Sample Form Of Counter-Notification To Mls Property Information Network, Inc. Objecting To A Claim Of Infringement Of Copyright And The Disabling Or Removal Of Material From The Multiple Listing Service

ADVERTISEMENT

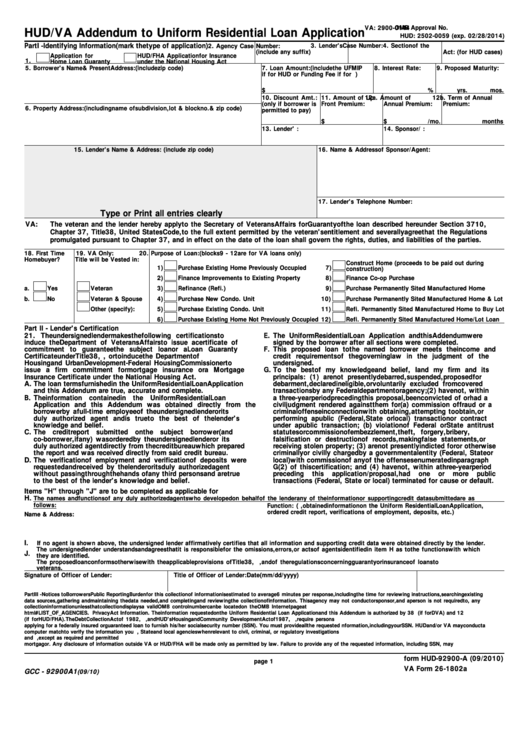

OMB Approval No.

VA: 2900-0144

HUD/VA Addendum to Uniform Residential Loan Application

HUD: 2502-0059 (exp. 02/28/2014)

Part I - Identifying Information (mark the type of application)

2. Agency Case Number:

3. Lender's Case Number:

4. Section of the

(include any suffix)

Act: (for HUD cases)

V.A. Application for

HUD/FHA Application for Insurance

1.

Home Loan Guaranty

under the National Housing Act

5. Borrower's Name & Present Address: (include zip code)

7. Loan Amount: (include the UFMIP

8. Interest Rate:

9. Proposed Maturity:

if for HUD or Funding Fee if for V.A.)

$

%

yrs.

mos.

10. Discount Amt.:

11. Amount of Up

12a. Amount of

12b. Term of Annual

(only if borrower is

Front Premium:

Annual Premium:

Premium:

6. Property Address: (including name of subdivision, lot & block no. & zip code)

permitted to pay)

$

$

/mo.

months

13. Lender's I.D. Code:

14. Sponsor/Agent I.D. Code:

15. Lender's Name & Address: (include zip code)

16. Name & Address of Sponsor/Agent:

17. Lender's Telephone Number:

Type or Print all entries clearly

VA:

The veteran and the lender hereby apply to the Secretary of Veterans Affairs for Guaranty of the loan described here under Section 3710,

Chapter 37, Title 38, United States Code, to the full extent permitted by the veteran's entitlement and severally agree that the Regulations

promulgated pursuant to Chapter 37, and in effect on the date of the loan shall govern the rights, duties, and liabilities of the parties.

18. First Time

19. VA Only:

20. Purpose of Loan: (blocks 9 - 12 are for VA loans only)

Homebuyer?

Title will be Vested in:

Construct Home (proceeds to be paid out during

1)

Purchase Existing Home Previously Occupied

7)

construction)

2)

Finance Improvements to Existing Property

8)

Finance Co-op Purchase

a.

Yes

Veteran

3)

Refinance (Refi.)

9)

Purchase Permanently Sited Manufactured Home

b.

No

Veteran & Spouse

4)

Purchase New Condo. Unit

10)

Purchase Permanently Sited Manufactured Home & Lot

Other (specify):

5)

Purchase Existing Condo. Unit

11)

Refi. Permanently Sited Manufactured Home to Buy Lot

6)

Purchase Existing Home Not Previously Occupied

12)

Refi. Permanently Sited Manufactured Home/Lot Loan

Part II - Lender's Certification

21. The undersigned lender makes the following certifications to

E.

The Uniform Residential Loan Application and this Addendum were

induce the Department of Veterans Affairs to issue a certificate of

signed by the borrower after all sections were completed.

commitment to guarantee the subject loan or a Loan Guaranty

F.

