Residential Property Tax Exemption - Municipality Of Anchorage

ADVERTISEMENT

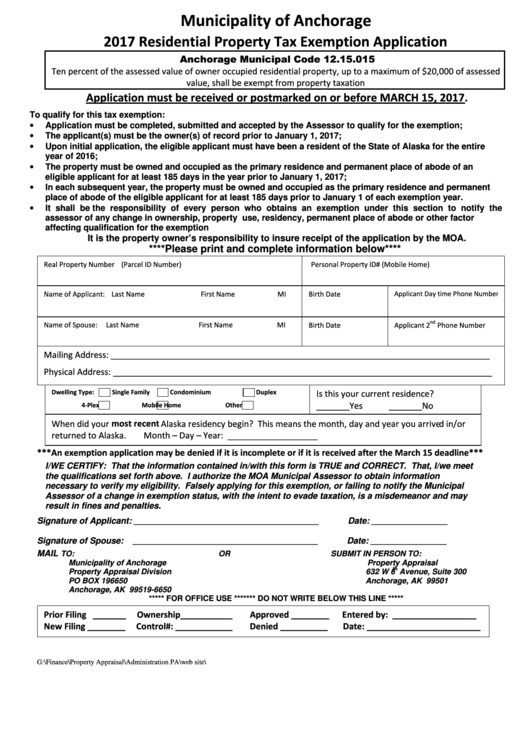

Municipality of Anchorage

2017 Residential Property Tax Exemption Application

Anchorage Municipal Code 12.15.015

Ten percent of the assessed value of owner occupied residential property, up to a maximum of $20,000 of assessed

value, shall be exempt from property taxation

Application must be received or postmarked on or before MARCH 15, 2017.

To qualify for this tax exemption:

Application must be completed, submitted and accepted by the Assessor to qualify for the exemption;

•

The applicant(s) must be the owner(s) of record prior to January 1, 2017;

•

Upon initial application, the eligible applicant must have been a resident of the State of Alaska for the entire

•

year of 2016;

The property must be owned and occupied as the primary residence and permanent place of abode of an

•

eligible applicant for at least 185 days in the year prior to January 1, 2017;

In each subsequent year, the property must be owned and occupied as the primary residence and permanent

•

place of abode of the eligible applicant for at least 185 days prior to January 1 of each exemption year.

It shall be the responsibility of every person who obtains an exemption under this section to notify the

•

assessor of any change in ownership, property use, residency, permanent place of abode or other factor

affecting qualification for the exemption

It is the property owner’s responsibility to insure receipt of the application by the MOA.

****Please print and complete information below****

Real Property Number (Parcel ID Number)

Personal Property ID# (Mobile Home)

Name of Applicant: Last Name

First Name

MI

Birth Date

Applicant Day time Phone Number

nd

Name of Spouse:

Last Name

First Name

MI

Birth Date

Applicant 2

Phone Number

Mailing Address: ________________________________________________________________________________

Physical Address: ________________________________________________________________________________

Dwelling Type:

Single Family

Condominium

Duplex

Is this your current residence?

_______Yes

_______No

4-Plex

Mobile Home

Other

When did your most recent Alaska residency begin? This means the month, day and year you arrived in/or

returned to Alaska.

Month – Day – Year: ___________________

***An exemption application may be denied if it is incomplete or if it is received after the March 15 deadline***

I/WE CERTIFY: That the information contained in/with this form is TRUE and CORRECT. That, I/we meet

the qualifications set forth above.

I authorize the MOA Municipal Assessor to obtain information

necessary to verify my eligibility. Falsely applying for this exemption, or failing to notify the Municipal

Assessor of a change in exemption status, with the intent to evade taxation, is a misdemeanor and may

result in fines and penalties.

Signature of Applicant: _______________________________________

Date: ________________

Signature of Spouse:

_______________________________________

Date: ________________

MAIL

TO:

OR

SUBMIT IN PERSON TO:

Municipality of Anchorage

Property Appraisal

th

Property Appraisal Division

632 W 6

Avenue, Suite 300

PO BOX 196650

Anchorage, AK 99501

Anchorage, AK 99519-6650

***** FOR OFFICE USE ******* DO NOT WRITE BELOW THIS LINE *****

Prior Filing _______

Ownership___________

Approved ________

Entered by: __________________

New Filing ________

Control#: ____________

Denied __________

Date: ________________________

G:\Finance\Property Appraisal\Administration PA\web site\ResExemptionForm.doc

Rev 3-16-16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1