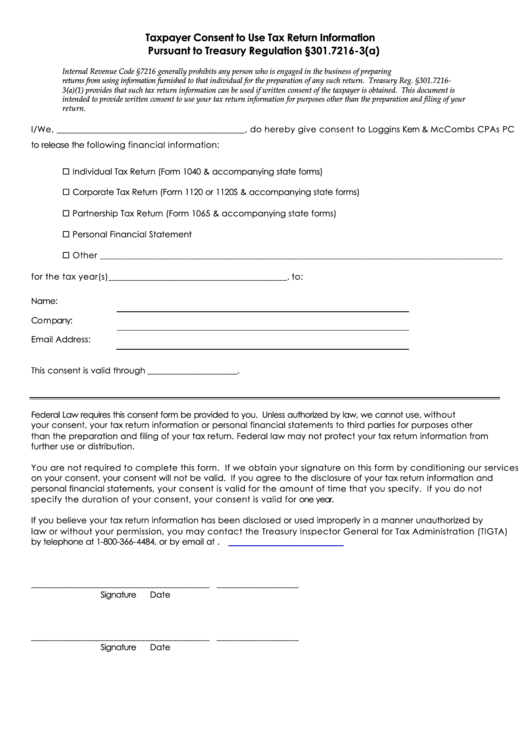

Taxpayer Consent to Use Tax Return Information

Pursuant to Treasury Regulation §301.7216-3(a)

Internal Revenue Code §7216 generally prohibits any person who is engaged in the business of preparing U.S. income tax

returns from using information furnished to that individual for the preparation of any such return. Treasury Reg. §301.7216-

3(a)(1) provides that such tax return information can be used if written consent of the taxpayer is obtained. This document is

intended to provide written consent to use your tax return information for purposes other than the preparation and filing of your

return.

I/We, _________________________________________, do hereby give consent to Loggins Kern & McCombs CPAs PC

to release the following financial information:

Individual Tax Return (Form 1040 & accompanying state forms)

Corporate Tax Return (Form 1120 or 1120S & accompanying state forms)

Partnership Tax Return (Form 1065 & accompanying state forms)

Personal Financial Statement

Other ________________________________________________________________________________________

for the tax year(s)_______________________________________, to:

Name:

Company:

Email Address:

This consent is valid through ____________________.

Federal Law requires this consent form be provided to you. Unless authorized by law, we cannot use, without

your consent, your tax return information or personal financial statements to third parties for purposes other

than the preparation and filing of your tax return. Federal law may not protect your tax return information from

further use or distribution.

You are not required to complete this form. If we obtain your signature on this form by conditioning our services

on your consent, your consent will not be valid. If you agree to the disclosure of your tax return information and

personal financial statements, your consent is valid for the amount of time that you specify. If you do not

specify the duration of your consent, your consent is valid for one year.

If you believe your tax return information has been disclosed or used improperl y in a manner unauthorized by

law or without your permission, you may contact the Treasury Inspector General for Tax Administration (TIGTA)

by telephone at 1-800-366-4484, or by email at complaints@tigta.treas.gov.

_______________________________________

__________________

Signature

Date

_______________________________________

__________________

Signature

Date

1

1