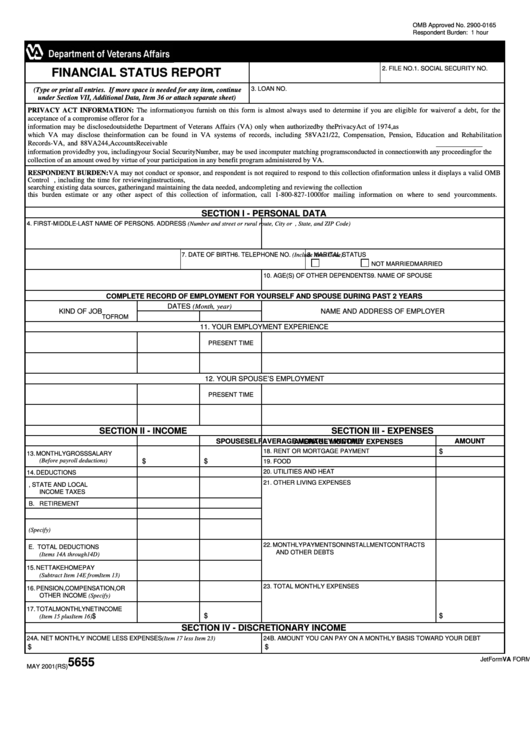

Financial Status Report - Veterans Benefits Administration

ADVERTISEMENT

OMB Approved No. 2900-0165

Respondent Burden: 1 hour

1. SOCIAL SECURITY NO.

2. FILE NO.

FINANCIAL STATUS REPORT

3. LOAN NO.

(Type or print all entries. If more space is needed for any item, continue

under Section VII, Additional Data, Item 36 or attach separate sheet)

PRIVACY ACT INFORMATION: The information you furnish on this form is almost always used to determine if you are eligible for waiver of a debt, for the

acceptance of a compromise offer or for a payment plan. The responses you submit are confidential and protected from unauthorized disclosure by 38 U.S.C. 5701. The

information may be disclosed outside the Department of Veterans Affairs (VA) only when authorized by the Privacy Act of 1974, as amended. The routine uses for

which VA may disclose the information can be found in VA systems of records, including 58VA21/22, Compensation, Pension, Education and Rehabilitation

Records-VA, and 88VA244, Accounts Receivable Records-VA. VA systems of records and alterations to the systems are published in the Federal Register. Any

information provided by you, including your Social Security Number, may be used in computer matching programs conducted in connection with any proceeding for the

collection of an amount owed by virtue of your participation in any benefit program administered by VA.

RESPONDENT BURDEN: VA may not conduct or sponsor, and respondent is not required to respond to this collection of information unless it displays a valid OMB

Control Number. Public reporting burden for this collection of information is estimated to average 1 hour per response, including the time for reviewing instructions,

searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. If you have comments regarding

this burden estimate or any other aspect of this collection of information, call 1-800-827-1000 for mailing information on where to send your comments.

SECTION I - PERSONAL DATA

4. FIRST-MIDDLE-LAST NAME OF PERSON

5. ADDRESS (Number and street or rural route, City or P.O. Box, State, and ZIP Code)

6. TELEPHONE NO. (Include Area Code)

7. DATE OF BIRTH

8. MARITAL STATUS

MARRIED

NOT MARRIED

9. NAME OF SPOUSE

10. AGE(S) OF OTHER DEPENDENTS

COMPLETE RECORD OF EMPLOYMENT FOR YOURSELF AND SPOUSE DURING PAST 2 YEARS

DATES (Month, year)

KIND OF JOB

NAME AND ADDRESS OF EMPLOYER

FROM

TO

11. YOUR EMPLOYMENT EXPERIENCE

PRESENT TIME

12. YOUR SPOUSE’S EMPLOYMENT

PRESENT TIME

SECTION II - INCOME

SECTION III - EXPENSES

AVERAGE MONTHLY INCOME

SELF

SPOUSE

AVERAGE MONTHLY EXPENSES

AMOUNT

18. RENT OR MORTGAGE PAYMENT

$

13. MONTHLY GROSS SALARY

(Before payroll deductions)

$

$

19. FOOD

20. UTILITIES AND HEAT

14. DEDUCTIONS

21. OTHER LIVING EXPENSES

A. FEDERAL, STATE AND LOCAL

INCOME TAXES

B. RETIREMENT

C. SOCIAL SECURITY

D. OTHER (Specify)

22. MONTHLY PAYMENTS ON INSTALLMENT CONTRACTS

E. TOTAL DEDUCTIONS

AND OTHER DEBTS

(Items 14A through 14D)

15. NET TAKE HOME PAY

(Subtract Item 14E from Item 13)

23. TOTAL MONTHLY EXPENSES

16. PENSION, COMPENSATION, OR

OTHER INCOME (Specify)

17. TOTAL MONTHLY NET INCOME

$

$

$

(Item 15 plus Item 16)

SECTION IV - DISCRETIONARY INCOME

24A. NET MONTHLY INCOME LESS EXPENSES (Item 17 less Item 23)

24B. AMOUNT YOU CAN PAY ON A MONTHLY BASIS TOWARD YOUR DEBT

$

$

VA FORM

JetForm

5655

MAY 2001(RS)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2