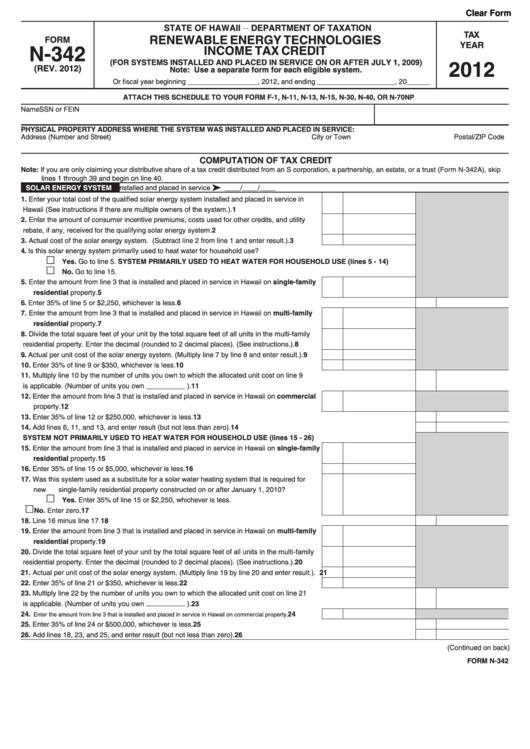

Clear Form

STATE OF HAWAII

DEPARTMENT OF TAXATION

__

TAX

RENEWABLE ENERGY TECHNOLOGIES

FORM

YEAR

N-342

INCOME TAX CREDIT

2012

(FOR SYSTEMS INSTALLED AND PLACED IN SERVICE ON OR AFTER JULY 1, 2009)

(REV. 2012)

Note: Use a separate form for each eligible system.

Or fiscal year beginning __________________, 2012, and ending ____________________, 20______

ATTACH THIS SCHEDULE TO YOUR FORM F-1, N-11, N-13, N-15, N-30, N-40, OR N-70NP

Name

SSN or FEIN

PHYSICAL PROPERTY ADDRESS WHERE THE SYSTEM WAS INSTALLED AND PLACED IN SERVICE:

Address (Number and Street)

City or Town

Postal/ZIP Code

COMPUTATION OF TAX CREDIT

Note: If you are only claiming your distributive share of a tax credit distributed from an S corporation, a partnership, an estate, or a trust (Form N-342A), skip

lines 1 through 39 and begin on line 40.

SOLAR ENERGY SYSTEM

Enter date system was installed and placed in service

____/____/____

1. Enter your total cost of the qualified solar energy system installed and placed in service in

Hawaii (See instructions if there are multiple owners of the system.). ......................................

1

2. Enter the amount of consumer incentive premiums, costs used for other credits, and utility

rebate, if any, received for the qualifying solar energy system. .................................................

2

3. Actual cost of the solar energy system. (Subtract line 2 from line 1 and enter result.). ............

3

4. Is this solar energy system primarily used to heat water for household use?

Yes. Go to line 5. SYSTEM PRIMARILY USED TO HEAT WATER FOR HOUSEHOLD USE (lines 5 - 14)

No. Go to line 15.

5. Enter the amount from line 3 that is installed and placed in service in Hawaii on single-family

residential property. .................................................................................................................

5

6. Enter 35% of line 5 or $2,250, whichever is less. .......................................................................................................................

6

7. Enter the amount from line 3 that is installed and placed in service in Hawaii on multi-family

residential property. .................................................................................................................

7

8. Divide the total square feet of your unit by the total square feet of all units in the multi-family

residential property. Enter the decimal (rounded to 2 decimal places). (See instructions.). ......

8

9. Actual per unit cost of the solar energy system. (Multiply line 7 by line 8 and enter result.). ....

9

10. Enter 35% of line 9 or $350, whichever is less. .........................................................................

10

11. Multiply line 10 by the number of units you own to which the allocated unit cost on line 9

is applicable. (Number of units you own __________ ). .............................................................................................................

11

12. Enter the amount from line 3 that is installed and placed in service in Hawaii on commercial

property. ....................................................................................................................................

12

13. Enter 35% of line 12 or $250,000, whichever is less. .................................................................................................................

13

14. Add lines 6, 11, and 13, and enter result (but not less than zero). .............................................................................................

14

SYSTEM NOT PRIMARILY USED TO HEAT WATER FOR HOUSEHOLD USE (lines 15 - 26)

15. Enter the amount from line 3 that is installed and placed in service in Hawaii on single-family

residential property. .................................................................................................................

15

16. Enter 35% of line 15 or $5,000, whichever is less. ....................................................................

16

17. Was this system used as a substitute for a solar water heating system that is required for

new single-family residential property constructed on or after January 1, 2010?

Yes. Enter 35% of line 15 or $2,250, whichever is less.

No. Enter zero. ..............................................................................................................

17

18. Line 16 minus line 17. ................................................................................................................................................................

18

19. Enter the amount from line 3 that is installed and placed in service in Hawaii on multi-family

residential property. .................................................................................................................

19

20. Divide the total square feet of your unit by the total square feet of all units in the multi-family

residential property. Enter the decimal (rounded to 2 decimal places). (See instructions.). ......

20

21. Actual per unit cost of the solar energy system. (Multiply line 19 by line 20 and enter result.).

21

22. Enter 35% of line 21 or $350, whichever is less. .......................................................................

22

23. Multiply line 22 by the number of units you own to which the allocated unit cost on line 21

is applicable. (Number of units you own __________ ). .............................................................................................................

23

24. Enter the amount from line 3 that is installed and placed in service in Hawaii on commercial property. ...............

24

25. Enter 35% of line 24 or $500,000, whichever is less. .................................................................................................................

25

26. Add lines 18, 23, and 25, and enter result (but not less than zero). ...........................................................................................

26

(Continued on back)

FORM N-342

1

1 2

2