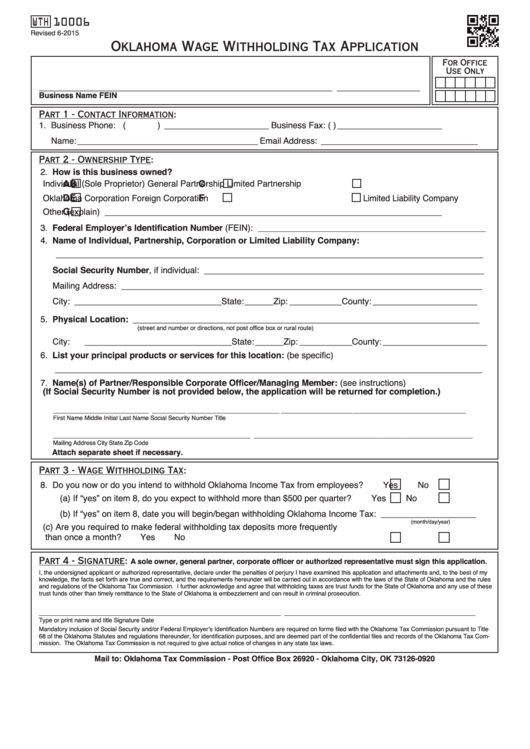

WTH 10006

Revised 6-2015

Oklahoma Wage Withholding Tax Application

For Office

Use Only

___________________________________________________________________

___________________

Business Name

FEIN

Part 1 - Contact Information:

1. Business Phone: (

) ______________________

Business Fax: (

) ______________________

Name: ______________________________________ Email Address: _________________________________

Part 2 - Ownership Type:

2. How is this business owned?

A

B

C

Individual (Sole Proprietor)

General Partnership

Limited Partnership

D

E

F

Oklahoma Corporation

Foreign Corporation

Limited Liability Company

G

Other (explain) _______________________________________________________________________

3. Federal Employer’s Identification Number (FEIN): ________________________________________________

4. Name of Individual, Partnership, Corporation or Limited Liability Company:

__________________________________________________________________________________________

Social Security Number, if individual: ___________________________________________________________

Mailing Address: ____________________________________________________________________________

City: _______________________________State: ______ Zip: ___________ County: ______________________

5. Physical Location: _________________________________________________________________________

(street and number or directions, not post office box or rural route)

City: _______________________________State: ______ Zip: ___________ County: ______________________

6. List your principal products or services for this location: (be specific)

__________________________________________________________________________________________

7. Name(s) of Partner/Responsible Corporate Officer/Managing Member: (see instructions)

(If Social Security Number is not provided below, the application will be returned for completion.)

____________________________

__________

___________________________

_____________________

_________________________________

First Name

Middle Initial

Last Name

Social Security Number

Title

__________________________________________________________

_____________________________________

_______

____________________

Mailing Address

City

State

Zip Code

Attach separate sheet if necessary.

Part 3 - Wage Withholding Tax:

8. Do you now or do you intend to withhold Oklahoma Income Tax from employees? .......

Yes

No

(a) If “yes” on item 8, do you expect to withhold more than $500 per quarter? ...........

Yes

No

(b) If “yes” on item 8, date you will begin/began withholding Oklahoma Income Tax: ____________________

(month/day/year)

(c) Are you required to make federal withholding tax deposits more frequently

than once a month? ...............................................................................................

Yes

No

Part 4 - Signature:

A sole owner, general partner, corporate officer or authorized representative must sign this application.

I, the undersigned applicant or authorized representative, declare under the penalties of perjury I have examined this application and attachments and, to the best of my

knowledge, the facts set forth are true and correct, and the requirements hereunder will be carried out in accordance with the laws of the State of Oklahoma and the rules

and regulations of the Oklahoma Tax Commission. I further acknowledge and agree that withholding taxes are trust funds for the State of Oklahoma and any use of these

trust funds other than timely remittance to the State of Oklahoma is embezzlement and can result in criminal prosecution.

_______________________________________________________________________

___________________________________________

_____________

Type or print name and title

Signature

Date

Mandatory inclusion of Social Security and/or Federal Employer’s Identification Numbers are required on forms filed with the Oklahoma Tax Commission pursuant to Title

68 of the Oklahoma Statutes and regulations thereunder, for identification purposes, and are deemed part of the confidential files and records of the Oklahoma Tax Com-

mission. The Oklahoma Tax Commission is not required to give actual notice of changes in any state tax laws.

Mail to: Oklahoma Tax Commission - Post Office Box 26920 - Oklahoma City, OK 73126-0920

1

1 2

2