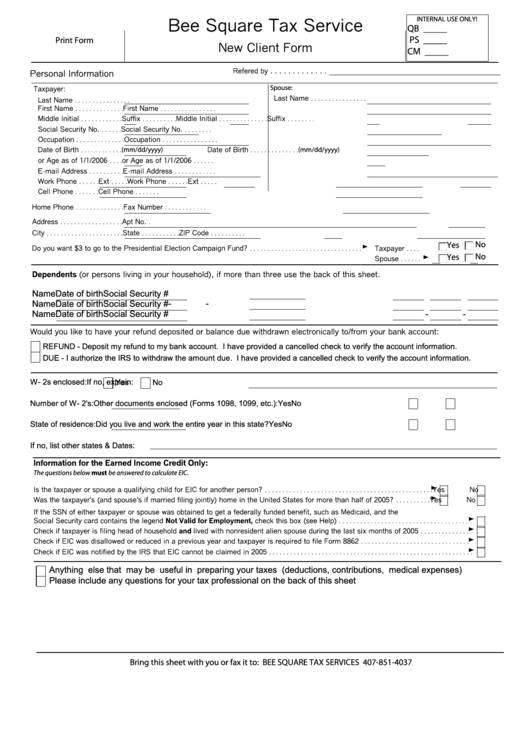

Bee Square Tax Service New Client Form

ADVERTISEMENT

INTERNAL USE ONLY!

Bee Square Tax Service

QB _____

PS _____

Print Form

New Client Form

CM _____

Refered by . . . . . . . . . . . . .

Personal Information

Spouse:

Taxpayer:

Last Name

. . . . . . . . . . . . . . . .

Last Name

. . . . . . . . . . . . . . . .

First Name

First Name

. . . . . . . . . . . . . .

. . . . . . . . . . . . . . . .

Middle Initial

Suffix

Middle Initial

Suffix

. . . . . . . . . . . .

. . . . . . . . . .

. . . . . . . . . . . . . .

. . . . . . . .

Social Security No.

Social Security No.

. . . . . .

. . . . . . . .

Occupation

Occupation

. . . . . . . . . . . . . .

. . . . . . . . . . . . . . . .

Date of Birth

(mm/dd/yyyy)

Date of Birth

(mm/dd/yyyy)

. . . . . . . . . . . .

. . . . . . . . . . . . . .

or Age as of 1/1/2006

or Age as of 1/1/2006

. . . .

. . . . . .

E-mail Address

E-mail Address

. . . . . . . . . .

. . . . . . . . . . . .

Work Phone

Ext

Work Phone

Ext

. . . . . .

. . . . .

. . . . . .

. . . . .

Cell Phone

Cell Phone

. . . . . . .

. . . . . . .

Home Phone

Fax Number

. . . . . . . . . . . . . .

. . . . . . . . . . . .

Address

Apt No.

. . . . . . . . . . . . . . . . . .

.

City

State

ZIP Code

. . . . . . . . . . . . . . . . . . . . . .

. . . . . . . . . . .

. . . . . . . . . .

No

Yes

G

Do you want $3 to go to the Presidential Election Campaign Fund?

Taxpayer

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

. . . .

No

Yes

G

Spouse

. . . . . .

Dependents (or persons living in your household), if more than three use the back of this sheet.

Name

Date of birth

Social Security #

Name

Date of birth

Social Security #

-

-

Name

Date of birth

Social Security #

-

-

Would you like to have your refund deposited or balance due withdrawn electronically to/from your bank account:

REFUND - Deposit my refund to my bank account. I have provided a cancelled check to verify the account information.

DUE - I authorize the IRS to withdraw the amount due. I have provided a cancelled check to verify the account information.

W- 2s enclosed:

If no, explain:

Yes

No

Number of W- 2's:

Other documents enclosed (Forms 1098, 1099, etc.):

Yes

No

State of residence:

Did you live and work the entire year in this state?

Yes

No

If no, list other states & Dates:

Information for the Earned Income Credit Only:

The questions below must be answered to calculate EIC.

G

Is the taxpayer or spouse a qualifying child for EIC for another person?

Yes

No

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

G

Was the taxpayer's (and spouse's if married filing jointly) home in the United States for more than half of 2005?

Yes

No

. . . . . . . . . .

If the SSN of either taxpayer or spouse was obtained to get a federally funded benefit, such as Medicaid, and the

G

Social Security card contains the legend Not Valid for Employment, check this box (see Help)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

G

Check if taxpayer is filing head of household and lived with nonresident alien spouse during the last six months of 2005

. . . . . . . . . . . . . .

G

Check if EIC was disallowed or reduced in a previous year and taxpayer is required to file Form 8862

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

G

Check if EIC was notified by the IRS that EIC cannot be claimed in 2005

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Anything else that may be useful in preparing your taxes (deductions, contributions, medical expenses)

Please include any questions for your tax professional on the back of this sheet

Bring this sheet with you or fax it to: BEE SQUARE TAX SERVICES 407-851-4037

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1