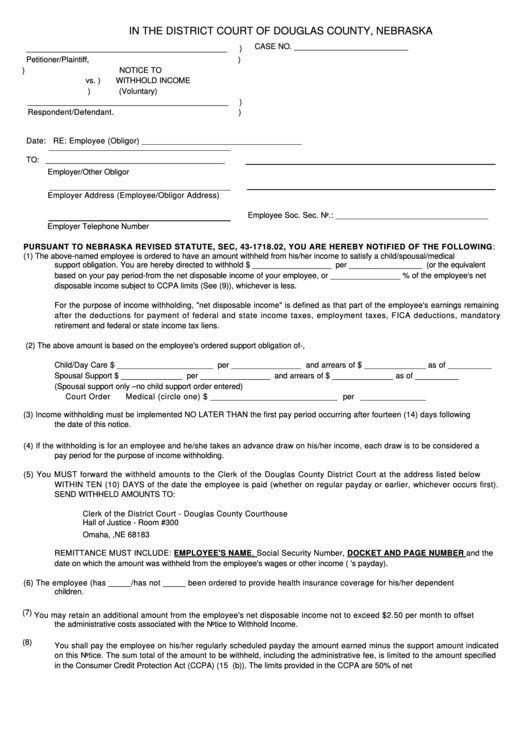

IN THE DISTRICT COURT OF DOUGLAS COUNTY, NEBRASKA

CASE NO. __________________________

______________________________________________

)

Petitioner/Plaintiff,

)

)

NOTICE TO

vs.

)

WITHHOLD INCOME

)

(Voluntary)

______________________________________________

)

Respondent/Defendant.

)

Date:

RE: Employee (Obligor) ___________________________________

TO: _________________________________________

Employer/Other Obligor

Employer Address

(Employee/Obligor Address)

Employee Soc. Sec. No.: ___________________________________

Employer Telephone Number

PURSUANT TO NEBRASKA REVISED STATUTE, SEC, 43-1718.02, YOU ARE HEREBY NOTIFIED OF THE FOLLOWING:

(1)

The above-named employee is ordered to have an amount withheld from his/her income to satisfy a child/spousal/medical

support obligation. You are hereby directed to withhold $ __________________ per _________________ (or the equivalent

based on your pay period-from the net disposable income of your employee, or ________________ % of the employee's net

disposable income subject to CCPA limits (See (9)), whichever is less.

For the purpose of income withholding, "net disposable income" is defined as that part of the employee's earnings remaining

after the deductions for payment of federal and state income taxes, employment taxes, FICA deductions, mandatory

retirement and federal or state income tax liens.

(2)

The above amount is based on the employee's ordered support obligation of-,

Child/Day Care $ ______________________ per ________________ and arrears of $ ______________ as of __________

Spousal Support

$ ______________ per ________________ and arrears of $ ______________ as of __________

(Spousal support only – no child support order entered)

Court Order

Medical (circle one) $ _____________________________ per _______________

(3)

Income withholding must be implemented NO LATER THAN the first pay period occurring after fourteen (14) days following

the date of this notice.

(4)

If the withholding is for an employee and he/she takes an advance draw on his/her income, each draw is to be considered a

pay period for the purpose of income withholding.

(5)

You MUST forward the withheld amounts to the Clerk of the Douglas County District Court at the address listed below

WITHIN TEN (10) DAYS of the date the employee is paid (whether on regular payday or earlier, whichever occurs first).

SEND WITHHELD AMOUNTS TO:

Clerk of the District Court - Douglas County Courthouse

Hall of Justice - Room #300

Omaha, ,NE 68183

REMITTANCE MUST INCLUDE: EMPLOYEE'S NAME, Social Security Number, DOCKET AND PAGE NUMBER and the

date on which the amount was withheld from the employee's wages or other income (i.e. the employee's payday).

(6)

The employee (has _____/has not _____ been ordered to provide health insurance coverage for his/her dependent

children.

(7)

You may retain an additional amount from the employee's net disposable income not to exceed $2.50 per month to offset

the administrative costs associated with the Notice to Withhold Income.

(8)

You shall pay the employee on his/her regularly scheduled payday the amount earned minus the support amount indicated

on this Notice. The sum total of the amount to be withheld, including the administrative fee, is limited to the amount specified

in the Consumer Credit Protection Act (CCPA) (15 U.S.C. 1673(b)). The limits provided in the CCPA are 50% of net

1

1 2

2