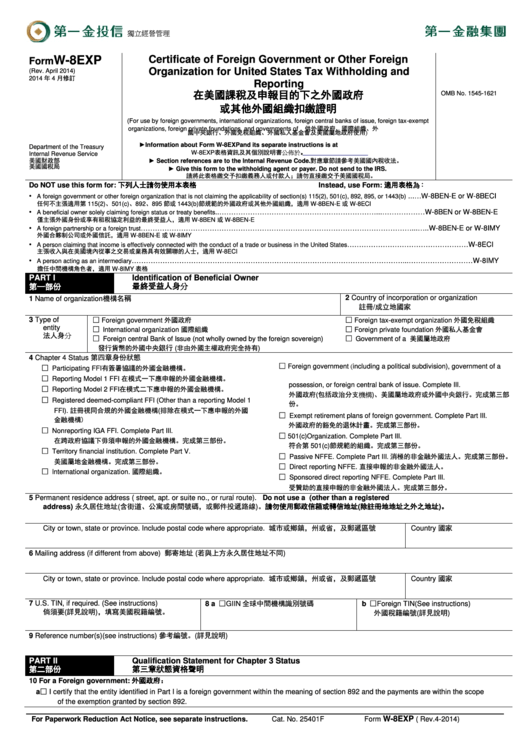

Form W-8exp (Chinese) - Certificate Of Foreign Government Or Other Foreign Organization For United States Tax Withholding And Reporting - 2014

ADVERTISEMENT

獨立經營管理

Certificate of Foreign Government or Other Foreign

W-8EXP

Form

Organization for United States Tax Withholding and

(Rev. April 2014)

2014 年 4 月修訂

Reporting

在美國課稅及申報目的下之外國政府

OMB No. 1545-1621

或其他外國組織扣繳證明

(For use by foreign governments, international organizations, foreign central banks of issue, foreign tax-exempt

organizations, foreign private foundations, and governments of U.S. possessions. 供外國政府、國際組織、外

國中央銀行、外國免稅組織、外國私人基金會及美國屬地政府使用)

► Information about Form W-8EXP and its separate instructions is at

Department of the Treasury

W-8EXP表格資訊及其個別說明書公佈於

Internal Revenue Service

► Section references are to the Internal Revenue Code. 對應章節請參考美國國內稅收法。

美國財政部

► Give this form to the withholding agent or payer. Do not send to the IRS.

美國國稅局

請將此表格繳交予扣繳義務人或付款人;請勿直接繳交予美國國稅局。

Do NOT use this form for: 下列人士請勿使用本表格

Instead, use Form: 適用表格為:

•

...…W-8BEN-E or W-8BECI

A foreign government or other foreign organization that is not claiming the applicability of section(s) 115(2), 501(c), 892, 895, or 1443(b)

任何不主張適用第 115(2)、501(c)、892、895 節或 1443(b)節規範的外國政府或其他外國組織,適用 W-8BEN-E 或 W-8ECI

•

..…………………………………………………………...………………W-8BEN or W-8BEN-E

A beneficial owner solely claiming foreign status or treaty benefits

僅主張外國身份或享有租稅協定利益的最終受益人,適用 W-8BEN 或 W-8BEN-E

•

……………………………………………………………………………………………………...…..W-8BEN-E or W-8IMY

A foreign partnership or a foreign trust

外國合夥制公司或外國信託,適用 W-8BEN-E 或 W-8IMY

•

……………………………………………W-8ECI

A person claiming that income is effectively connected with the conduct of a trade or business in the United States

主張收入與在美國境內從事之交易或業務具有效關聯的人士,適用 W-8ECI

•

……………………………………………………………………………………………………...………………………W-8IMY

A person acting as an intermediary

擔任中間機構角色者,適用 W-8IMY 表格

PART I

Identification of Beneficial Owner

第一部份

最終受益人身分

Name of organization 機構名稱

2

Country of incorporation or organization

1

註冊/成立地國家

□

□

3

Type of

Foreign government 外國政府

Foreign tax-exempt organization 外國免稅組織

entity

□

□

International organization 國際組織

Foreign private foundation 外國私人基金會

法人身分

□

□

Government of a U.S. possession 美國屬地政府

Foreign central Bank of Issue (not wholly owned by the foreign sovereign)

發行貨幣的外國中央

銀行

(非由外國主權政府完全持有)

Chapter 4 Status 第四章身份狀態

4

□

Foreign government (including a political subdivision), government of a

□

Participating FFI 有簽署協議的外國金融機構。

U.S.

□

Reporting Model 1 FFI 在模式一下應申報的外國金融機構。

possession, or foreign central bank of issue. Complete III.

□

Reporting Model 2 FFI 在模式二下應申報的外國金融機構。

外國政府(包括政治分支機構)、美國屬地政府或外國中央銀行。完成第三部

□

Registered deemed-compliant FFI (Other than a reporting Model 1

份。

FFI). 註冊視同合規的外國金融機構(排除在模式一下應申報的外國

□

Exempt retirement plans of foreign government. Complete Part III.

金融機構)

外國政府的豁免的退休計畫。完成第三部份。

□

Nonreporting IGA FFI. Complete Part III.

□

501(c)Organization. Complete Part III.

在跨政府協議下毋須申報的外國金融機構。完成第三部份。

符合第 501(c)節規範的組織。完成第三部份。

□

Territory financial institution. Complete Part V.

□

Passive NFFE. Complete Part III.消極的非金融外國法人。完成第三部份。

美國屬地金融機構。完成第三部份。

□

Direct reporting NFFE. 直接申報的非金融外國法人。

□

International organization. 國際組織。

□

Sponsored direct reporting NFFE. Complete Part III.

受贊助的直接申報的非金融外國法人。完成第三部分。

5

Permanent residence address ( street, apt. or suite no., or rural route). Do not use a P.O. box or in-care-of address. (other than a registered

address) 永久居住地址(含街道、公寓或房間號碼,或郵件投遞路線)。請勿使用郵政信箱或轉信地址(除註冊地地址之外之地址)。

City or town, state or province. Include postal code where appropriate. 城市或鄉鎮,州或省,及郵遞區號

Country 國家

Mailing address (if different from above) 郵寄地址 (若與上方永久居住地址不同)

6

City or town, state or province. Include postal code where appropriate. 城市或鄉鎮,州或省,及郵遞區號

Country 國家

8 a □ GIIN 全球中間機構識別號碼

b □ Foreign TIN(See instructions)

7

U.S. TIN, if required. (See instructions)

倘須要(詳見說明),填寫美國稅籍編號。

外國稅籍編號(詳見說明)

Reference number(s)(see instructions) 參考編號。(詳見說明)

9

PART II

Qualification Statement for Chapter 3 Status

第二部份

第三章狀態資格聲明

10 For a Foreign government: 外國政府:

a □ I certify that the entity identified in Part I is a foreign government within the meaning of section 892 and the payments are within the scope

of the exemption granted by section 892.

W-8EXP

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 25401F

Form

( Rev.4-2014)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3