This proposed loan to the named borrower meets the income and

Certificate under Title 38, U.S. Code, or to induce the Department of

credit requirements of the governing law in the judgment of the

Housing and Urban Development - Federal Housing Commissioner to

undersigned.

issue a firm commitment for mortgage insurance or a Mortgage

G.

To the best of my knowledge and belief, I and my firm and its

Insurance Certificate under the National Housing Act.

principals: (1) are not presently debarred, suspended, proposed for

A.

The loan terms furnished in the Uniform Residential Loan Application

debarment, declared ineligible, or voluntarily excluded from covered

and this Addendum are true, accurate and complete.

transactions by any Federal department or agency; (2) have not, within

B.

The

information contained

in the Uniform Residential

Loan

a three-year period preceding this proposal, been convicted of or had a

Application and this Addendum was obtained directly from the

civil judgment rendered against them for (a) commission of fraud or a

borrower by a full-time employee of the undersigned lender or its

criminal offense in connection with obtaining, attempting to obtain, or

duly authorized agent and is true to the best of the lender's

performing a public (Federal, State or local) transaction or contract

knowledge and belief.

under a public transaction; (b) violation of Federal or State antitrust

C.

The credit report submitted on the subject borrower

(and

statutes or commission of embezzlement, theft, forgery, bribery,

co-borrower, if any) was ordered by the undersigned lender or its

falsification or destruction of records, making false statements, or

duly authorized agent directly from the credit bureau which prepared

receiving stolen property; (3) are not presently indicted for or otherwise

the report and was received directly from said credit bureau.

criminally or civilly charged by a governmental entity (Federal, State or

D.

The verification of employment and verification of deposits were

local) with commission of any of the offenses enumerated in paragraph

requested and received by the lender or its duly authorized agent

G(2) of this certification; and (4) have not, within a three-year period

without passing through the hands of any third persons and are true

preceding

this

application/proposal,

had

one

or

more

public

to the best of the lender's knowledge and belief.

transactions (Federal, State or local) terminated for cause or default.

Items "H" through "J" are to be completed as applicable for V.A. loans only.

H.

The names and functions of any duly authorized agents who developed on behalf of the lender any of the information or supporting credit data submitted are as

follows:

Function: (e.g., obtained information on the Uniform Residential Loan Application,

ordered credit report, verifications of employment, deposits, etc.)

Name & Address:

I.

If no agent is shown above, the undersigned lender affirmatively certifies that all information and supporting credit data were obtained directly by the lender.

The undersigned lender understands and agrees that it is responsible for the omissions, errors, or acts of agents identified in item H as to the functions with which

J.

they are identified.

The proposed loan conforms otherwise with the applicable provisions of Title 38, U.S. Code, and of the regulations concerning guaranty or insurance of loans to

veterans.

Signature of Officer of Lender:

Title of Officer of Lender:

Date(mm/dd/yyyy)

Part III - Notices to Borrowers Public Reporting Burden for this collection of information is estimated to average 6 minutes per response, including the time for reviewing instructions, searching existing

data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. This agency may not conduct or sponsor, and a person is not required to, any

collection information unless that collection displays a valid OMB control number can be located on the OMB Internet page at

html#LIST_OF_AGENCIES. Privacy Act Information. The information requested on the Uniform Residential Loan Application and this Addendum is authorized by 38 U.S.C. 3710 (if for DVA) and 12

U.S.C. 1701 et seq . (if for HUD/FHA). The Debt Collection Act of 1982, Pub. Law 97-365, and HUD's Housing and Community Development Act of 1987, 42U.S.C. 3543, require persons

applying for a federally insured or guaranteed loan to furnish his/her social security number (SSN). You must provide all the requested nformation, including your SSN. HUD and/or VA may conduct a

computer match to verify the information you provide. HUD and/or VA may disclose certain information to Federal, State and local agencies when relevant to civil, criminal, or regulatory investigations

and prosecutions. It will not otherwise be disclosed or released outside of HUD or VA, except as required and permitted by law. The information will be used to determine whether you qualify as a

mortgagor. Any disclosure of information outside VA or HUD/FHA will be made only as permitted by law. Failure to provide any of the requested information, including SSN, may

form HUD-92900-A (09/2010)

page 1

VA Form 26-1802a

GCC - 92900A1

(09/10)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4