Loan Repayment Planning Worksheet - Brown University

ADVERTISEMENT

BROWN

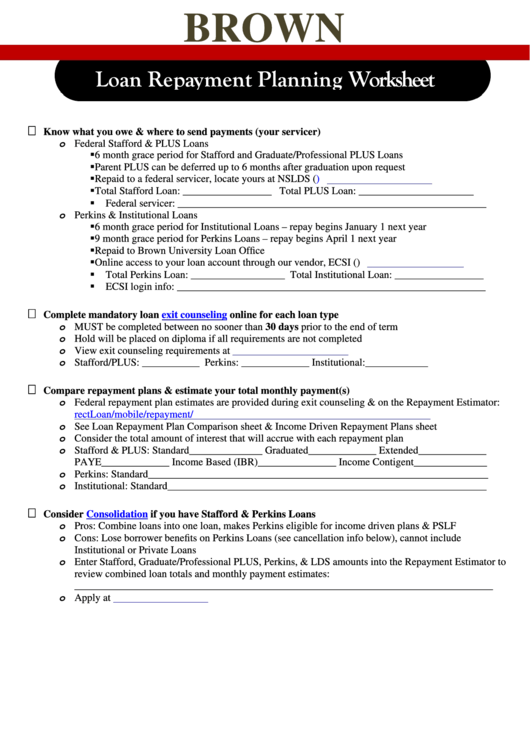

Loan Repayment Planning Worksheet

Know what you owe & where to send payments (your servicer)

o Federal Stafford & PLUS Loans

6 month grace period for Stafford and Graduate/Professional PLUS Loans

Parent PLUS can be deferred up to 6 months after graduation upon request

Repaid to a federal servicer, locate yours at NSLDS

( )

Total Stafford Loan: _________________ Total PLUS Loan: ______________________

Federal servicer: ___________________________________________________________

o Perkins & Institutional Loans

6 month grace period for Institutional Loans – repay begins January 1 next year

9 month grace period for Perkins Loans – repay begins April 1 next year

Repaid to Brown University Loan Office

Online access to your loan account through our vendor, ECSI ( )

Total Perkins Loan: __________________ Total Institutional Loan: _________________

ECSI login info: ___________________________________________________________

Complete mandatory loan

exit counseling

online for each loan type

o MUST be completed between no sooner than 30 days prior to the end of term

o Hold will be placed on diploma if all requirements are not completed

o View exit counseling requirements at

o Stafford/PLUS: ___________ Perkins: _____________ Institutional:____________

Compare repayment plans & estimate your total monthly payment(s)

o Federal repayment plan estimates are provided during exit counseling & on the Repayment Estimator:

https://studentloans.gov/myDirectLoan/mobile/repayment/repaymentEstimator.action

o See Loan Repayment Plan Comparison sheet & Income Driven Repayment Plans sheet

o Consider the total amount of interest that will accrue with each repayment plan

o Stafford & PLUS: Standard______________ Graduated_____________ Extended_____________

PAYE_____________ Income Based (IBR)_______________ Income Contigent______________

o Perkins: Standard_________________________________________________________________

o Institutional: Standard_____________________________________________________________

Consider

Consolidation

if you have Stafford & Perkins Loans

o Pros: Combine loans into one loan, makes Perkins eligible for income driven plans & PSLF

o Cons: Lose borrower benefits on Perkins Loans (see cancellation info below), cannot include

Institutional or Private Loans

o Enter Stafford, Graduate/Professional PLUS, Perkins, & LDS amounts into the Repayment Estimator to

review combined loan totals and monthly payment estimates:

________________________________________________________________________________

o Apply at

Brown Financial Literacy

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2