2015 Individual Income Tax Return Annual Engagement Template

ADVERTISEMENT

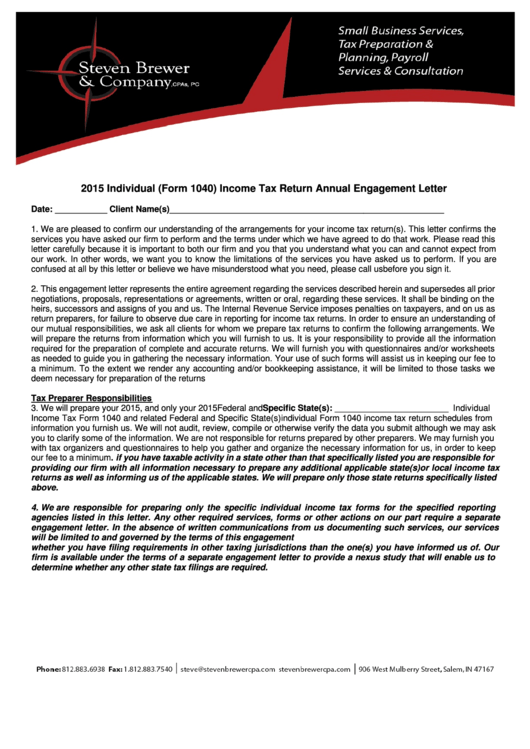

2015 Individual (Form 1040) Income Tax Return Annual Engagement Letter

Date: ___________ Client Name(s)__________________________________________________________

1. We are pleased to confirm our understanding of the arrangements for your income tax return(s). This letter confirms the

services you have asked our firm to perform and the terms under which we have agreed to do that work. Please read this

letter carefully because it is important to both our firm and you that you understand what you can and cannot expect from

our work. In other words, we want you to know the limitations of the services you have asked us to perform. If you are

confused at all by this letter or believe we have misunderstood what you need, please call us before you sign it.

2. This engagement letter represents the entire agreement regarding the services described herein and supersedes all prior

negotiations, proposals, representations or agreements, written or oral, regarding these services. It shall be binding on the

heirs, successors and assigns of you and us. The Internal Revenue Service imposes penalties on taxpayers, and on us as

return preparers, for failure to observe due care in reporting for income tax returns. In order to ensure an understanding of

our mutual responsibilities, we ask all clients for whom we prepare tax returns to confirm the following arrangements. We

will prepare the returns from information which you will furnish to us. It is your responsibility to provide all the information

required for the preparation of complete and accurate returns. We will furnish you with questionnaires and/or worksheets

as needed to guide you in gathering the necessary information. Your use of such forms will assist us in keeping our fee to

a minimum. To the extent we render any accounting and/or bookkeeping assistance, it will be limited to those tasks we

deem necessary for preparation of the returns

Tax Preparer Responsibilities

3. We will prepare your 2015, and only your 2015 Federal and Specific State(s): ________________________ Individual

Income Tax Form 1040 and related Federal and Specific State(s) individual Form 1040 income tax return schedules from

information you furnish us. We will not audit, review, compile or otherwise verify the data you submit although we may ask

you to clarify some of the information. We are not responsible for returns prepared by other preparers. We may furnish you

with tax organizers and questionnaires to help you gather and organize the necessary information for us, in order to keep

our fee to a minimum. if you have taxable activity in a state other than that specifically listed you are responsible for

providing our firm with all information necessary to prepare any additional applicable state(s)or local income tax

returns as well as informing us of the applicable states. We will prepare only those state returns specifically listed

above.

4. We are responsible for preparing only the specific individual income tax forms for the specified reporting

agencies listed in this letter. Any other required services, forms or other actions on our part require a separate

engagement letter. In the absence of written communications from us documenting such services, our services

will be limited to and governed by the terms of this engagement letter. Our services are not intended to determine

whether you have filing requirements in other taxing jurisdictions than the one(s) you have informed us of. Our

firm is available under the terms of a separate engagement letter to provide a nexus study that will enable us to

determine whether any other state tax filings are required.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4