Deductions Working Sheet - Paper Size A3

ADVERTISEMENT

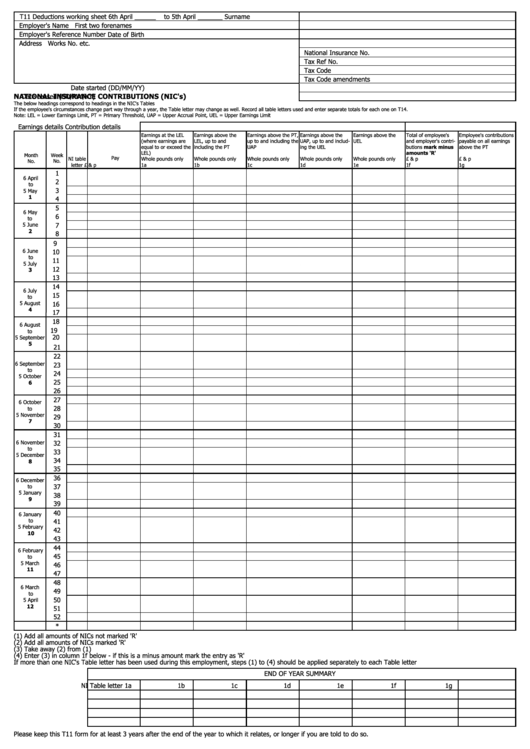

T11 Deductions working sheet 6th April ______

to 5th April _______

Surname

Employer's Name

First two forenames

Employer's Reference Number

Date of Birth

Address

Works No. etc.

National Insurance No.

Tax Ref No.

Tax Code

Tax Code amendments

Date started (DD/MM/YY)

NATIONAL INSURANCE CONTRIBUTIONS (NIC's)

Date ceased (DD/MM/YY)

The below headings correspond to headings in the NIC's Tables

If the employee's circumstances change part way through a year, the Table letter may change as well. Record all table letters used and enter separate totals for each one on T14.

Note: LEL = Lower Earnings Limit, PT = Primary Threshold, UAP = Upper Accrual Point, UEL = Upper Earnings Limit

Earnings details

Contribution details

Earnings at the LEL

Earnings above the

Earnings above the PT,

Earnings above the

Earnings above the

Total of employee's

Employee's contributions

(where earnings are

LEL, up to and

up to and including the

UAP, up to and includ-

UEL

and employer's contri-

payable on all earnings

equal to or exceed the

including the PT

UAP

ing the UEL

butions mark minus

above the PT

LEL)

amounts 'R'

Month

Week

Pay

NI table

Whole pounds only

Whole pounds only

Whole pounds only

Whole pounds only

Whole pounds only

£ & p

£ & p

No.

No

.

letter

£ & p

1a

1b

1c

1d

1e

1f

1g

1

6 April

2

to

3

5 May

1

4

5

6 May

6

to

5 June

7

2

8

9

6 June

10

to

11

5 July

12

3

13

14

6 July

15

to

5 August

16

4

17

18

6 August

19

to

5 September

20

5

21

22

6 September

23

to

24

5 October

25

6

26

27

6 October

28

to

5 November

29

7

30

31

6 November

32

to

33

5 December

34

8

35

36

6 December

37

to

5 January

38

9

39

40

6 January

to

41

5 February

42

10

43

44

6 February

45

to

5 March

46

11

47

48

6 March

49

to

50

5 April

12

51

52

*

(1) Add all amounts of NICs not marked 'R'

(2) Add all amounts of NICs marked 'R'

(3) Take away (2) from (1)

(4) Enter (3) in column 1f below - if this is a minus amount mark the entry as 'R'

If more than one NIC's Table letter has been used during this employment, steps (1) to (4) should be applied separately to each Table letter

END OF YEAR SUMMARY

NI Table letter

1a

1b

1c

1d

1e

1f

1g

Please keep this T11 form for at least 3 years after the end of the year to which it relates, or longer if you are told to do so.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2