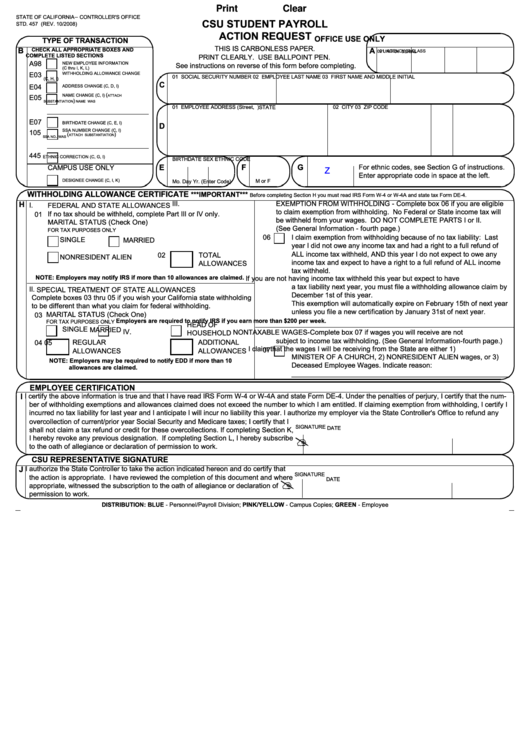

Print

Clear

¦

STATE OF CALIFORNIA

CONTROLLER'S OFFICE

CSU STUDENT PAYROLL

STD. 457 (REV. 10/2008)

ACTION REQUEST

OFFICE USE ONLY

TYPE OF TRANSACTION

THIS IS CARBONLESS PAPER.

B

CHECK ALL APPROPRIATE BOXES AND

A

01 AGENCY

03 CLASS

02 UNIT

04 SERIAL

COMPLETE LISTED SECTIONS

PRINT CLEARLY. USE BALLPOINT PEN.

A98

NEW EMPLOYEE INFORMATION

See instructions on reverse of this form before completing.

(C thru I, K, L)

E03

WITHHOLDING ALLOWANCE CHANGE

01 SOCIAL SECURITY NUMBER

02 EMPLOYEE LAST NAME

03 FIRST NAME AND MIDDLE INITIAL

(C, H, I)

C

ADDRESS CHANGE (C, D, I)

E04

(

NAME CHANGE (C, I)

ATTACH

E05

)

SUBSTANTIATION

NAME WAS

01 EMPLOYEE ADDRESS (Street, P.O. Box or Rural Route)

02 CITY

STATE

03 ZIP CODE

E07

BIRTHDATE CHANGE (C, E, I)

D

SSA NUMBER CHANGE (C, I)

105

(

)

ATTACH SUBSTANTIATION

.

SSA NO

WAS

445

ETHNIC CORRECTION (C, G, I)

BIRTHDATE

SEX

ETHNIC CODE

E

F

G

For ethnic codes, see Section G of instructions.

CAMPUS USE ONLY

Z

Enter appropriate code in space at the left.

DESIGNEE CHANGE (C, I, K)

Mo.

Day

Yr.

M or F

(Enter Code)

WITHHOLDING ALLOWANCE CERTIFICATE

***IMPORTANT***

Before completing Section H you must read IRS Form W-4 or W-4A and state tax Form DE-4.

EXEMPTION FROM WITHHOLDING - Complete box 06 if you are eligible

III.

H

I.

FEDERAL AND STATE ALLOWANCES

to claim exemption from withholding. No Federal or State income tax will

If no tax should be withheld, complete Part III or IV only.

01

be withheld from your wages. DO NOT COMPLETE PARTS I or II.

MARITAL STATUS (Check One)

(See General Information - fourth page.)

FOR TAX PURPOSES ONLY

06

I claim exemption from withholding because of no tax liability: Last

SINGLE

MARRIED

year I did not owe any income tax and had a right to a full refund of

ALL income tax withheld, AND this year I do not expect to owe any

02

TOTAL

NONRESIDENT ALIEN

income tax and expect to have a right to a full refund of ALL income

ALLOWANCES

tax withheld.

NOTE: Employers may notify IRS if more than 10 allowances are claimed.

If you are not having income tax withheld this year but expect to have

a tax liability next year, you must file a withholding allowance claim by

II.

SPECIAL TREATMENT OF STATE ALLOWANCES

December 1st of this year.

Complete boxes 03 thru 05 if you wish your California state withholding

This exemption will automatically expire on February 15th of next year

to be different than what you claim for federal withholding.

unless you file a new certification by January 31st of next year.

MARITAL STATUS (Check One)

03

Employers are required to notify IRS if you earn more than $200 per week.

FOR TAX PURPOSES ONLY

HEAD OF

SINGLE

MARRIED

IV.

NONTAXABLE WAGES-Complete box 07 if wages you will receive are not

HOUSEHOLD

subject to income tax withholding. (See General Information-fourth page.)

04

REGULAR

05

ADDITIONAL

I claim that the wages I will be receiving from the State are either 1)

07

ALLOWANCES

ALLOWANCES

MINISTER OF A CHURCH, 2) NONRESIDENT ALIEN wages, or 3)

NOTE: Employers may be required to notify EDD if more than 10

Deceased Employee Wages. Indicate reason:

allowances are claimed.

________________________________________________________

EMPLOYEE CERTIFICATION

I

I certify the above information is true and that I have read IRS Form W-4 or W-4A and state Form DE-4. Under the penalties of perjury, I certify that the num

ber of withholding exemptions and allowances claimed does not exceed the number to which I am entitled. If claiming exemption from withholding, I certify I

incurred no tax liability for last year and I anticipate I will incur no liability this year. I authorize my employer via the State Controller's Office to refund any

overcollection of current/prior year Social Security and Medicare taxes; I certify that I

SIGNATURE

DATE

shall not claim a tax refund or credit for these overcollections. If completing Section K,

�

I hereby revoke any previous designation. If completing Section L, I hereby subscribe

to the oath of allegiance or declaration of permission to work.

CSU REPRESENTATIVE SIGNATURE

J

I authorize the State Controller to take the action indicated hereon and do certify that

SIGNATURE

�

the action is appropriate. I have reviewed the completion of this document and where

DATE

appropriate, witnessed the subscription to the oath of allegiance or declaration of

permission to work.

DISTRIBUTION:

BLUE - Personnel/Payroll Division;

PINK/YELLOW - Campus Copies;

GREEN - Employee

1

1 2

2 3

3