PRINT

IRA Account No.

Rep. No.

IRA DISTRIBUTION

REQUEST

RESET

Since 1895. Member sipc, nyse, Inc.

TIN or SSN

View Instructions

Complete online, print, and sign as appropriate.

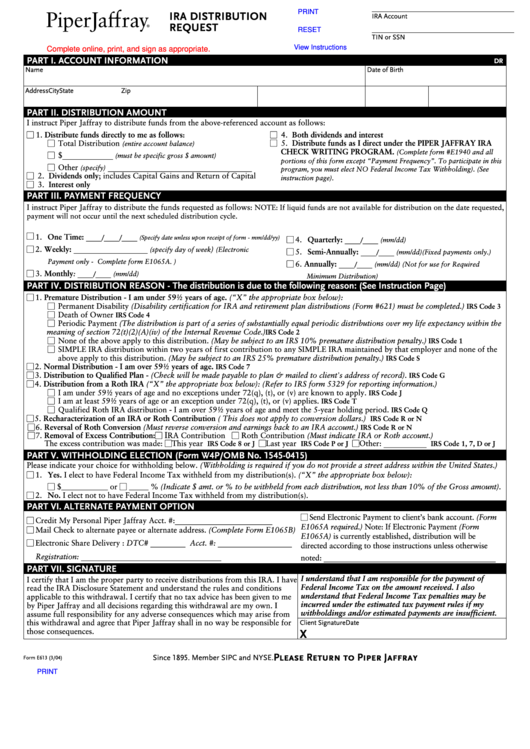

PART I. ACCOUNT INFORMATION

DR

Name

Date of Birth

Address

City

State

Zip

PART II. DISTRIBUTION AMOUNT

I instruct Piper Jaffray to distribute funds from the above-referenced account as follows:

1. Distribute funds directly to me as follows

4. Both dividends and interest

:

Total Distribution

5. Distribute funds as I direct under the PIPER JAFFRAY IRA

(entire account balance)

CHECK WRITING PROGRAM.

(Complete form #E1940 and all

$ _____________

(must be specific gross $ amount)

portions of this form except “Payment Frequency”. To participate in this

Other

(specify)

_____________________________________

program, you must elect NO Federal Income Tax Withholding). (See

2. Dividends only; includes Capital Gains and Return of Capital

instruction page).

3. Interest only

PART III. PAYMENT FREQUENCY

I instruct Piper Jaffray to distribute the funds requested as follows:

NOTE: If liquid funds are not available for distribution on the date requested,

payment will not occur until the next scheduled distribution cycle.

1. One Time: ____/____/____

(Specify date unless upon receipt of form - mm/dd/yy)

4. Quarterly: ____/____

(mm/dd)

2. Weekly: ___________________

)

(specify day of week

(Electronic

5. Semi-Annually: ____/____

(mm/dd) (Fixed payments only.)

Payment only - Complete form E1065A. )

6. Annually: ____/____

(mm/dd) (Not for use for Required

3. Monthly: ____/____

(mm/dd)

Minimum Distribution)

PART IV. DISTRIBUTION REASON - The distribution is due to the following reason: (See Instruction Page)

1. Premature Distribution - I am under 59½ years of age. (“X” the appropriate box below):

Permanent Disability (Disability certification for IRA and retirement plan distributions (Form #621) must be completed.)

IRS Code 3

Death of Owner

IRS Code 4

Periodic Payment (The distribution is part of a series of substantially equal periodic distributions over my life expectancy within the

meaning of section 72(t)(2)(A)(iv) of the Internal Revenue Code.)

IRS Code 2

None of the above apply to this distribution. (May be subject to an IRS 10% premature distribution penalty.)

IRS Code 1

SIMPLE IRA distribution within two years of first contribution to any SIMPLE IRA maintained by that employer and none of the

above apply to this distribution. (May be subject to an IRS 25% premature distribution penalty.)

IRS Code S

2. Normal Distribution - I am over 59½ years of age.

IRS Code 7

3. Distribution to Qualified Plan - (Check will be made payable to plan & mailed to client's address of record).

IRS Code G

4. Distribution from a Roth IRA (“X” the appropriate box below): (Refer to IRS form 5329 for reporting information.)

I am under 59½ years of age and no exceptions under 72(q), (t), or (v) are known to apply.

IRS Code J

I am at least 59½ years of age or an exception under 72(q), (t), or (v) applies.

IRS Code T

Qualified Roth IRA distribution - I am over 59½ years of age and meet the 5-year holding period.

IRS Code Q

5. Recharacterization of an IRA or Roth Contribution ( This does not apply to conversion dollars.)

IRS Code R or N

6. Reversal of Roth Conversion (Must reverse conversion and earnings back to an IRA account.)

IRS Code R or N

I

7. Removal of Excess Contribution:

RA Contribution

Roth Contribution (Must indicate IRA or Roth account.)

The excess contribution was made:

This year

Last year

Other: ___________

IRS Code 8 or J

IRS Code P or J

IRS Code 1, 7, D or J

PART V. WITHHOLDING ELECTION (Form W4P/OMB No. 1545-0415)

Please indicate your choice for withholding below. (Withholding is required if you do not provide a street address within the United States.)

1. Yes. I elect to have Federal Income Tax withheld from my distribution(s). (“X” the appropriate box below):

$____________ or

_____ % (Indicate $ amt. or % to be withheld from each distribution, not less than 10% of the Gross amount).

2. No. I elect not to have Federal Income Tax withheld from my distribution(s).

PART VI. ALTERNATE PAYMENT OPTION

Send Electronic Payment to client’s bank account. (Form

Credit My Personal Piper Jaffray Acct. #: _________________________

E1065A required.) Note: If Electronic Payment (Form

Mail Check to alternate payee or alternate address. (Complete Form E1065B)

E1065A) is currently established, distribution will be

Electronic Share Delivery : DTC# _________ Acct. #: ___________________

directed according to those instructions unless otherwise

Registration: ____________________________________

noted: _____________________________________________

PART VII. SIGNATURE

I understand that I am responsible for the payment of

I certify that I am the proper party to receive distributions from this IRA. I have

Federal Income Tax on the amount received. I also

read the IRA Disclosure Statement and understand the rules and conditions

understand that Federal Income Tax penalties may be

applicable to this withdrawal. I certify that no tax advice has been given to me

incurred under the estimated tax payment rules if my

by Piper Jaffray and all decisions regarding this withdrawal are my own. I

withholdings and/or estimated payments are insufficient.

assume full responsibility for any adverse consequences which may arise from

this withdrawal and agree that Piper Jaffray shall in no way be responsible for

Client Signature

Date

those consequences.

X

Since 1895. Member SIPC and NYSE.

Form E613 (3/04)

Please Return to Piper Jaffray

PRINT

1

1 2

2 3

3