Petition For Review Of Assessment Before The Indiana Board Of Tax Review

ADVERTISEMENT

Reset Form

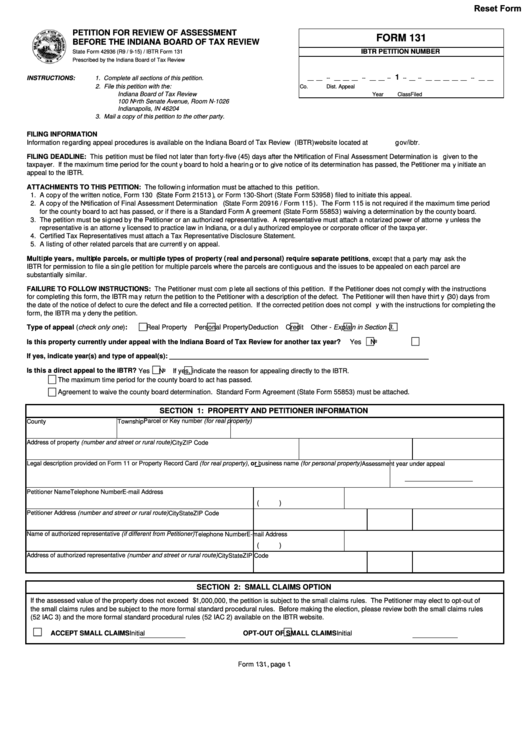

PETITION FOR REVIEW OF ASSESSMENT

FORM 131

BEFORE THE INDIANA BOARD OF TAX REVIEW

IBTR PETITION NUMBER

State Form 42936 (R9 / 9-15) / IBTR Form 131

Prescribed by the Indiana Board of Tax Review

1

INSTRUCTIONS:

1. Complete all sections of this petition.

__ __ -- __ __ __ -- __ __ --

-- __ -- __ __ __ __ __ -- __ __

2. File this petition with the:

Co.

Dist.

Appeal

Prop.

Sequence

Year

Indiana Board of Tax Review

Year

Class

Filed

100 North Senate Avenue, Room N-1026

Indianapolis, IN 46204

3. Mail a copy of this petition to the other party.

FILING INFORMATION

Information regarding appeal procedures is available on the Indiana Board of Tax Review (IBTR) website located at

FILING DEADLINE: This petition must be filed not later than forty-five (45) days after the Notification of Final Assessment Determination is given to the

taxpayer. If the maximum time period for the county board to hold a hearing or to give notice of its determination has passed, the Petitioner may initiate an

appeal to the IBTR.

ATTACHMENTS TO THIS PETITION: The following information must be attached to this petition.

1. A copy of the written notice, Form 130 (State Form 21513), or Form 130-Short (State Form 53958) filed to initiate this appeal.

2. A copy of the Notification of Final Assessment Determination (State Form 20916 / Form 115). The Form 115 is not required if the maximum time period

for the county board to act has passed, or if there is a Standard Form Agreement (State Form 55853) waiving a determination by the county board.

3. The petition must be signed by the Petitioner or an authorized representative. A representative must attach a notarized power of attorney unless the

representative is an attorney licensed to practice law in Indiana, or a duly authorized employee or corporate officer of the taxpayer.

4. Certified Tax Representatives must attach a Tax Representative Disclosure Statement.

5. A listing of other related parcels that are currently on appeal.

Multiple years, multiple parcels, or multiple types of property (real and personal) require separate petitions, except that a party may ask the

IBTR for permission to file a single petition for multiple parcels where the parcels are contiguous and the issues to be appealed on each parcel are

substantially similar.

FAILURE TO FOLLOW INSTRUCTIONS: The Petitioner must complete all sections of this petition. If the Petitioner does not comply with the instructions

for completing this form, the IBTR may return the petition to the Petitioner with a description of the defect. The Petitioner will then have thirty (30) days from

the date of the notice of defect to cure the defect and file a corrected petition. If the corrected petition does not comply with the instructions for completing the

form, the IBTR may deny the petition.

Type of appeal (check only one ):

Real Property

Personal Property

Deduction

Credit

Other - Explain in Section 3.

Is this property currently under appeal with the Indiana Board of Tax Review for another tax year?

Yes

No

If yes, indicate year(s) and type of appeal(s): _____________________________________________________________________

Is this a direct appeal to the IBTR?

Yes

No

If yes, indicate the reason for appealing directly to the IBTR.

The maximum time period for the county board to act has passed.

Agreement to waive the county board determination. Standard Form Agreement (State Form 55853) must be attached.

SECTION 1: PROPERTY AND PETITIONER INFORMATION

Parcel or Key number (for real property)

County

Township

Address of property (number and street or rural route)

City

ZIP Code

Legal description provided on Form 11 or Property Record Card (for real property) , or business name (for personal property)

Assessment year under appeal

__________________

Petitioner Name

Telephone Number

E-mail Address

(

)

Petitioner Address (number and street or rural route)

City

State

ZIP Code

Name of authorized representative (if different from Petitioner)

Telephone Number

E-mail Address

(

)

Address of authorized representative (number and street or rural route)

City

State

ZIP Code

SECTION 2: SMALL CLAIMS OPTION

If the assessed value of the property does not exceed $1,000,000, the petition is subject to the small claims rules. The Petitioner may elect to opt-out of

the small claims rules and be subject to the more formal standard procedural rules. Before making the election, please review both the small claims rules

(52 IAC 3) and the more formal standard procedural rules (52 IAC 2) available on the IBTR website.

ACCEPT SMALL CLAIMS

Initial

OPT-OUT OF SMALL CLAIMS

Initial

Form 131, page 1

Form 131, page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2