Multiple Activities Tax Credit Form - City Of Bellingham

ADVERTISEMENT

Firm Name:_____________________________ Registration #__________

Prepared by: _________________________________________________

City of Bellingham

Tax Period: _________________, 20___

Finance Department

210 Lottie St

Bellingham WA 98225

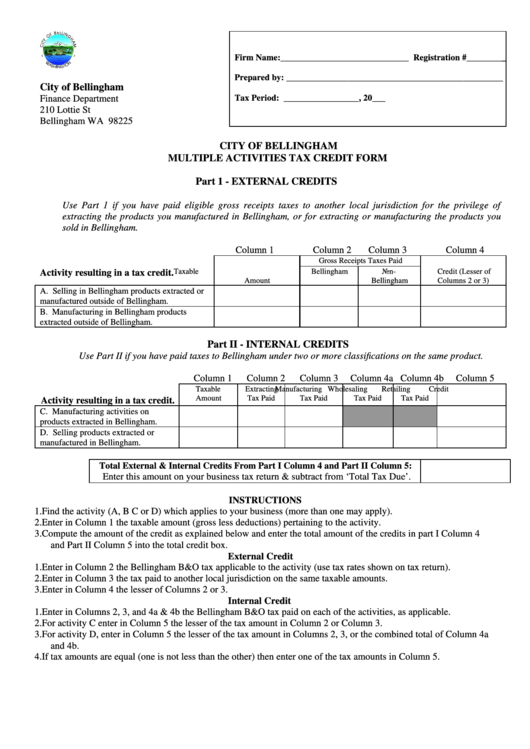

CITY OF BELLINGHAM

MULTIPLE ACTIVITIES TAX CREDIT FORM

Part 1 - EXTERNAL CREDITS

Use Part 1 if you have paid eligible gross receipts taxes to another local jurisdiction for the privilege of

extracting the products you manufactured in Bellingham, or for extracting or manufacturing the products you

sold in Bellingham.

Column 1

Column 2

Column 3

Column 4

Gross Receipts Taxes Paid

Taxable

Bellingham

Non-

Credit (Lesser of

Activity resulting in a tax credit.

Amount

Bellingham

Columns 2 or 3)

A. Selling in Bellingham products extracted or

manufactured outside of Bellingham.

B. Manufacturing in Bellingham products

extracted outside of Bellingham.

Part II - INTERNAL CREDITS

Use Part II if you have paid taxes to Bellingham under two or more classifications on the same product.

Column 1

Column 2

Column 3

Column 4a Column 4b

Column 5

Taxable

Extracting

Manufacturing

Wholesaling

Retailing

Credit

Amount

Tax Paid

Tax Paid

Tax Paid

Tax Paid

Activity resulting in a tax credit.

C. Manufacturing activities on

products extracted in Bellingham.

D. Selling products extracted or

manufactured in Bellingham.

Total External & Internal Credits From Part I Column 4 and Part II Column 5:

Enter this amount on your business tax return & subtract from ‘Total Tax Due’.

INSTRUCTIONS

1. Find the activity (A, B C or D) which applies to your business (more than one may apply).

2. Enter in Column 1 the taxable amount (gross less deductions) pertaining to the activity.

3. Compute the amount of the credit as explained below and enter the total amount of the credits in part I Column 4

and Part II Column 5 into the total credit box.

External Credit

1. Enter in Column 2 the Bellingham B&O tax applicable to the activity (use tax rates shown on tax return).

2. Enter in Column 3 the tax paid to another local jurisdiction on the same taxable amounts.

3. Enter in Column 4 the lesser of Columns 2 or 3.

Internal Credit

1. Enter in Columns 2, 3, and 4a & 4b the Bellingham B&O tax paid on each of the activities, as applicable.

2. For activity C enter in Column 5 the lesser of the tax amount in Column 2 or Column 3.

3. For activity D, enter in Column 5 the lesser of the tax amount in Columns 2, 3, or the combined total of Column 4a

and 4b.

4. If tax amounts are equal (one is not less than the other) then enter one of the tax amounts in Column 5.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1