Print

Reset

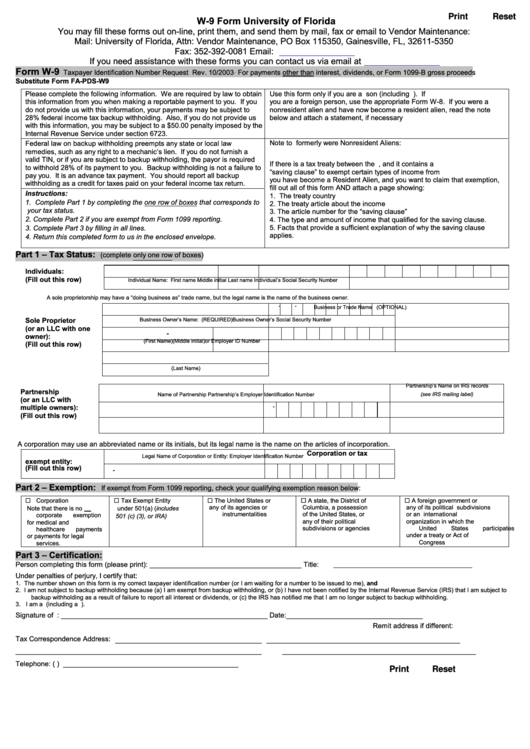

W-9 Form University of Florida

You may fill these forms out on-line, print them, and send them by mail, fax or email to Vendor Maintenance:

Mail: University of Florida, Attn: Vendor Maintenance, PO Box 115350, Gainesville, FL, 32611-5350

Fax: 352-392-0081 Email:

addvendor@ufl.edu

If you need assistance with these forms you can contact us via email at

addvendor@ufl.edu

Form W-9

Taxpayer Identification Number Request Rev. 10/2003ּ For payments other than interest, dividends, or Form 1099-B gross proceeds

Substitute Form FA-PDS-W9

Please complete the following information. We are required by law to obtain

Use this form only if you are a U.S. person (including U.S. resident alien). If

this information from you when making a reportable payment to you. If you

you are a foreign person, use the appropriate Form W-8. If you were a

do not provide us with this information, your payments may be subject to

nonresident alien and have now become a resident alien, read the note

28% federal income tax backup withholding. Also, if you do not provide us

below and attach a statement, if necessary

with this information, you may be subject to a $50.00 penalty imposed by the

Internal Revenue Service under section 6723.

Note to U.S. Resident Aliens who formerly were Nonresident Aliens:

Federal law on backup withholding preempts any state or local law

remedies, such as any right to a mechanic’s lien. If you do not furnish a

valid TIN, or if you are subject to backup withholding, the payor is required

If there is a tax treaty between the U.S. and your country, and it contains a

to withhold 28% of its payment to you. Backup withholding is not a failure to

“saving clause” to exempt certain types of income from U.S. tax even after

pay you. It is an advance tax payment. You should report all backup

you have become a Resident Alien, and you want to claim that exemption,

withholding as a credit for taxes paid on your federal income tax return.

fill out all of this form AND attach a page showing:

Instructions:

1. The treaty country

1. Complete Part 1 by completing the one row of boxes that corresponds to

2. The treaty article about the income

your tax status.

3. The article number for the “saving clause”

2. Complete Part 2 if you are exempt from Form 1099 reporting.

4. The type and amount of income that qualified for the saving clause.

5. Facts that provide a sufficient explanation of why the saving clause

3. Complete Part 3 by filling in all lines.

applies.

4. Return this completed form to us in the enclosed envelope.

Part 1 – Tax Status:

(complete only one row of boxes)

Individuals:

(Fill out this row)

Individual Name: First name

Middle initial

Last name

Individual’s Social Security Number

A sole proprietorship may have a “doing business as” trade name, but the legal name is the name of the business owner.

-

-

Business or Trade Name (OPTIONAL)

Sole Proprietor

Business Owner’s Name: (REQUIRED)

Business Owner’s Social Security Number

(or an LLC with one

-

owner):

(Fill out this row)

(First Name)

(Middle initial)

or Employer ID Number

(Last Name)

Partnership’s Name on IRS records

Partnership

Name of Partnership

Partnership’s Employer Identification Number

(see IRS mailing label)

(or an LLC with

-

multiple owners):

(Fill out this row)

A corporation may use an abbreviated name or its initials, but its legal name is the name on the articles of incorporation.

Corporation or tax

Legal Name of Corporation or Entity:

Employer Identification Number

exempt entity:

(Fill out this row)

-

Part 2 – Exemption:

If exempt from Form 1099 reporting, check your qualifying exemption reason below:

Corporation

Tax Exempt Entity

The United States or

A state, the District of

A foreign government or

any of its agencies or

Columbia, a possession

any of its political subdivisions

Note that there is no

under 501(a) (includes

instrumentalities

of the United States, or

or an international

corporate exemption

501 (c) (3), or IRA)

any of their political

organization in which the

for medical and

subdivisions or agencies

United States participates

healthcare payments

under a treaty or Act of

or payments for legal

Congress

services.

Part 3 – Certification:

Person completing this form (please print): _______________________________________

Title:

Under penalties of perjury, I certify that:

1.

The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2.

I am not subject to backup withholding because (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to

backup withholding as a result of failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding.

3.

I am a U.S. Person (including a U.S. resident Alien).

Signature of U.S. Person: _____________________________________________________

Date: ___________________________________

Remit address if different:

____________________________

_____________________________________

Tax Correspondence Address:

_______________________________________________

_____________________________________

Telephone: (

) _____________________________________________

Print

Reset

1

1