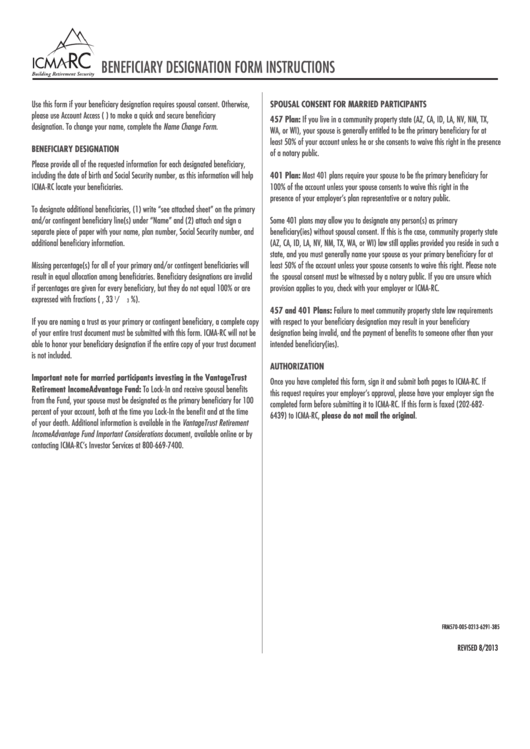

Beneficiary Designation Form Instructions

ADVERTISEMENT

BENEFICIARY DESIGNATION FORM INSTRUCTIONS

Use this form if your beneficiary designation requires spousal consent. Otherwise,

sPoUsaL consent for Married ParticiPants

please use Account Access ( ) to make a quick and secure beneficiary

457 Plan: If you live in a community property state (AZ, CA, ID, LA, NV, NM, TX,

designation. To change your name, complete the Name Change Form.

WA, or WI), your spouse is generally entitled to be the primary beneficiary for at

least 50% of your account unless he or she consents to waive this right in the presence

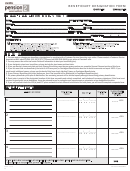

beneficiary designation

of a notary public.

Please provide all of the requested information for each designated beneficiary,

including the date of birth and Social Security number, as this information will help

401 Plan: Most 401 plans require your spouse to be the primary beneficiary for

ICMA-RC locate your beneficiaries.

100% of the account unless your spouse consents to waive this right in the

presence of your employer’s plan representative or a notary public.

To designate additional beneficiaries, (1) write “see attached sheet” on the primary

and/or contingent beneficiary line(s) under “Name” and (2) attach and sign a

Some 401 plans may allow you to designate any person(s) as primary

separate piece of paper with your name, plan number, Social Security number, and

beneficiary(ies) without spousal consent. If this is the case, community property state

additional beneficiary information.

(AZ, CA, ID, LA, NV, NM, TX, WA, or WI) law still applies provided you reside in such a

state, and you must generally name your spouse as your primary beneficiary for at

Missing percentage(s) for all of your primary and/or contingent beneficiaries will

least 50% of the account unless your spouse consents to waive this right. Please note

result in equal allocation among beneficiaries. Beneficiary designations are invalid

the spousal consent must be witnessed by a notary public. If you are unsure which

if percentages are given for every beneficiary, but they do not equal 100% or are

provision applies to you, check with your employer or ICMA-RC.

expressed with fractions (e.g., 33

%).

/

1

3

457 and 401 Plans: Failure to meet community property state law requirements

If you are naming a trust as your primary or contingent beneficiary, a complete copy

with respect to your beneficiary designation may result in your beneficiary

of your entire trust document must be submitted with this form. ICMA-RC will not be

designation being invalid, and the payment of benefits to someone other than your

able to honor your beneficiary designation if the entire copy of your trust document

intended beneficiary(ies).

is not included.

aUthorization

important note for married participants investing in the Vantagetrust

Once you have completed this form, sign it and submit both pages to ICMA-RC. If

retirement incomeadvantage fund: To Lock-In and receive spousal benefits

this request requires your employer’s approval, please have your employer sign the

from the Fund, your spouse must be designated as the primary beneficiary for 100

completed form before submitting it to ICMA-RC. If this form is faxed (202-682-

percent of your account, both at the time you Lock-In the benefit and at the time

6439) to ICMA-RC, please do not mail the original.

of your death. Additional information is available in the VantageTrust Retirement

IncomeAdvantage Fund Important Considerations document, available online or by

contacting ICMA-RC’s Investor Services at 800-669-7400.

FRM570-005-0213-6291-385

REVISED 8/2013

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Medical

1

1 2

2 3

3