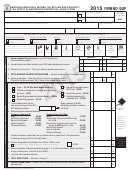

Staple all donation and childcare/housekeeper receipts here.

DONATION RECEIPTS

• a clear statement that it’s a donation

All receipts must show:

• the signature of an authorised person

• an official stamp with the name of the donee organisation

• your and/or your spouse/partner’s name

• the word “copy” or “replacement” if it’s a replacement receipt.

• the amount and date of the donation

YOUR TAX CREDIT REFUND

Please note that if you have any amounts owing from previous years (that

Inland Revenue uses truncation rather than rounding to the nearest

aren’t under an instalment arrangement) or if you have any child support

cent, for all tax credit refund amounts. This means if you calculate you’re

entitled to a tax credit of $99.9999, your refund will be truncated to

arrears, your refund will be used to pay these first.

2 decimal places, eg, $99.99 rather than being rounded to the nearest cent.

CAN I CLAIM A TAX CREDIT?

HOW MUCH CAN I CLAIM?

You can claim a tax credit if you’re an individual (not a company, trust or

• The total donations, childcare and/or housekeeper payments you claim

partnership) and you:

can’t be more than your taxable income for the year.

• If you need to file an IR 3 income tax return, we may need your return to

• earned taxable income (eg, salary, wages, benefit, self-employed income,

check your taxable income before we can process your claim.

interest) in the income year you’re claiming for, and

• To avoid delays you can either file your claim with or after your IR 3 or we

• were a NZ resident for tax purposes at any time during the tax year.

may send you a letter advising we need your return.

WHAT CAN I CLAIM?

Claiming donations

Donations

If you’re claiming for donations, you can claim the lesser of:

A donation is a gift of money made voluntarily to a school/kindergarten

• 33.3333% of the total donations you’ve made, or

or a donee organisation, where there is no identifiable direct benefit to the

• 33.3333% of your taxable income.

donor, or the donor’s family.

Before 1 April 2008 there was a limit on total donations that could be

If you have receipts, you can claim a tax credit for donations of $5 or more.

claimed. Go to for more information.

Go to for a list of approved donee organisations.

Claiming childcare and/or housekeeper payments

School/kindergarten donations

The maximum amount you can claim for childcare and/or housekeeper

payments is $310 per family. If both you and your spouse/partner are

You can claim a donation tax credit for school fees or state run

claiming a portion of the childcare and/or housekeeper payments then the

kindergartens as long as they go to the general fund. In order to claim a

tax credit must be split. For example, if you’re claiming the maximum of

tax credit, a receipt must have the word “donation” written on it.

$310, you can each claim only $155.

Church donations

If you’re claiming for childcare and/or housekeeper payments, you can claim

A church donation is an unconditional donation to a donee church

the lesser of:

organisation or group. Place all church donations in Box 4. If you made a

• 33% of the total payments you’ve made, or

donation through a church to an unrelated charitable organisation, place

• $310 ($940 x 33%), or

this amount in Box 5.

• 33% of your taxable income.

Childcare

SHARING RECEIPTS WITH YOUR SPOUSE/PARTNER

If your child(ren) was either under 18 or unable to work because of a

disability and you paid a person or organisation (eg, a créche, Barnardos,

If your spouse/partner has taxable income they may be eligible to claim the

kindergarten) for childcare and have receipts, you can claim a tax credit if:

balance of your receipts.

• you were a single parent, or

Example

• you and your spouse/partner were employed or self-employed, (this

Your taxable income is $1,000, but you have receipts of $1,500. You’re

doesn’t apply to couples who are separated), or

only eligible to claim $1,000. If your partner/spouse has income of $500

• you or your partner were disabled or physically unable to care for your

or more, then they can claim the other $500.

child(ren).

PRIVACY

Housekeeper

Meeting your tax obligations means giving us accurate information so we

You can claim a housekeeper tax credit if you have receipts to show you

can assess your liabilities or your entitlements under the Acts we administer.

paid for a housekeeper, because you or your spouse/partner were disabled

or physically unable to look after the home. This doesn’t include amounts

For full details of our privacy policy go to (keyword: privacy).

covered by subsidies and reimbursements.

ARE YOUR PERSONAL DETAILS CORRECT?

We need your correct information so next year we can send you your tax credit claim form without delay. If any of your contact details shown on the front

are missing or incorrect, please enter your correct details here:

DAYTIME TELEPHONE NUMBER

(

)

11

POSTAL ADDRESS

If your new address is a PO Box number, please show your box lobby if you have one. If you’re unsure of your box lobby please contact New Zealand Post.

12

STREET ADDRESS

13

CORRESP.

OPERATOR

14

OFFICE USE ONLY

CODE

INDICATOR

RESET form

1

1 2

2