Tangible Personal Property Tax Return

ADVERTISEMENT

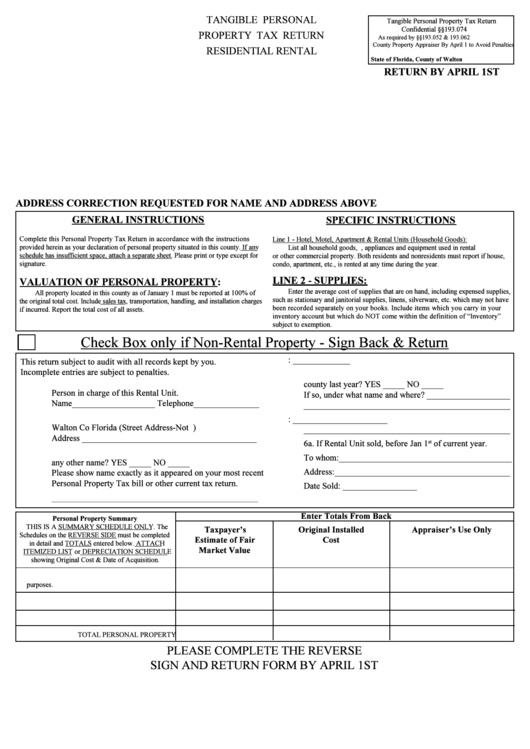

TANGIBLE PERSONAL

Tangible Personal Property Tax Return

Confidential §§193.074 F.S.

PROPERTY TAX RETURN

As required by §§193.052 & 193.062 F.S. Return to

County Property Appraiser By April 1 to Avoid Penalties

RESIDENTIAL RENTAL

State of Florida, County of Walton

RETURN BY APRIL 1ST

ADDRESS CORRECTION REQUESTED FOR NAME AND ADDRESS ABOVE

GENERAL INSTRUCTIONS

SPECIFIC INSTRUCTIONS

Complete this Personal Property Tax Return in accordance with the instructions

Line 1 - Hotel, Motel, Apartment & Rental Units (Household Goods):

provided herein as your declaration of personal property situated in this county. If any

List all household goods, i.e. furniture, appliances and equipment used in rental

schedule has insufficient space, attach a separate sheet. Please print or type except for

or other commercial property. Both residents and nonresidents must report if house,

signature.

condo, apartment, etc., is rented at any time during the year.

LINE 2 - SUPPLIES:

VALUATION OF PERSONAL PROPERTY:

Enter the average cost of supplies that are on hand, including expensed supplies,

All property located in this county as of January 1 must be reported at 100% of

such as stationary and janitorial supplies, linens, silverware, etc. which may not have

the original total cost. Include sales tax, transportation, handling, and installation charges

been recorded separately on your books. Include items which you carry in your

if incurred. Report the total cost of all assets.

inventory account but which do NOT come within the definition of “Inventory”

subject to exemption.

Check Box only if Non-Rental Property - Sign Back & Return

4. Date you began Rental Unit in this county: _____________

This return subject to audit with all records kept by you.

Incomplete entries are subject to penalties.

5. Did you file a Tangible Personal Property Return in this

1. Please give name and telephone number of Owner or

county last year? YES _____ NO _____

Person in charge of this Rental Unit.

If so, under what name and where? ___________________

Name___________________ Telephone_______________

_______________________________________________

2. Actual Physical Location of Property for Rental Unit in

6. Former owner of the Rental Unit: ______________________

Walton Co Florida (Street Address-Not P.O. Box)

_______________________________________________

Address ________________________________________

6a. If Rental Unit sold, before Jan 1

of current year.

st

3. Do you file a Tangible Personal Property Tax Return under

To whom:________________________________________

any other name? YES _____ NO _____

Address:________________________________________

Please show name exactly as it appeared on your most recent

Personal Property Tax bill or other current tax return.

Date Sold: _________________

_______________________________________________

Enter Totals From Back

Personal Property Summary

THIS IS A SUMMARY SCHEDULE ONLY. The

Taxpayer’s

Original Installed

Appraiser’s Use Only

Schedules on the REVERSE SIDE must be completed

Estimate of Fair

Cost

in detail and TOTALS entered below. ATTACH

Market Value

ITEMIZED LIST or DEPRECIATION SCHEDULE

showing Original Cost & Date of Acquisition.

1. Rental Units - Removable items used for rental

purposes.

2. Supplies - Not Held for Resale

3. Other - Please Specify

TOTAL PERSONAL PROPERTY

PLEASE COMPLETE THE REVERSE

SIGN AND RETURN FORM BY APRIL 1ST

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2