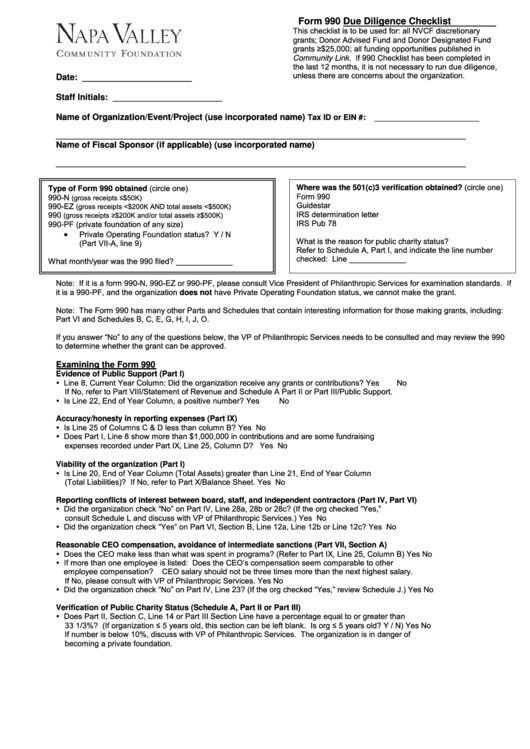

Form 990 Due Diligence Checklist Napa Valley Community Foundation

ADVERTISEMENT

Form 990 Due Diligence Checklist

This checklist is to be used for: all NVCF discretionary

grants; Donor Advised Fund and Donor Designated Fund

grants ≥$25,000; all funding opportunities published in

Community Link. If 990 Checklist has been completed in

the last 12 months, it is not necessary to run due diligence,

unless there are concerns about the organization.

Date: _______________________

Staff Initials: _______________________

________________________

Name of Organization/Event/Project (use incorporated name)

Tax ID or EIN #:

______________________________________________________________________________________________

Name of Fiscal Sponsor (if applicable) (use incorporated name)

______________________________________________________________________________________________

Where was the 501(c)3 verification obtained? (circle one)

Type of Form 990 obtained (circle one)

Form 990

990-N

(gross receipts ≤$50K)

Guidestar

990-EZ

(gross receipts <$200K AND total assets <$500K)

IRS determination letter

990

(gross receipts ≥$200K and/or total assets ≥$500K)

IRS Pub 78

990-PF (private foundation of any size)

•

Private Operating Foundation status? Y / N

What is the reason for public charity status?

(Part VII-A, line 9)

Refer to Schedule A, Part I, and indicate the line number

checked: Line _____________

What month/year was the 990 filed? _____________

Note: If it is a form 990-N, 990-EZ or 990-PF, please consult Vice President of Philanthropic Services for examination standards. If

it is a 990-PF, and the organization does not have Private Operating Foundation status, we cannot make the grant.

Note: The Form 990 has many other Parts and Schedules that contain interesting information for those making grants, including:

Part VI and Schedules B, C, E, G, H, I, J, O.

If you answer “No” to any of the questions below, the VP of Philanthropic Services needs to be consulted and may review the 990

to determine whether the grant can be approved.

Examining the Form 990

Evidence of Public Support (Part I)

Line 8, Current Year Column: Did the organization receive any grants or contributions?

Yes

No

If No, refer to Part VIII/Statement of Revenue and Schedule A Part II or Part III/Public Support.

Is Line 22, End of Year Column, a positive number?

Yes

No

Accuracy/honesty in reporting expenses (Part IX)

Is Line 25 of Columns C & D less than column B?

Yes

No

Does Part I, Line 8 show more than $1,000,000 in contributions and are some fundraising

expenses recorded under Part IX, Line 25, Column D?

Yes

No

Viability of the organization (Part I)

Is Line 20, End of Year Column (Total Assets) greater than Line 21, End of Year Column

(Total Liabilities)? If No, refer to Part X/Balance Sheet.

Yes

No

Reporting conflicts of interest between board, staff, and independent contractors (Part IV, Part VI)

Did the organization check “No” on Part IV, Line 28a, 28b or 28c? (If the org checked “Yes,”

consult Schedule L and discuss with VP of Philanthropic Services.)

Yes

No

Did the organization check “Yes” on Part VI, Section B, Line 12a, Line 12b or Line 12c?

Yes

No

Reasonable CEO compensation, avoidance of intermediate sanctions (Part VII, Section A)

Does the CEO make less than what was spent in programs? (Refer to Part IX, Line 25, Column B)

Yes

No

If more than one employee is listed: Does the CEO’s compensation seem comparable to other

employee compensation?

CEO salary should not be three times more than the next highest salary.

If No, please consult with VP of Philanthropic Services.

Yes

No

Did the organization check “No” on Part IV, Line 23? (If the org checked “Yes,” review Schedule J.)

Yes

No

Verification of Public Charity Status (Schedule A, Part II or Part III)

Does Part II, Section C, Line 14 or Part III Section Line have a percentage equal to or greater than

33 1/3%? (If organization ≤ 5 years old, this section can be left blank. Is org ≤ 5 years old? Y / N)

Yes

No

If number is below 10%, discuss with VP of Philanthropic Services. The organization is in danger of

becoming a private foundation.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1