line 10.)

11 Add Lines 1 through 10.

12 Certain subtractions. You may subtract only the reported adjustments to income from

U.S. 1040, Line 36,

or

U.S. 1 040A, Line 20.

Subtraction item

Amount

12a________________________________ _ ___________ I __ __

12b________________________________ _ ___________ , I

Add the amounts on Lines 12a and 12b, and write the result.

13 Subtract Line 12 from Line 11, and write the result. This is your total household income

2

I _ _

3

I

4 __________ _

5

6

7

________ I ___

8 ______ __

9 ______ __

10 _ _ _ _ _ _ _

11 ______ _

12 _ _ _ _ _ _

for 2013. If the amount is greater than $55,000,

STOP.

You do not qualify for this exemption.13 ________

l _ _

Date received

Application number

Base year

Revised base year

Approved

___ Yes

No

Do not write in this space.

Income verified

Base year EAV

Revised base year EAV

EAV of added improvements

Base amount

Yes

No

-$-

$ ___________ _

$ ___________ _

$ _ _ _ _ _ _ _ __

1

1 2

2 3

3 4

4