Substitute Form W-9 - Payer'S Request For Taxpayer Identification Number (Tin) - Kinross Gold Corporation

ADVERTISEMENT

.

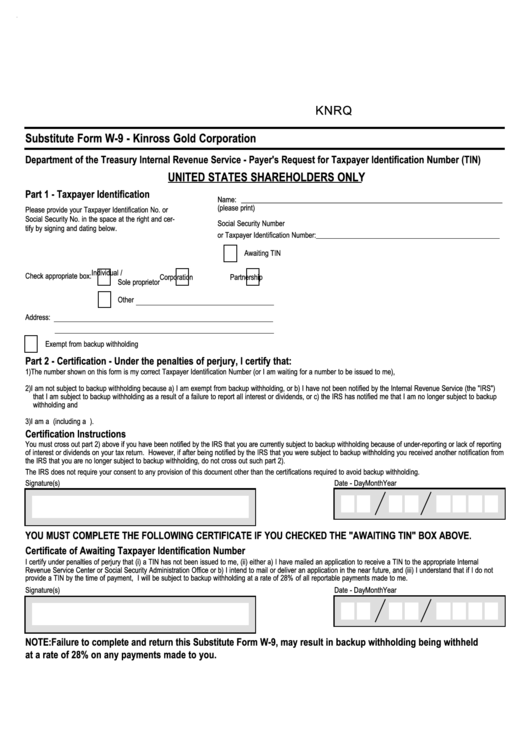

KNRQ

Substitute Form W-9 - Kinross Gold Corporation

Department of the Treasury Internal Revenue Service - Payer's Request for Taxpayer Identification Number (TIN)

UNITED STATES SHAREHOLDERS ONLY

Part 1 - Taxpayer Identification

Name: __________________________________________________________________________

(please print)

Please provide your Taxpayer Identification No. or

Social Security No. in the space at the right and cer-

Social Security Number

tify by signing and dating below.

or Taxpayer Identification Number: ____________________________________________________

Awaiting TIN

Individual /

Check appropriate box:

Corporation

Partnership

Sole proprietor

Other

Address:

Exempt from backup withholding

Part 2 - Certification - Under the penalties of perjury, I certify that:

1) The number shown on this form is my correct Taxpayer Identification Number (or I am waiting for a number to be issued to me),

2) I am not subject to backup withholding because a) I am exempt from backup withholding, or b) I have not been notified by the Internal Revenue Service (the "IRS")

that I am subject to backup withholding as a result of a failure to report all interest or dividends, or c) the IRS has notified me that I am no longer subject to backup

withholding and

3) I am a U.S. person (including a U.S. resident alien).

Certification Instructions

You must cross out part 2) above if you have been notified by the IRS that you are currently subject to backup withholding because of under-reporting or lack of reporting

of interest or dividends on your tax return. However, if after being notified by the IRS that you were subject to backup withholding you received another notification from

the IRS that you are no longer subject to backup withholding, do not cross out such part 2).

The IRS does not require your consent to any provision of this document other than the certifications required to avoid backup withholding.

Signature(s)

Date - Day

Month

Year

YOU MUST COMPLETE THE FOLLOWING CERTIFICATE IF YOU CHECKED THE "AWAITING TIN" BOX ABOVE.

Certificate of Awaiting Taxpayer Identification Number

I certify under penalties of perjury that (i) a TIN has not been issued to me, (ii) either a) I have mailed an application to receive a TIN to the appropriate Internal

Revenue Service Center or Social Security Administration Office or b) I intend to mail or deliver an application in the near future, and (iii) I understand that if I do not

provide a TIN by the time of payment, I will be subject to backup withholding at a rate of 28% of all reportable payments made to me.

Signature(s)

Date - Day

Month

Year

NOTE: Failure to complete and return this Substitute Form W-9, may result in backup withholding being withheld

at a rate of 28% on any payments made to you.

Page 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2