Enrollment & Income Eligibility Form For Child Care Centers

ADVERTISEMENT

Dear Parent or Guardian:

Our center has been approved for participation in the Child and Adult Care Food Program (CACFP). The CACFP reimburses the

center for the partial cost of meals. Participation in the CACFP enables us to keep our fees lower as well as serve nutritious meals to

children in our program.

The parent/guardian must complete Parts 1 and 4 and one of the following options: Part 2, Part 3A or Part 3B, to determine the

amount of CACFP funds the center will be eligible to receive. This form will be placed in our files and treated as confidential

information. Note: no white out or erasure should be used. If there is an error cross through, correct, and initial.

Part 1 FOR CHILD ENROLLMENT:

CHILD’S NAME: List the first and last name of all children enrolled at this center.

DATE OF BIRTH: List each child’s date of birth.

TIMES OF CARE, DAYS OF CARE and MEALS SERVED: List the regular times of care for each child by listing their arrival time

and leave time, check each day the child will be in care and check each meal type received while in care.

ETHNICITY/RACE: Using the codes provided, enter the codes for ethnicity and race.

FOSTER CHILD: If the child is a foster child (the legal responsibility of a foster care agency or the court), please check the box.

Part 2 FOR A HOUSEHOLD RECEIVING BENEFITS FROM THE FOOD ASSISTANCE PROGRAM (FAP), TEMPORARY

ASSISTANCE FOR FAMILIES (TAF), OR FOOD DISTRIBUTION PROGRAM ON INDIAN RESERVATIONS (FDPIR):

Complete Parts 1, 2 and 4 on the reverse side.

Provide the name and case number for the program from which benefits are received.

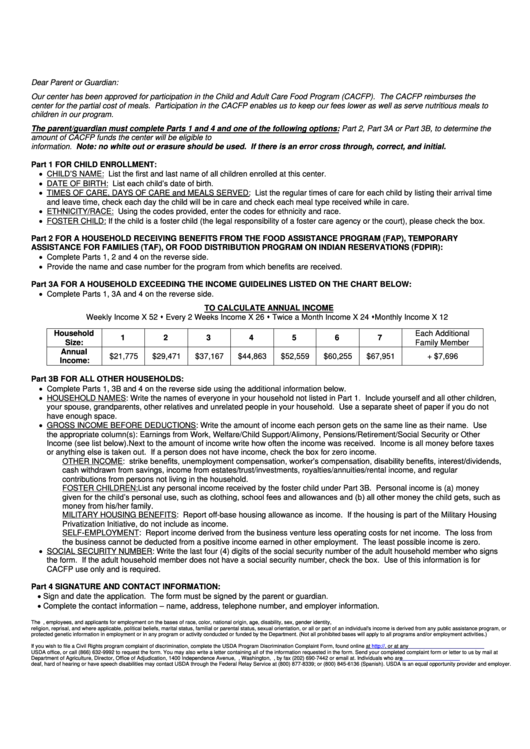

Part 3A FOR A HOUSEHOLD EXCEEDING THE INCOME GUIDELINES LISTED ON THE CHART BELOW:

Complete Parts 1, 3A and 4 on the reverse side.

TO CALCULATE ANNUAL INCOME

Weekly Income X 52 Every 2 Weeks Income X 26 Twice a Month Income X 24 Monthly Income X 12

Household

Each Additional

1

2

3

4

5

6

7

Size:

Family Member

Annual

$21,775

$29,471

$37,167

$44,863

$52,559

$60,255

$67,951

+ $7,696

Income:

Part 3B FOR ALL OTHER HOUSEHOLDS:

Complete Parts 1, 3B and 4 on the reverse side using the additional information below.

HOUSEHOLD NAMES: Write the names of everyone in your household not listed in Part 1. Include yourself and all other children,

your spouse, grandparents, other relatives and unrelated people in your household. Use a separate sheet of paper if you do not

have enough space.

GROSS INCOME BEFORE DEDUCTIONS: Write the amount of income each person gets on the same line as their name. Use

the appropriate column(s): Earnings from Work, Welfare/Child Support/Alimony, Pensions/Retirement/Social Security or Other

Income (see list below). Next to the amount of income write how often the income was received. Income is all money before taxes

or anything else is taken out. If a person does not have income, check the box for zero income.

OTHER INCOME: strike benefits, unemployment compensation, worker’s compensation, disability benefits, interest/dividends,

cash withdrawn from savings, income from estates/trust/investments, royalties/annuities/rental income, and regular

contributions from persons not living in the household.

FOSTER CHILDREN: List any personal income received by the foster child under Part 3B. Personal income is (a) money

given for the child’s personal use, such as clothing, school fees and allowances and (b) all other money the child gets, such as

money from his/her family.

MILITARY HOUSING BENEFITS: Report off-base housing allowance as income. If the housing is part of the Military Housing

Privatization Initiative, do not include as income.

SELF-EMPLOYMENT: Report income derived from the business venture less operating costs for net income. The loss from

the business cannot be deducted from a positive income earned in other employment. The least possible income is zero.

SOCIAL SECURITY NUMBER: Write the last four (4) digits of the social security number of the adult household member who signs

the form. If the adult household member does not have a social security number, check the box. Use of this information is for

CACFP use only and is required.

Part 4 SIGNATURE AND CONTACT INFORMATION:

Sign and date the application. The form must be signed by the parent or guardian.

Complete the contact information – name, address, telephone number, and employer information.

The U.S. Department of Agriculture prohibits discrimination against its customers, employees, and applicants for employment on the bases of race, color, national origin, age, disability, sex, gender identity,

religion, reprisal, and where applicable, political beliefs, marital status, familial or parental status, sexual orientation, or all or part of an individual's income is derived from any public assistance program, or

protected genetic information in employment or in any program or activity conducted or funded by the Department. (Not all prohibited bases will apply to all programs and/or employment activities.)

If you wish to file a Civil Rights program complaint of discrimination, complete the USDA Program Discrimination Complaint Form, found online at , or at any

USDA office, or call (866) 632-9992 to request the form. You may also write a letter containing all of the information requested in the form. Send your completed complaint form or letter to us by mail at U.S.

Department of Agriculture, Director, Office of Adjudication, 1400 Independence Avenue, S.W., Washington, D.C. 20250-9410, by fax (202) 690-7442 or email at program.intake@usda.gov. Individuals who are

deaf, hard of hearing or have speech disabilities may contact USDA through the Federal Relay Service at (800) 877-8339; or (800) 845-6136 (Spanish). USDA is an equal opportunity provider and employer.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Education

1

1 2

2