Sema4 Employee Expense Report

Download a blank fillable Sema4 Employee Expense Report in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Sema4 Employee Expense Report with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

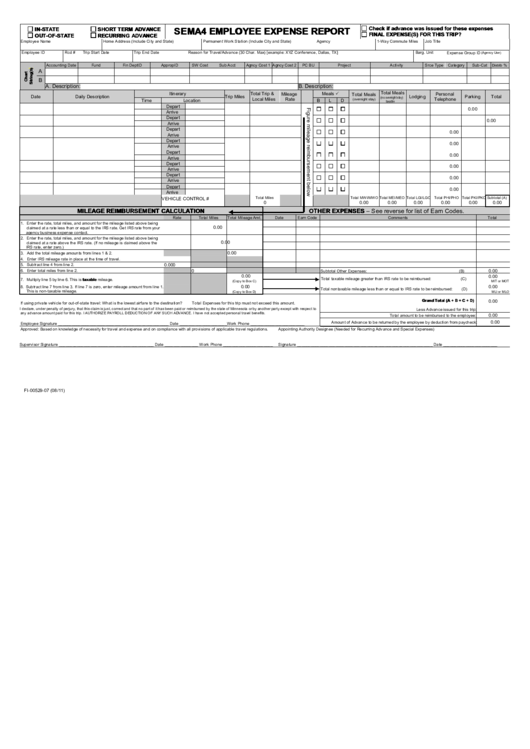

Check if advance was issued for these expenses

IN-STATE

SHORT TERM ADVANCE

SEMA4 EMPLOYEE EXPENSE REPORT

FINAL EXPENSE(S) FOR THIS TRIP?

OUT-OF-STATE

RECURRING ADVANCE

Employee Name

Home Address (Include City and State)

Permanent Work Station (Include City and State)

Agency

1-Way Commute Miles

Job Title

Employee ID

Rcd #

Trip Start Date

Trip End Date

Reason for Travel/Advance (30 Char. Max) [example: XYZ Conference, Dallas, TX]

Barg. Unit

Expense Group ID

(Agency Use)

Accounting Date

Fund

Fin DeptID

AppropID

SW Cost

Sub Acct

Agncy Cost 1 Agncy Cost 2

PC BU

Project

Activity

Srce Type

Category

Sub-Cat

Distrib

%

A

B

A. Description:

B. Description:

Total Meals

Meals

Itinerary

Total Trip &

Mileage

Personal

Total Meals

Date

Daily Description

Trip Miles

(no overnight stay)

Lodging

Parking

Total

Local Miles

Rate

Telephone

(overnight stay)

taxable

Time

Location

B

L

D

Depart

0.00

Arrive

Depart

0.00

Arrive

Depart

0.00

Arrive

Depart

0.00

Arrive

Depart

0.00

Arrive

Depart

0.00

Arrive

Depart

0.00

Arrive

Depart

0.00

Arrive

VEHICLE CONTROL #

Total Miles

Total MWI/MWO

Total MEI/MEO

Total LGI/LGO

Total PHI/PHO

Total PKI/PKO

Subtotal (A)

0

0.00

0.00

0.00

0.00

0.00

0.00

MILEAGE REIMBURSEMENT CALCULATION

OTHER EXPENSES – See reverse for list of Earn Codes.

Rate

Total Miles

Total Mileage Amt.

Date

Earn Code

Comments

Total

1. Enter the rate, total miles, and amount for the mileage listed above being

0.00

claimed at a rate less than or equal to the IRS rate. Get IRS rate from your

agency business expense contact.

2. Enter the rate, total miles, and amount for the mileage listed above being

0.00

claimed at a rate above the IRS rate. (If no mileage is claimed above the

IRS rate, enter zero.)

3. Add the total mileage amounts from lines 1 & 2.

0.00

4. Enter IRS mileage rate in place at the time of travel.

5. Subtract line 4 from line 2.

0.000

0

0.00

6. Enter total miles from line 2.

Subtotal Other Expenses:

(B)

0.00

0.00

Total taxable mileage greater than IRS rate to be reimbursed:

(C)

7. Multiply line 5 by line 6. This is taxable mileage.

(Copy to Box C)

MIT or MOT

0.00

8. Subtract line 7 from line 3. If line 7 is zero, enter mileage amount from line 1.

0.00

Total nontaxable mileage less than or equal to IRS rate to be reimbursed:

(D)

This is non-taxable mileage.

(Copy to Box D)

MLI or MLO

Grand Total (A + B + C + D)

0.00

If using private vehicle for out-of-state travel: What is the lowest airfare to the destination?

Total Expenses for this trip must not exceed this amount.

I declare, under penalty of perjury, that this claim is just, correct and that no part of it has been paid or reimbursed by the state of Minnesota or by another party except with respect to

Less Advance issued for this trip:

any advance amount paid for this trip. I AUTHORIZE PAYROLL DEDUCTION OF ANY SUCH ADVANCE. I have not accepted personal travel benefits.

Total amount to be reimbursed to the employee:

0.00

Amount of Advance to be returned by the employee by deduction from paycheck:

0.00

Employee Signature _________________________________________________ Date _____________________Work Phone ________________________

Approved: Based on knowledge of necessity for travel and expense and on compliance with all provisions of applicable travel regulations.

Appointing Authority Designee (Needed for Recurring Advance and Special Expenses)

Supervisor Signature __________________________________________ Date _______________ Work Phone ______________________

Signature ____________________________________________________________ Date ________________________

FI-00529-07 (08/11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2