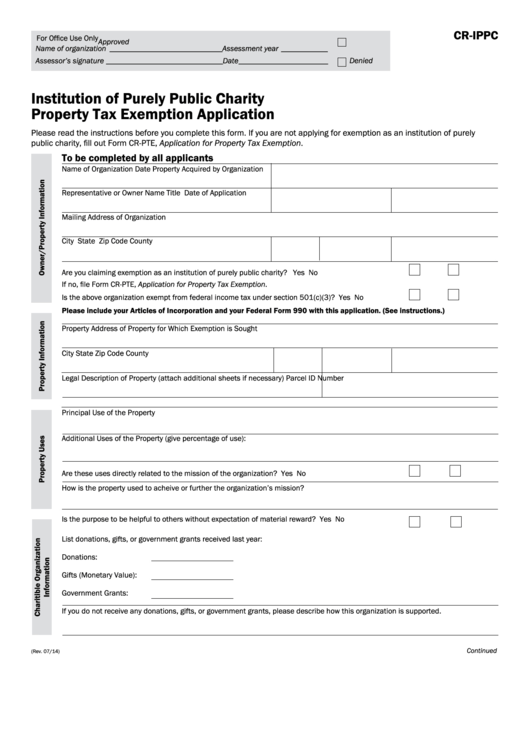

CR-IPPC

For Office Use Only

Approved

Name of organization _____________________________Assessment year ____________

Denied

Assessor’s signature ______________________________Date _______________________

Institution of Purely Public Charity

Property Tax Exemption Application

Please read the instructions before you complete this form. If you are not applying for exemption as an institution of purely

public charity, fill out Form CR-PTE, Application for Property Tax Exemption.

To be completed by all applicants

Name of Organization

Date Property Acquired by Organization

Representative or Owner Name

Title

Date of Application

Mailing Address of Organization

City

State

Zip Code

County

Are you claiming exemption as an institution of purely public charity?

Yes

No

If no, file Form CR-PTE, Application for Property Tax Exemption.

Is the above organization exempt from federal income tax under section 501(c)(3)?

Yes

No

Please include your Articles of Incorporation and your Federal Form 990 with this application. (See instructions.)

Property Address of Property for Which Exemption is Sought

City

State

Zip Code

County

Legal Description of Property (attach additional sheets if necessary)

Parcel ID Number

Principal Use of the Property

Additional Uses of the Property (give percentage of use):

Are these uses directly related to the mission of the organization?

Yes

No

How is the property used to acheive or further the organization’s mission?

Is the purpose to be helpful to others without expectation of material reward?

Yes

No

List donations, gifts, or government grants received last year:

Donations:

Gifts (Monetary Value):

Government Grants:

If you do not receive any donations, gifts, or government grants, please describe how this organization is supported.

Continued

(Rev. 07/14)

1

1 2

2 3

3