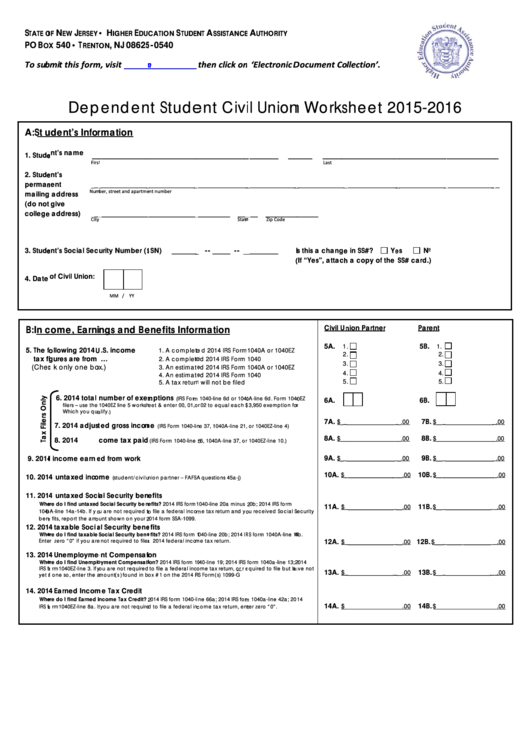

Dependent Student Civil Union Worksheet

ADVERTISEMENT

S

N

J

• H

E

S

A

A

TATE O

OF

EW

ERSEY

IGHER

DU

CATION

TUDEN

NT

SSISTANCE

E

UTHORITY

PO B

540 • T

, NJ 08625

5-0540

OX

X

RENTO

ON

To sub

bmit this form

m, visit

njgrants.org

then click on

n ‘Electronic D

Document Co

ollection’.

Dep

penden

nt Stude

ent Civi

il Union

n Works

sheet 2

015-20

16

A: Stu

udent’s Infor

rmation

__

___________

____________

___________

_______

__

____

_____

____________

___________

____________

_

1. Stude

ent’s name

First

t

M.I.

Last

2. Stude

ent’s

perman

nent

___

_______________

_______________

________________

_______________

_______________

________________

________________

_______________

__

mailing

address

Num

mber, street and apartme

ent number

(do not

give

college

e address)

___

_______________

_______________

__________

____

___

__________

_______

City

State

e

Zip Code

3. Stude

ent’s Social Sec

urity Number (S

SSN)

________

_ -- _____ -- __

_________

I

Is this a change

e in SS#?

Ye

es

No

(

(If “Yes”, attach

h a copy of the

SS# card.)

4. Date

of Civil Union:

MM / YY

Civil Un

nion Partner

Parent

B: Inc

come, Earni

ings and Be

enefits Infor

mation

5A.

5B.

1

.

1.

5. The fo

ollowing 2014 U

U.S. income

1. A complete

ed 2014 IRS Form

1040A or 1040EZ

2

.

2.

tax fi

gures are from

…

2. A complete

ed 2014 IRS Form

1040

3

.

3.

(Chec

ck only one box

x.)

3. An estimate

ed 2014 IRS Form

1040A or 1040EZ

4

.

4.

4. An estimate

ed 2014 IRS Form

1040

5

.

5.

5. A tax return

n will not be filed

6. 2014 total

number of exem

mptions

(IRS Form

m 1040-line 6d or 1040

0A-line 6d. Form 1040

0EZ

6A.

6B.

filers – use the

1040EZ line 5 worksh

eet & enter 00, 01,o

r 02 to equal each $

$3,950 exemption for

r

Which you qua

alify.)

7A.

7B.

$__

__________________

__.00

$___

__________________

_.00

7. 2014 adjust

ted gross incom

me

(IRS Form 1040-lin

ne 37, 1040A-line 21,

or 1040EZ-line 4)

8A.

8B.

$__

__________________

__.00

$___

__________________

_.00

8. 2014 U.S. in

come tax paid

(IRS Form 1040-line 5

56, 1040A-line 37, or

1040EZ-line 10.)

9A.

9B.

9. 2014

4 income earne

ed from work

$__

__________________

__.00

$___

__________________

_.00

10A.

10B.

$_

_________________

___.00

$___

__________________

_.00

10. 2014

4 untaxed inco

me

(student/civil u

union partner – FAFSA

A questions 45a-j)

11. 2014

4 untaxed Soci

al Security ben

efits

Whe

ere do I find untaxed

d Social Security ben

nefits? 2014 IRS form

1040-line 20a minus 2

20b; 2014 IRS form

11A.

11B.

$_

_________________

___.00

$___

__________________

_.00

1040

0A-line 14a-14b. If yo

ou are not required to

o file a federal incom

me tax return and yo

ou received Social S

Security

bene

efits, report the amo

ount shown on your 2

2014 form SSA-1099.

12. 2014

4 taxable Socia

al Security bene

efits

Whe

ere do I find taxable

Social Security bene

efits? 2014 IRS form 1

040-line 20b; 2014 IR

RS form 1040A-line 14

4b.

12A.

12B.

Ente

er zero “0” if you are

not required to file a

a 2014 federal incom

me tax return.

$_

_________________

___.00

$____

______ ___________

_.00

13. 2014

4 Unemployme

ent Compensati

ion

Whe

ere do I find Unemplo

oyment Compensati

ion? 2014 IRS form 10

040-line 19; 2014 IRS

form 1040a-line 13; 2

2014

IRS fo

orm1040EZ-line 3. If y

you are not required

to file a federal inco

ome tax return, or re

equired to file but ha

ave not

13A.

13B.

$_

_________________

___.00

$___

__________________

_.00

yet d

done so, enter the a

mount(s) found in b

ox #1 on the 2014 IR

RS Form(s) 1099-G

14. 2014

4 Earned Incom

me Tax Credit

Whe

ere do I find Earned I

ncome Tax Credit? 2

2014 IRS form 1040-li

ne 66a; 2014 IRS form

m 1040a-line 42a; 20

14

14A.

14B.

$_

_________________

___.00

$___

__________________

_.00

IRS fo

orm1040EZ-line 8a. If

f you are not require

d to file a federal inc

come tax return, ent

ter zero “0”.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2