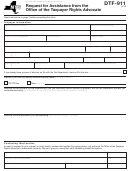

FORM

NYC Department of Finance

The Office of the Taxpayer Advocate

REQUEST FOR HELP FROM THE

l

DOF-911

OFFICE OF THE TAXPAYER ADVOCATE

TM

- INSTRUCTIONS -

INSTRUCTIONS

Department of Finance

WHERE TO FILE THIS FORM

by mail: The Office of the Taxpayer Advocate,

253 Broadway, 6th Floor, New York, NY 10007

by e-fax: 646-500-6907

if you already have a deadline to take action, filing this form does not extend the deadline.

the office of the taxpayer advocate is an independent organization within the department of

finance. the taxpayer advocate was created to safeguard taxpayer rights and assist taxpay-

ers who are having problems with the department of finance.

USE THIS FORM IF

You have made a reasonable attempt to solve your inquiry or complaint with the Department of

Finance. Your inquiry or complaint has not been fixed or you have not received a timely response.

l

You believe you can show that the Department of Finance is applying the tax laws, regulations or

policies unfairly or incorrectly, or have injured or will injure your taxpayer rights.

l

You face a threat of immediate harmful action (e.g., seizure of your funds or property) by the

Department of Finance for a debt you believe you can show is not owed.

l

You face a threat of immediate harmful action (e.g., seizure of your funds or property) by the

Department of Finance for a debt you believe you can show is incorrect, unfair, or illegal.

l

You believe you can show that you will suffer damage that is beyond repair or a long-term harmful

impact if relief is not granted.

l

You believe you can show that your problem also affects other similar taxpayers and is a problem

with the Department of Finance’s systems or processes.

l

You believe you can show that the rare facts in your case justify help from the Office of the Taxpayer

Advocate.

l

Your believe you can show that there is a compelling public policy reason why you should get help

from the Office of the Taxpayer Advocate.

l

DO NOT USE THIS FORM IF

You have not made a reasonable attempt to obtain relief through normal Department of Finance

l

channels, including contacting 311.

You have problems with parking tickets. For that, visit

nyc.gov/contactdof

l

You have a problem with personal income or sales tax. For that, contact the New York State Office

l

of the Taxpayer Rights Advocate at 518-530-HELP(4357).

You are asking for legal or tax return preparation advice.

l

You are trying to file a case with the Tax Commission, Tax Appeal Tribunal or New York State court.

l

You are appealing an unfavorable decision from the Tax Commission, Tax Appeal Tribunal or New

l

York State court.

You are claiming that a NYC tax law or tax system violates the New York State or U.S. Constitution.

l

Your focus involves only frivolous strategies intended to avoid or delay filing or paying New

l

York City taxes.

1

1 2

2 3

3 4

4