Complete This Form Or Use Current Year W4

ADVERTISEMENT

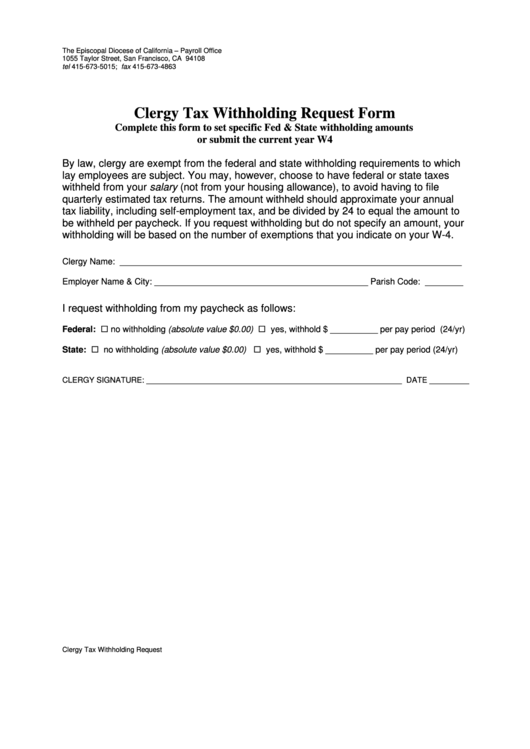

The Episcopal Diocese of California – Payroll Office

1055 Taylor Street, San Francisco, CA 94108

tel 415-673-5015; fax 415-673-4863

Clergy Tax Withholding Request Form

Complete this form to set specific Fed & State withholding amounts

or submit the current year W4

By law, clergy are exempt from the federal and state withholding requirements to which

lay employees are subject. You may, however, choose to have federal or state taxes

withheld from your salary (not from your housing allowance), to avoid having to file

quarterly estimated tax returns. The amount withheld should approximate your annual

tax liability, including self-employment tax, and be divided by 24 to equal the amount to

be withheld per paycheck. If you request withholding but do not specify an amount, your

withholding will be based on the number of exemptions that you indicate on your W-4.

Clergy Name: ________________________________________________________________________

Employer Name & City: _____________________________________________ Parish Code: ________

I request withholding from my paycheck as follows:

Federal: no withholding (absolute value $0.00) yes, withhold $ __________ per pay period (24/yr)

State: no withholding (absolute value $0.00) yes, withhold $ __________ per pay period (24/yr)

CLERGY SIGNATURE: __________________________________________________________ DATE _________

Clergy Tax Withholding Request Form.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1