Wells Fargo - Flexible Benefits Plan Election Form / Salary Reduction Agreement

ADVERTISEMENT

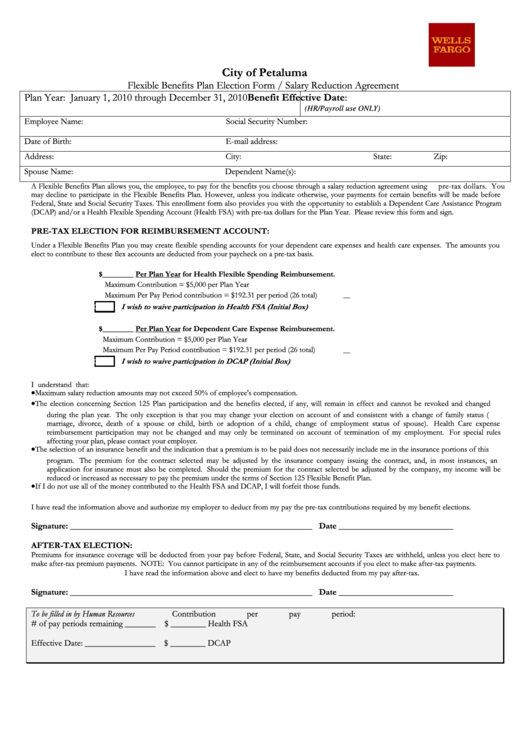

City of Petaluma

Flexible Benefits Plan Election Form / Salary Reduction Agreement

Plan Year: January 1, 2010 through December 31, 2010

Benefit Effective Date:

(HR/Payroll use ONLY)

Employee Name:

Social Security Number:

Date of Birth:

E-mail address:

Address:

City:

State:

Zip:

Spouse Name:

Dependent Name(s):

A Flexible Benefits Plan allows you, the employee, to pay for the benefits you choose through a salary reduction agreement using

pre-tax dollars. You

may decline to participate in the Flexible Benefits Plan. However, unless you indicate otherwise, your payments for certain benefits will be made before

Federal, State and Social Security Taxes. This enrollment form also provides you with the opportunity to establish a Dependent Care Assistance Program

(DCAP) and/or a Health Flexible Spending Account (Health FSA) with pre-tax dollars for the Plan Year. Please review this form and sign.

PRE-TAX ELECTION FOR REIMBURSEMENT ACCOUNT:

Under a Flexible Benefits Plan you may create flexible spending accounts for your dependent care expenses and health care expenses. The amounts you

elect to contribute to these flex accounts are deducted from your paycheck on a pre-tax basis.

$________ Per Plan Year for Health Flexible Spending Reimbursement.

Maximum Contribution = $5,000 per Plan Year

Maximum Per Pay Period contribution = $192.31 per period (26 total)

OOO

I wish to waive participation in Health FSA (Initial Box)

$________ Per Plan Year for Dependent Care Expense Reimbursement.

Maximum Contribution = $5,000 per Plan Year

Maximum Per Pay Period contribution = $192.31 per period (26 total)

I wish to waive participation in DCAP (Initial Box)

OOO

I understand that:

•

Maximum salary reduction amounts may not exceed 50% of employee's compensation.

•

The election concerning Section 125 Plan participation and the benefits elected, if any, will remain in effect and cannot be revoked and changed

during the plan year. The only exception is that you may change your election on account of and consistent with a change of family status (e.g.

marriage, divorce, death of a spouse or child, birth or adoption of a child, change of employment status of spouse). Health Care expense

reimbursement participation may not be changed and may only be terminated on account of termination of my employment. For special rules

affecting your plan, please contact your employer.

•

The selection of an insurance benefit and the indication that a premium is to be paid does not necessarily include me in the insurance portions of this

program. The premium for the contract selected may be adjusted by the insurance company issuing the contract, and, in most instances, an

application for insurance must also be completed. Should the premium for the contract selected be adjusted by the company, my income will be

reduced or increased as necessary to pay the premium under the terms of Section 125 Flexible Benefit Plan.

•

If I do not use all of the money contributed to the Health FSA and DCAP, I will forfeit those funds.

I have read the information above and authorize my employer to deduct from my pay the pre-tax contributions required by my benefit elections.

Signature: _______________________________________________________

Date __________________________

AFTER-TAX ELECTION:

Premiums for insurance coverage will be deducted from your pay before Federal, State, and Social Security Taxes are withheld, unless you elect here to

make after-tax premium payments. NOTE: You cannot participate in any of the reimbursement accounts if you elect to make after-tax payments.

.

I have read the information above and elect to have my benefits deducted from my pay after-tax

Signature: _______________________________________________________

Date __________________________

To be filled in by Human Resources

Contribution per pay period:

# of pay periods remaining _______

$ ________ Health FSA

Effective Date: ________________

$ ________ DCAP

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3