West Virginia State Tax Department - Motor Fuel Excise Tax

ADVERTISEMENT

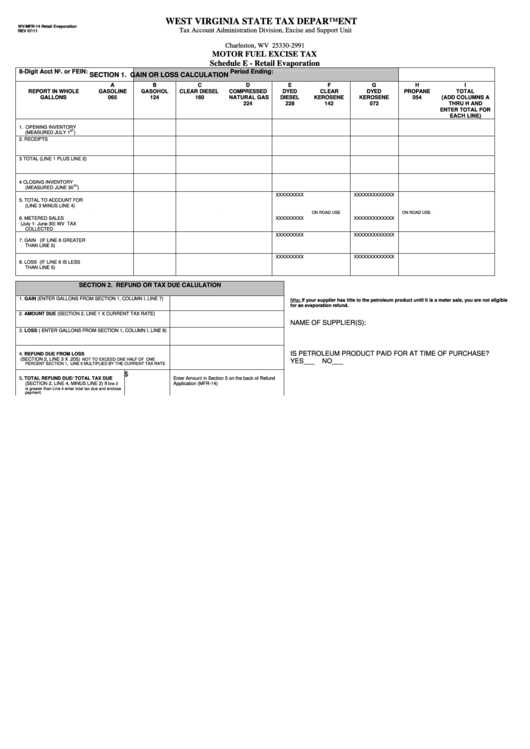

WEST VIRGINIA STATE TAX DEPARTMENT

WV/MFR-14 Retail Evaporation

Tax Account Administration Division, Excise and Support Unit

REV 07/11

P.O. Box 2991

Charleston, WV 25330-2991

MOTOR FUEL EXCISE TAX

Schedule E - Retail Evaporation

8-Digit Acct No. or FEIN:

Period Ending:

SECTION 1. GAIN OR LOSS CALCULATION

A

B

C

D

E

F

G

H

I

REPORT IN WHOLE

GASOLINE

GASOHOL

CLEAR DIESEL

COMPRESSED

DYED

CLEAR

DYED

PROPANE

TOTAL

GALLONS

065

124

160

NATURAL GAS

DIESEL

KEROSENE

KEROSENE

054

(ADD COLUMNS A

224

228

142

072

THRU H AND

ENTER TOTAL FOR

EACH LINE)

1. OPENING INVENTORY

ST

(MEASURED JULY 1

)

2. RECEIPTS

3 TOTAL (LINE 1 PLUS LINE 2)

4 CLOSING INVENTORY

TH

(MEASURED JUNE 30

)

5. TOTAL TO ACCOUNT FOR

XXXXXXXXX

XXXXXXXXXXXXX

(LINE 3 MINUS LINE 4)

ON ROAD USE

ON ROAD USE

6. METERED SALES

XXXXXXXXX

XXXXXXXXXXXXX

(July 1- June 30) WV TAX

COLLECTED

7. GAIN (IF LINE 6 GREATER

XXXXXXXXX

XXXXXXXXXXXXX

THAN LINE 5)

8. LOSS (IF LINE 6 IS LESS

XXXXXXXXX

XXXXXXXXXXXXX

THAN LINE 5)

SECTION 2. REFUND OR TAX DUE CALULATION

Note: If your supplier has title to the petroleum product until it is a meter sale, you are not eligible

1. GAIN (ENTER GALLONS FROM SECTION 1, COLUMN I, LINE 7)

for an evaporation refund.

2. AMOUNT DUE (SECTION 2, LINE 1 X CURRENT TAX RATE)

NAME OF SUPPLIER(S):

3. LOSS ( ENTER GALLONS FROM SECTION 1, COLUMN I, LINE 8)

IS PETROLEUM PRODUCT PAID FOR AT TIME OF PURCHASE?

4. REFUND DUE FROM LOSS

(SECTION 2, LINE 3 X .205)

NOT TO EXCEED ONE HALF OF ONE

YES___

NO___

PERCENT SECTION 1, LINE 5 MULTIPLIED BY THE CURRENT TAX RATE

5. TOTAL REFUND DUE/ TOTAL TAX DUE

$

Enter Amount in Section 5 on the back of Refund

(SECTION 2, LINE 4, MINUS LINE 2) If

line 2

Application (MFR-14)

is greater than Line 4 enter total tax due and enclose

payment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1