Application For Exemption And/or Abatement For The Improvement

ADVERTISEMENT

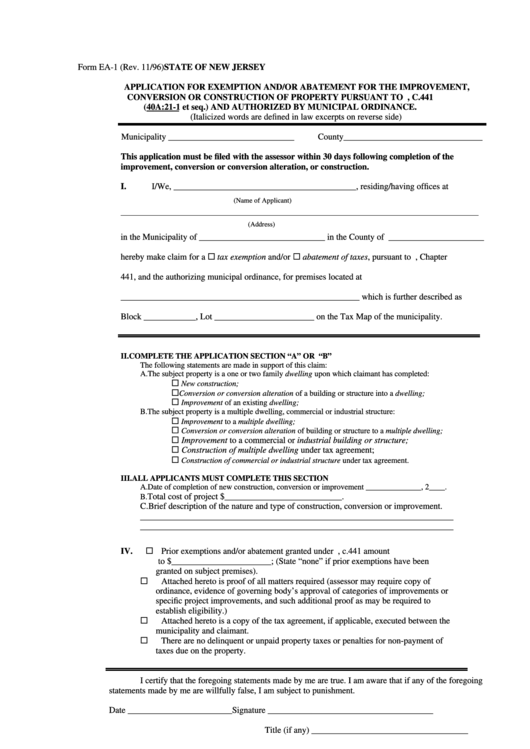

Form EA-1 (Rev. 11/96)

STATE OF NEW JERSEY

APPLICATION FOR EXEMPTION AND/OR ABATEMENT FOR THE IMPROVEMENT,

CONVERSION OR CONSTRUCTION OF PROPERTY PURSUANT TO P.L. 1991, C.441

(N.J.S.A. 40A:21-1 et seq.) AND AUTHORIZED BY MUNICIPAL ORDINANCE.

(Italicized words are defined in law excerpts on reverse side)

Municipality _____________________________

County________________________________

This application must be filed with the assessor within 30 days following completion of the

improvement, conversion or conversion alteration, or construction.

I.

I/We, __________________________________________, residing/having offices at

(Name of Applicant)

________________________________________________________________________________________________________

(Address)

in the Municipality of _____________________________ in the County of ______________________

hereby make claim for a ¨ tax exemption and/or ¨ abatement of taxes, pursuant to P.L. 1991, Chapter

441, and the authorizing municipal ordinance, for premises located at

_______________________________________________________ which is further described as

Block ____________, Lot _______________________ on the Tax Map of the municipality.

II.

COMPLETE THE APPLICATION SECTION “A” OR “B”

The following statements are made in support of this claim:

A. The subject property is a one or two family dwelling upon which claimant has completed:

¨

New construction;

¨

Conversion or conversion alteration of a building or structure into a dwelling;

¨

Improvement of an existing dwelling;

B.

The subject property is a multiple dwelling, commercial or industrial structure:

¨

Improvement to a multiple dwelling;

¨

Conversion or conversion alteration of building or structure to a multiple dwelling;

¨ Improvement to a commercial or industrial building or structure;

¨ Construction of multiple dwelling under tax agreement;

¨

Construction of commercial or industrial structure under tax agreement.

III. ALL APPLICANTS MUST COMPLETE THIS SECTION

A. Date of completion of new construction, conversion or improvement ______________, 2____.

Total cost of project $___________________________.

B.

C. Brief description of the nature and type of construction, conversion or improvement.

________________________________________________________________________

________________________________________________________________________

IV. ¨ Prior exemptions and/or abatement granted under P.L. 1991, c.441 amount

to $_______________________; (State “none” if prior exemptions have been

granted on subject premises).

¨ Attached hereto is proof of all matters required (assessor may require copy of

ordinance, evidence of governing body’s approval of categories of improvements or

specific project improvements, and such additional proof as may be required to

establish eligibility.)

¨ Attached hereto is a copy of the tax agreement, if applicable, executed between the

municipality and claimant.

¨ There are no delinquent or unpaid property taxes or penalties for non-payment of

taxes due on the property.

I certify that the foregoing statements made by me are true. I am aware that if any of the foregoing

statements made by me are willfully false, I am subject to punishment.

Date ________________________

Signature ______________________________________

Title (if any) ____________________________________

¨ Approved

Date ________________________

_________________________________

¨ Disapproved

(Assessor)

This form is prescribed by the Director, Division of Taxation, in the Department off the Treasury, as

required by law and may be reproduced for distribution, but no alteration may be made therein without

prior approval.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1