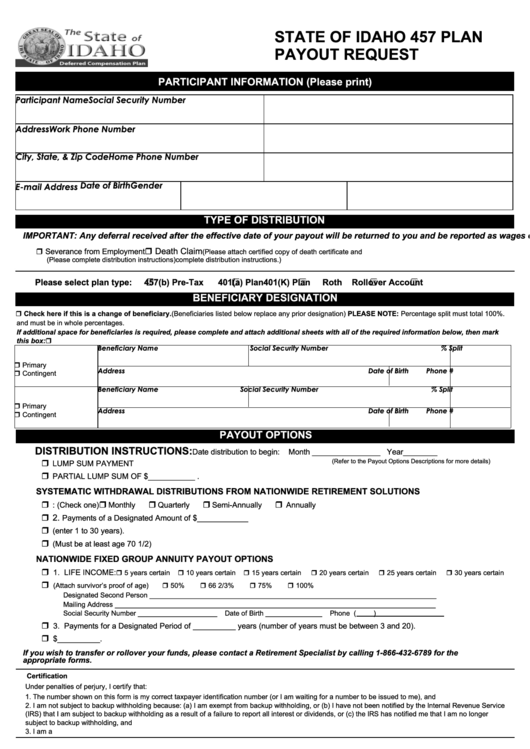

State Of Idaho 457 Plan Payout Request

ADVERTISEMENT

STATE OF IDAHO 457 PLAN

PAYOUT REQUEST

PARTICIPANT INFORMATION (Please print)

Participant Name

Social Security Number

Address

Work Phone Number

City, State, & Zip Code

Home Phone Number

Date of Birth

Gender

E-mail Address

TYPE OF DISTRIBUTION

IMPORTANT: Any deferral received after the effective date of your payout will be returned to you and be reported as wages on a 1099-R.

r Death Claim

r Severance from Employment

(Please attach certified copy of death certificate and

(Please complete distribution instructions)

complete distribution instructions.)

Please select plan type:

457(b) Pre-Tax

401(a) Plan

401(K) Plan

Roth

Rollover Account

BENEFICIARY DESIGNATION

r Check here if this is a change of beneficiary. (Beneficiaries listed below replace any prior designation) PLEASE NOTE: Percentage split must total 100%.

and must be in whole percentages.

If additional space for beneficiaries is required, please complete and attach additional sheets with all of the required information below, then mark

this box: r

Beneficiary Name

Social Security Number

% Split

r Primary

Address

Date of Birth

Phone #

r Contingent

Beneficiary Name

Social Security Number

% Split

r Primary

Address

Date of Birth

Phone #

r Contingent

PAYOUT OPTIONS

DISTRIBUTION INSTRUCTIONS:

Date distribution to begin:

Month ________________ Year________

r

LUMP SUM PAYMENT

(Refer to the Payout Options Descriptions for more details)

r

PARTIAL LUMP SUM OF $___________ .

SYSTEMATIC WITHDRAWAL DISTRIBUTIONS FROM NATIONWIDE RETIREMENT SOLUTIONS

r

r

r

r

r

1. Systematic payments to be paid at a frequency of: (Check one)

Monthly

Quarterly

Semi-Annually

Annually

r 2.

Payments of a Designated Amount of $____________

r

3. Designated Period of ___________ years (enter 1 to 30 years).

r

4. Required Minimum Distribution (Must be at least age 70 1/2)

NATIONWIDE FIXED GROUP ANNUITY PAYOUT OPTIONS

r

1. LIFE INCOME:

r 5 years certain

r 10 years certain

r 15 years certain

r 20 years certain

r 25 years certain

r 30 years certain

r

2. JOINT AND LAST SURVIVOR INCOME

(Attach survivor’s proof of age)

r 50%

r 66 2/3%

r 75%

r 100%

Designated Second Person ____________________________________________________________________________

Mailing Address _____________________________________________________________________________________

Social Security Number _____________________

Date of Birth _______________

Phone (

)

r

3. Payments for a Designated Period of __________ years (number of years must be between 3 and 20).

r

4. Payments for a designated amount of $__________.

If you wish to transfer or rollover your funds, please contact a Retirement Specialist by calling 1-866-432-6789 for the

appropriate forms.

Certification

Under penalties of perjury, I certify that:

1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service

(IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer

subject to backup withholding, and

3. I am a U.S. citizen or other U.S. person.

You must submit a current W-4P with this request for withholding of the correct amount of taxes. For Death Claims, form W-4P is required and Beneficiary

payments will be reported on a 1099-R form. REQUESTS ARE PROCESSED AS RECEIVED.

I certify that I have received and read the “Special Tax Notice Regarding Plan Payments”. If I elect to receive this distribution before the end of the 30-day minimum

notice period, my signature on this election shall constitute a waiver of my rights to the 30-day notice requirement.

Federal Income tax will be withheld from your payments as required by the Internal Revenue Code. If you select a lump sum or systematic withdrawal lasting less than

10 years, 20% of the taxable portion of the distribution paid to you will be withheld for federal income taxes. State taxes will be withheld where applicable. State and

federal taxes withheld will be reported on a form 1099R. Some mutual funds may impose a short term trade fee. Please read the underlying prospectuses carefully.

The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup with-

holding.

_____________________________________________

__________________________________________________

______________

STATE AUTHORIZATION

SIGNATURE OF PARTICIPANT (or claimant)

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2