Form St-6 - Certificate Of Registration

ADVERTISEMENT

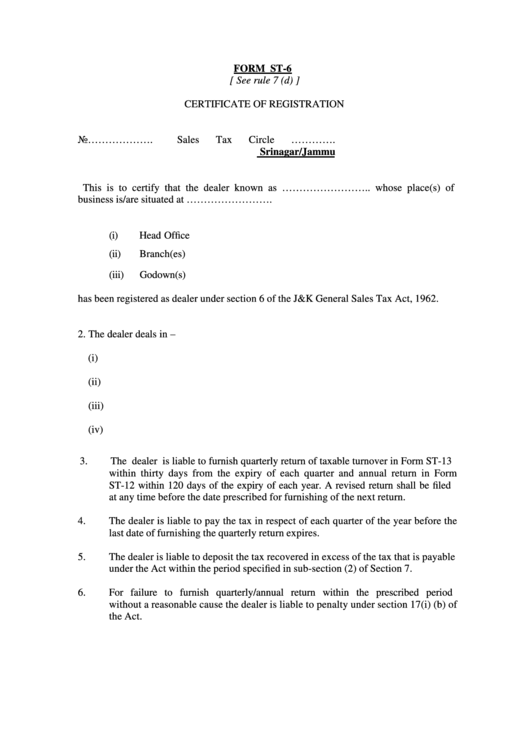

FORM ST-6

[ See rule 7 (d) ]

CERTIFICATE OF REGISTRATION

No……………….

Sales Tax Circle ………….

Srinagar/Jammu

This is to certify that the dealer known as …………………….. whose place(s) of

business is/are situated at …………………….

(i)

Head Office

(ii)

Branch(es)

(iii)

Godown(s)

has been registered as dealer under section 6 of the J&K General Sales Tax Act, 1962.

2. The dealer deals in –

(i)

(ii)

(iii)

(iv)

3.

The dealer is liable to furnish quarterly return of taxable turnover in Form ST-13

within thirty days from the expiry of each quarter and annual return in Form

ST-12 within 120 days of the expiry of each year. A revised return shall be filed

at any time before the date prescribed for furnishing of the next return.

4.

The dealer is liable to pay the tax in respect of each quarter of the year before the

last date of furnishing the quarterly return expires.

5.

The dealer is liable to deposit the tax recovered in excess of the tax that is payable

under the Act within the period specified in sub-section (2) of Section 7.

6.

For failure to furnish quarterly/annual return within the prescribed period

without a reasonable cause the dealer is liable to penalty under section 17(i) (b) of

the Act.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2