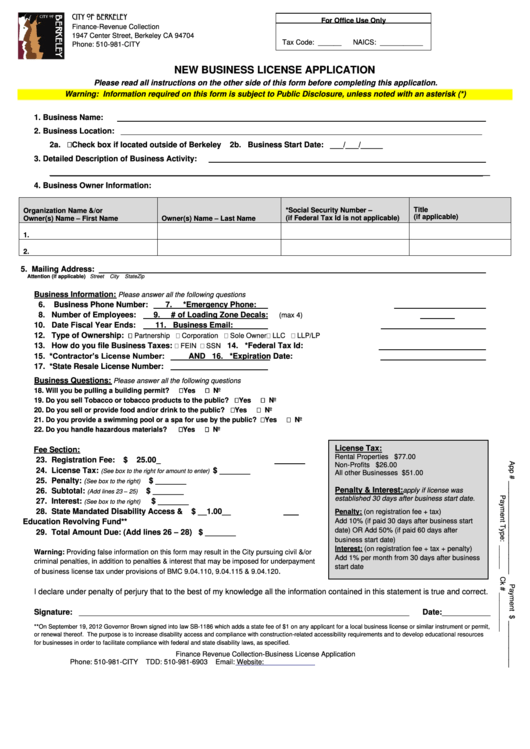

New Business License Application - City Of Berkeley

ADVERTISEMENT

CITY OF BERKELEY

For Office Use Only

Finance-Revenue Collection

1947 Center Street, Berkeley CA 94704

Tax Code: ______

NAICS: ___________

Phone: 510-981-CITY

NEW BUSINESS LICENSE APPLICATION

Please read all instructions on the other side of this form before completing this application.

Warning: Information required on this form is subject to Public Disclosure, unless noted with an asterisk (*)

1.

Business Name:

2.

Business Location: __________________________________________________________________________________

2a.

Check box if located outside of Berkeley

2b. Business Start Date: ___/___/_____

3.

Detailed Description of Business Activity:

____________________________________________________________________________________________________

4.

Business Owner Information:

*Social Security Number –

Title

Organization Name &/or

Owner(s) Name – First Name

Owner(s) Name – Last Name

(if Federal Tax Id is not applicable)

(if applicable)

1.

2.

5. Mailing Address:

Attention (if applicable)

Street

City

State

Zip

Business Information:

Please answer all the following questions

6. Business Phone Number:

7.

*Emergency Phone:

8. Number of Employees:

9.

# of Loading Zone Decals:

(max 4)

10. Date Fiscal Year Ends:

11. Business Email:

12. Type of Ownership:

Partnership

Corporation

Sole Owner

LLC

LLP/LP

13. How do you file Business Taxes:

14. *Federal Tax Id:

FEIN

SSN

15. *Contractor’s License Number:

AND 16. *Expiration Date:

17. *State Resale License Number:

Business Questions:

Please answer all the following questions

18. Will you be pulling a building permit?

Yes

No

19. Do you sell Tobacco or tobacco products to the public?

Yes

No

20. Do you sell or provide food and/or drink to the public?

Yes

No

21. Do you provide a swimming pool or a spa for use by the public?

Yes

No

22. Do you handle hazardous materials?

Yes

No

License Tax:

Fee Section:

Rental Properties

$77.00

23. Registration Fee:

$

25.00_

Non-Profits

$26.00

24. License Tax:

$ _______

(See box to the right for amount to enter)

All other Businesses

$51.00

25. Penalty:

$ _______

(

See box to the right)

Penalty & Interest:

26. Subtotal:

(Add lines 23 – 25)

$ _______

apply if license was

established 30 days after business start date.

27. Interest:

$ _______

(See box to the right)

28. State Mandated Disability Access &

$ __1.00__

Penalty: (on registration fee + tax)

Add 10% (if paid 30 days after business start

Education Revolving Fund**

29. Total Amount Due: (Add lines 26 – 28)

date) OR Add 50% (if paid 60 days after

$ _______

business start date)

Interest: (on registration fee + tax + penalty)

Warning: Providing false information on this form may result in the City pursuing civil &/or

Add 1% per month from 30 days after business

criminal penalties, in addition to penalties & interest that may be imposed for underpayment

start date

.

of business license tax under provisions of BMC 9.04.110, 9.04.115 & 9.04.120

I declare under penalty of perjury that to the best of my knowledge all the information contained in this statement is true and correct.

Signature: ___________________________________________________________________________

Date: ___________

**On September 19, 2012 Governor Brown signed into law SB-1186 which adds a state fee of $1 on any applicant for a local business license or similar instrument or permit,

or renewal thereof. The purpose is to increase disability access and compliance with construction-related accessibility requirements and to develop educational resources

for businesses in order to facilitate compliance with federal and state disability laws, as specified.

Finance Revenue Collection-Business License Application

Phone: 510-981-CITY

TDD: 510-981-6903

Email:

BusLic@ci.berkeley.ca.us

Website:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2