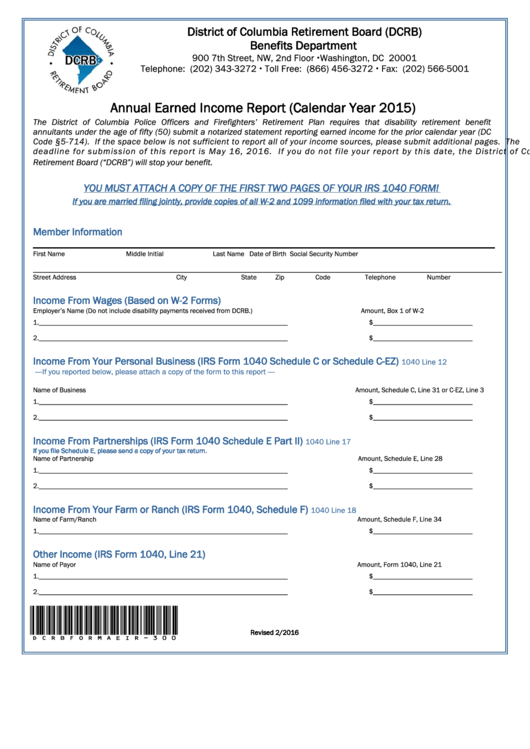

Annual Earned Income Report (Calendar Year 2015)

ADVERTISEMENT

District of Columbia Retirement Board (DCRB)

Benefits Department

900 7th Street, NW, 2nd Floor Washington, DC 20001

Telephone: (202) 343-3272 Toll Free: (866) 456-3272 Fax: (202) 566-5001

Annual Earned Income Report (Calendar Year 2015)

The District of Columbia Police Officers and Firefighters’ Retirement Plan requires that disability retirement benefit

annuitants under the age of fifty (50) submit a notarized statement reporting earned income for the prior calendar year (DC

Code §5-714). If the space below is not sufficient to report all of your income sources, please submit additional pages. The

deadline for submission of this report is May 16, 2016. If you do not file your report by this date, the District of Columbia

Retirement Board (“DCRB”) will stop your benefit.

YOU MUST ATTACH A COPY OF THE FIRST TWO PAGES OF YOUR IRS 1040 FORM!

If you are married filing jointly, provide copies of all W-2 and 1099 information filed with your tax return.

Member Information

________________________________________________________________________________________

First Name

Middle Initial

Last Name

Date of Birth

Social Security Number

____________________________________________________________________________________________________________________________________

Street Address

City

State

Zip Code

Telephone Number

Income From Wages (Based on W-2 Forms)

Employer’s Name (Do not include disability payments received from DCRB.)

Amount, Box 1 of W-2

1.______________________________________________________________________

$____________________________

2.______________________________________________________________________

$____________________________

Income From Your Personal Business (IRS Form 1040 Schedule C or Schedule C-EZ)

1040 Line 12

—-If you reported below, please attach a copy of the form to this report —-

Name of Business

Amount, Schedule C, Line 31 or C-EZ, Line 3

1.______________________________________________________________________

$____________________________

2.______________________________________________________________________

$____________________________

Income From Partnerships (IRS Form 1040 Schedule E Part II)

1040 Line 17

If you file Schedule E, please send a copy of your tax return.

Name of Partnership

Amount, Schedule E, Line 28

1.______________________________________________________________________

$____________________________

2.______________________________________________________________________

$____________________________

Income From Your Farm or Ranch (IRS Form 1040, Schedule F)

1040 Line 18

Name of Farm/Ranch

Amount, Schedule F, Line 34

1.______________________________________________________________________

$____________________________

Other Income (IRS Form 1040, Line 21)

Name of Payor

Amount, Form 1040, Line 21

1.______________________________________________________________________

$____________________________

2.______________________________________________________________________

$____________________________

DCRBFormAEIR-300

Revised 2/2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2