Form Av-9 - Application For Exclusion Under G.s. 105-277.1 - 2008

ADVERTISEMENT

WEB DOWLOADED

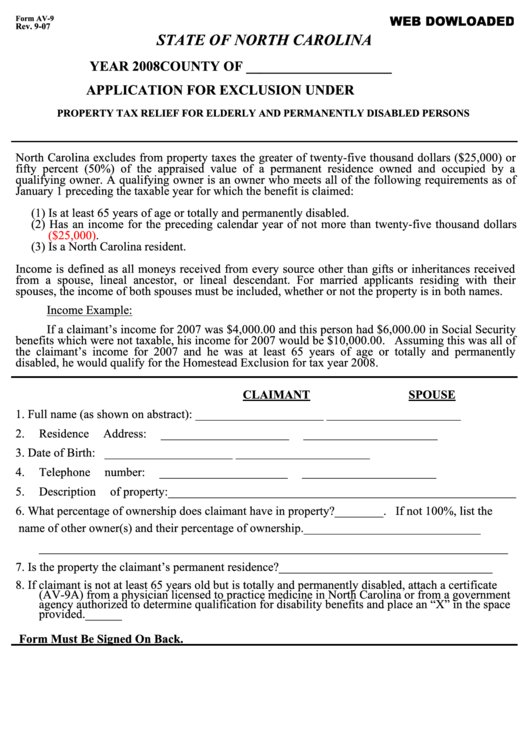

Form AV-9

Rev. 9-07

STATE OF NORTH CAROLINA

YEAR 2008

COUNTY OF _____________________

APPLICATION FOR EXCLUSION UNDER G.S. 105-277.1

PROPERTY TAX RELIEF FOR ELDERLY AND PERMANENTLY DISABLED PERSONS

North Carolina excludes from property taxes the greater of twenty-five thousand dollars ($25,000) or

fifty percent (50%) of the appraised value of a permanent residence owned and occupied by a

qualifying owner. A qualifying owner is an owner who meets all of the following requirements as of

January 1 preceding the taxable year for which the benefit is claimed:

(1) Is at least 65 years of age or totally and permanently disabled.

(2) Has an income for the preceding calendar year of not more than twenty-five thousand dollars

($25,000).

(3) Is a North Carolina resident.

Income is defined as all moneys received from every source other than gifts or inheritances received

from a spouse, lineal ancestor, or lineal descendant. For married applicants residing with their

spouses, the income of both spouses must be included, whether or not the property is in both names.

Income Example:

If a claimant’s income for 2007 was $4,000.00 and this person had $6,000.00 in Social Security

benefits which were not taxable, his income for 2007 would be $10,000.00. Assuming this was all of

the claimant’s income for 2007 and he was at least 65 years of age or totally and permanently

disabled, he would qualify for the Homestead Exclusion for tax year 2008.

CLAIMANT

SPOUSE

1.

Full name (as shown on abstract):

_____________________

______________________

2.

Residence Address:

_____________________

______________________

3.

Date of Birth:

_____________________

______________________

4.

Telephone number:

_____________________

______________________

5.

Description of property: _________________________________________________________

6.

What percentage of ownership does claimant have in property?________. If not 100%, list the

name of other owner(s) and their percentage of ownership. _____________________________

_____________________________________________________________________________

7.

Is the property the claimant’s permanent residence? ___________________________________

8.

If claimant is not at least 65 years old but is totally and permanently disabled, attach a certificate

(AV-9A) from a physician licensed to practice medicine in North Carolina or from a government

agency authorized to determine qualification for disability benefits and place an “X” in the space

provided.______

Form Must Be Signed On Back.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3