Form Ssa-97-Sm (04-11) - Employer Questionnaire - Discrepancy Between Irs And Ssa Records Form

ADVERTISEMENT

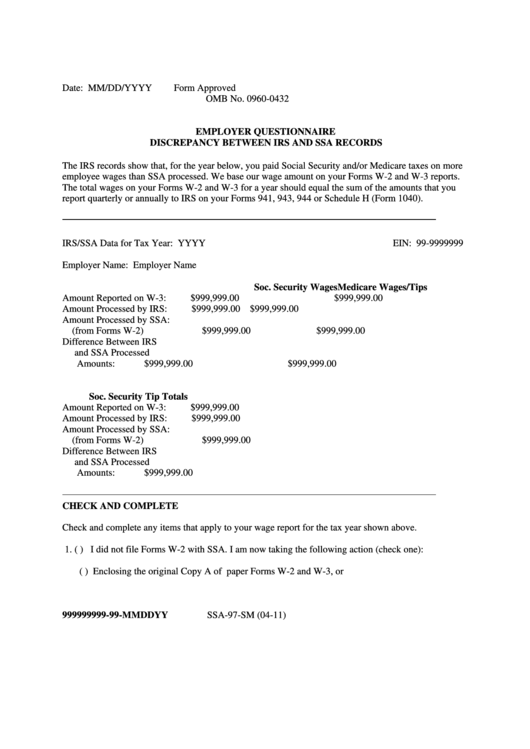

Date: MM/DD/YYYY

Form Approved

OMB No. 0960-0432

EMPLOYER QUESTIONNAIRE

DISCREPANCY BETWEEN IRS AND SSA RECORDS

The IRS records show that, for the year below, you paid Social Security and/or Medicare taxes on more

employee wages than SSA processed. We base our wage amount on your Forms W-2 and W-3 reports.

The total wages on your Forms W-2 and W-3 for a year should equal the sum of the amounts that you

report quarterly or annually to IRS on your Forms 941, 943, 944 or Schedule H (Form 1040).

IRS/SSA Data for Tax Year: YYYY

EIN: 99-9999999

Employer Name: Employer Name

Soc. Security Wages

Medicare Wages/Tips

Amount Reported on W-3:

$999,999.00

$999,999.00

Amount Processed by IRS:

$999,999.00

$999,999.00

Amount Processed by SSA:

(from Forms W-2)

$999,999.00

$999,999.00

Difference Between IRS

and SSA Processed

Amounts:

$999,999.00

$999,999.00

Soc. Security Tip Totals

Amount Reported on W-3:

$999,999.00

Amount Processed by IRS:

$999,999.00

Amount Processed by SSA:

(from Forms W-2)

$999,999.00

Difference Between IRS

and SSA Processed

Amounts:

$999,999.00

CHECK AND COMPLETE

Check and complete any items that apply to your wage report for the tax year shown above.

1. ( ) I did not file Forms W-2 with SSA. I am now taking the following action (check one):

( ) Enclosing the original Copy A of paper Forms W-2 and W-3, or

999999999-99-MMDDYY

SSA-97-SM (04-11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4