Form H-19(A) - Fixed Rate Mortgage Model Form

ADVERTISEMENT

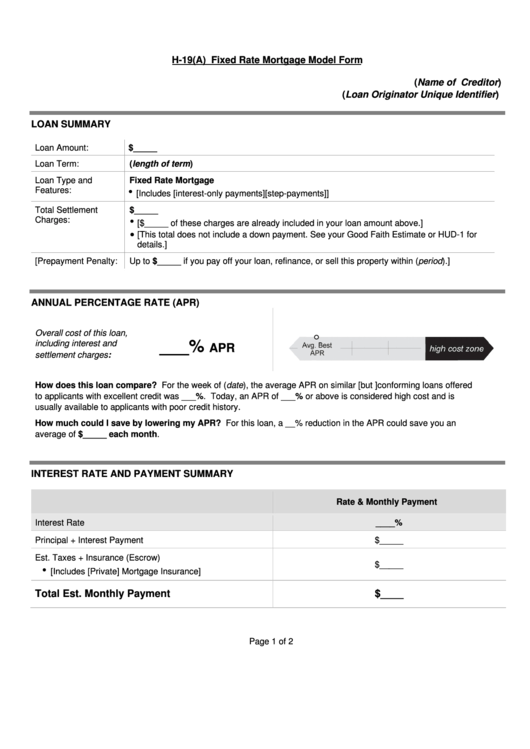

H-19(A) Fixed Rate Mortgage Model Form

(Name of Creditor)

(Loan Originator Unique Identifier)

LOAN SUMMARY

Loan Amount:

$_____

(length of term)

Loan Term:

Loan Type and

Fixed Rate Mortgage

Features:

[Includes [interest-only payments][step-payments]]

Total Settlement

$_____

Charges:

[$_____ of these charges are already included in your loan amount above.]

[This total does not include a down payment. See your Good Faith Estimate or HUD-1 for

details.]

[Prepayment Penalty:

Up to $_____ if you pay off your loan, refinance, or sell this property within (period).]

ANNUAL PERCENTAGE RATE (APR)

Overall cost of this loan,

___%

including interest and

APR

settlement charges:

How does this loan compare? For the week of (date), the average APR on similar [but ]conforming loans offered

to applicants with excellent credit was ___%. Today, an APR of ___% or above is considered high cost and is

usually available to applicants with poor credit history.

How much could I save by lowering my APR? For this loan, a __% reduction in the APR could save you an

average of $_____ each month.

INTEREST RATE AND PAYMENT SUMMARY

Rate & Monthly Payment

Interest Rate

____%

Principal + Interest Payment

$_____

Est. Taxes + Insurance (Escrow)

$_____

[Includes [Private] Mortgage Insurance]

Total Est. Monthly Payment

$____

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2