Simple Ira Distribution Request

Download a blank fillable Simple Ira Distribution Request in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Simple Ira Distribution Request with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Reset Form

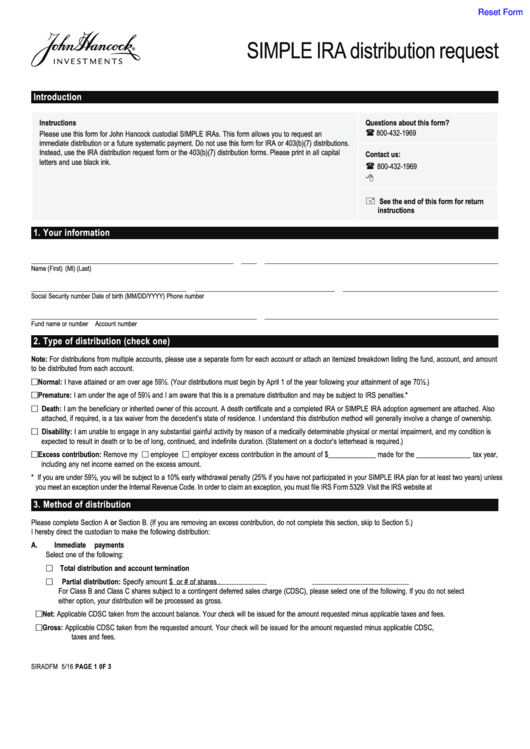

SIMPLE IRA distribution request

Introduction

Instructions

Questions about this form?

800-432-1969

Please use this form for John Hancock custodial SIMPLE IRAs. This form allows you to request an

immediate distribution or a future systematic payment. Do not use this form for IRA or 403(b)(7) distributions.

Instead, use the IRA distribution request form or the 403(b)(7) distribution forms. Please print in all capital

Contact us:

letters and use black ink.

800-432-1969

See the end of this form for return

instructions

1. Your information

Name (First)

(MI)

(Last)

Social Security number

Date of birth (MM/DD/YYYY)

Phone number

Fund name or number

Account number

2. Type of distribution (check one)

Note: For distributions from multiple accounts, please use a separate form for each account or attach an itemized breakdown listing the fund, account, and amount

to be distributed from each account.

Normal: I have attained or am over age 59½. (Your distributions must begin by April 1 of the year following your attainment of age 70½.)

Premature: I am under the age of 59½ and I am aware that this is a premature distribution and may be subject to IRS penalties.*

Death: I am the beneficiary or inherited owner of this account. A death certificate and a completed IRA or SIMPLE IRA adoption agreement are attached. Also

attached, if required, is a tax waiver from the decedent’s state of residence. I understand this distribution method will generally involve a change of ownership.

Disability: I am unable to engage in any substantial gainful activity by reason of a medically determinable physical or mental impairment, and my condition is

expected to result in death or to be of long, continued, and indefinite duration. (Statement on a doctor’s letterhead is required.)

Excess contribution: Remove my

employee

employer excess contribution in the amount of $_____________ made for the _______________ tax year,

including any net income earned on the excess amount.

* If you are under 59½, you will be subject to a 10% early withdrawal penalty (25% if you have not participated in your SIMPLE IRA plan for at least two years) unless

you meet an exception under the Internal Revenue Code. In order to claim an exception, you must file IRS Form 5329. Visit the IRS website at irs.gov for more details.

3. Method of distribution

Please complete Section A or Section B. (If you are removing an excess contribution, do not complete this section, skip to Section 5.)

I hereby direct the custodian to make the following distribution:

A.

Immediate payments

Select one of the following:

Total distribution and account termination

Partial distribution: Specify amount $

or # of shares

.

For Class B and Class C shares subject to a contingent deferred sales charge (CDSC), please select one of the following. If you do not select

either option, your distribution will be processed as gross.

Net: Applicable CDSC taken from the account balance. Your check will be issued for the amount requested minus applicable taxes and fees.

Gross: Applicable CDSC taken from the requested amount. Your check will be issued for the amount requested minus applicable CDSC,

taxes and fees.

SIRADFM 5/16

PAGE 1 0F 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3