Poverty Exemption Policy - York Township Michigan

ADVERTISEMENT

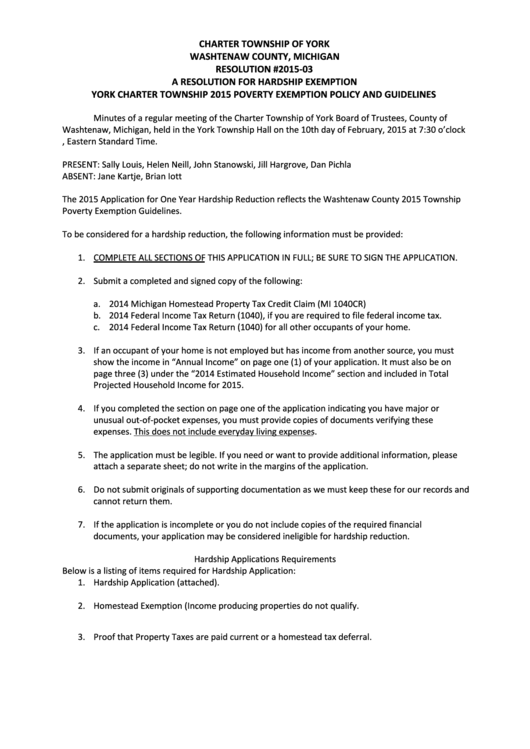

CHARTER TOWNSHIP OF YORK

WASHTENAW COUNTY, MICHIGAN

RESOLUTION #2015-03

A RESOLUTION FOR HARDSHIP EXEMPTION

YORK CHARTER TOWNSHIP 2015 POVERTY EXEMPTION POLICY AND GUIDELINES

Minutes of a regular meeting of the Charter Township of York Board of Trustees, County of

Washtenaw, Michigan, held in the York Township Hall on the 10th day of February, 2015 at 7:30 o’clock

p.m., Eastern Standard Time.

PRESENT:

Sally Louis, Helen Neill, John Stanowski, Jill Hargrove, Dan Pichla

ABSENT:

Jane Kartje, Brian Iott

The 2015 Application for One Year Hardship Reduction reflects the Washtenaw County 2015 Township

Poverty Exemption Guidelines.

To be considered for a hardship reduction, the following information must be provided:

1. COMPLETE ALL SECTIONS OF THIS APPLICATION IN FULL; BE SURE TO SIGN THE APPLICATION.

2. Submit a completed and signed copy of the following:

a. 2014 Michigan Homestead Property Tax Credit Claim (MI 1040CR)

b. 2014 Federal Income Tax Return (1040), if you are required to file federal income tax.

c. 2014 Federal Income Tax Return (1040) for all other occupants of your home.

3. If an occupant of your home is not employed but has income from another source, you must

show the income in “Annual Income” on page one (1) of your application. It must also be on

page three (3) under the “2014 Estimated Household Income” section and included in Total

Projected Household Income for 2015.

4. If you completed the section on page one of the application indicating you have major or

unusual out-of-pocket expenses, you must provide copies of documents verifying these

expenses. This does not include everyday living expenses.

5. The application must be legible. If you need or want to provide additional information, please

attach a separate sheet; do not write in the margins of the application.

6. Do not submit originals of supporting documentation as we must keep these for our records and

cannot return them.

7. If the application is incomplete or you do not include copies of the required financial

documents, your application may be considered ineligible for hardship reduction.

Hardship Applications Requirements

Below is a listing of items required for Hardship Application:

1. Hardship Application (attached).

2. Homestead Exemption (Income producing properties do not qualify.

3. Proof that Property Taxes are paid current or a homestead tax deferral.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3