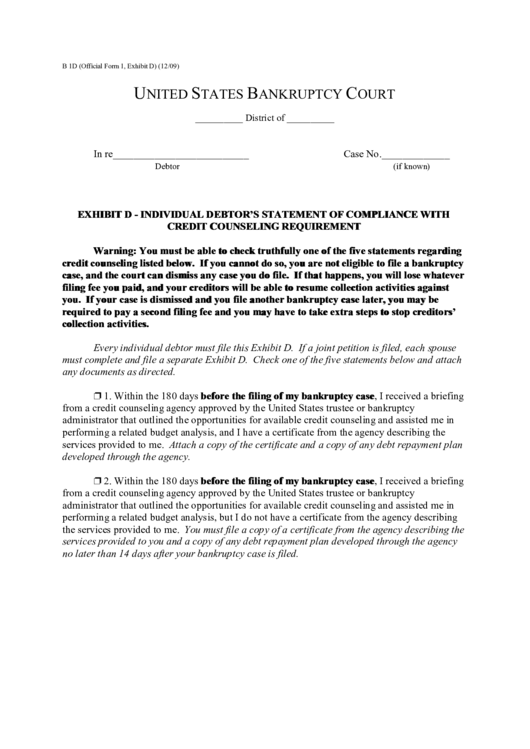

B 1D (Official Form 1, Exhibit D) (12/09)

U

S

B

C

NITED

TATES

ANKRUPTCY

OURT

__________ District of __________

In re__________________________

Case No._____________

Debtor

(if known)

EXHIBIT D - INDIVIDUAL DEBTOR’S STATEMENT OF COMPLIANCE WITH

CREDIT COUNSELING REQUIREMENT

Warning: You must be able to check truthfully one of the five statements regarding

credit counseling listed below. If you cannot do so, you are not eligible to file a bankruptcy

case, and the court can dismiss any case you do file. If that happens, you will lose whatever

filing fee you paid, and your creditors will be able to resume collection activities against

you. If your case is dismissed and you file another bankruptcy case later, you may be

required to pay a second filing fee and you may have to take extra steps to stop creditors’

collection activities.

Every individual debtor must file this Exhibit D. If a joint petition is filed, each spouse

must complete and file a separate Exhibit D. Check one of the five statements below and attach

any documents as directed.

’ 1. Within the 180 days before the filing of my bankruptcy case, I received a briefing

from a credit counseling agency approved by the United States trustee or bankruptcy

administrator that outlined the opportunities for available credit counseling and assisted me in

performing a related budget analysis, and I have a certificate from the agency describing the

services provided to me. Attach a copy of the certificate and a copy of any debt repayment plan

developed through the agency.

’ 2. Within the 180 days before the filing of my bankruptcy case, I received a briefing

from a credit counseling agency approved by the United States trustee or bankruptcy

administrator that outlined the opportunities for available credit counseling and assisted me in

performing a related budget analysis, but I do not have a certificate from the agency describing

the services provided to me. You must file a copy of a certificate from the agency describing the

services provided to you and a copy of any debt repayment plan developed through the agency

no later than 14 days after your bankruptcy case is filed.

1

1 2

2