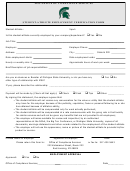

Student Business Travel Certification Form

ADVERTISEMENT

Responsible Executive: Controller

Tax Department

Responsible Department: Tax

Review Date: November, 2012

STUDENT TRAVEL AND TAX

ISSUES

POLICY STATEMENT

OVERVIEW

A payment/reimbursement to a student for travel represents either a “University business expense” or a

“fellowship/scholarship/award” (“FSA”) payment. We are providing this additional guidance in order to

assist faculty and students in appropriately classifying the type of payment made. This revised guidance

may allow more students to travel on a tax-free basis, if the proper documentation is provided. From a

tax standpoint, you should be aware that properly documented business expenses are non-taxable

payments/reimbursements to the recipient. FSA payments may represent taxable income to the student

(and in cases of non-U.S. persons may also require withholding and reporting).

I.

UNIVERSITY BUSINESS EXPENSE

A.

What Qualifies As A Business Expense?

In order to meet the criteria of “University business travel”, the purpose of the payment

must represent a reimbursement for business expenses incurred for travel made on

behalf of the University (i.e., the University is the primary beneficiary of the student’s

travel). A payment of this type meets the business connection requirement of the IRS

definition of an Accountable Plan and can be made on a tax-free basis. Please see

( ).

Examples of the types of student travel that could be considered “business expenses”:

•

If the travel directly supports a faculty member’s project or research program,

or;

•

If the travel is related to presenting or leading a session at a conference (a

photocopy of the conference program indicating the traveler is a speaker/presenter will

be required), or;

•

If the travel is required to officially represent the University.

B.

How to Report Business Expenses for Reimbursement

•

Report business expenses through the travel ND expense reporting system. This

includes providing proper documentation and filing the expense report within 60 days of

the date the expense is incurred or paid.

•

New Requirement: The student must include with the expense report a “Student

Business Travel Certification Form” (here is the electronic link:

-

also see form below),

approved by a faculty member to show that the travel meets one of the business

purposes mentioned above.

Student Travel and Tax Issues

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3