County Of Alameda Substitute Irs Form W-9 - Request For Taxpayer Identification Number And Certification - 2009

ADVERTISEMENT

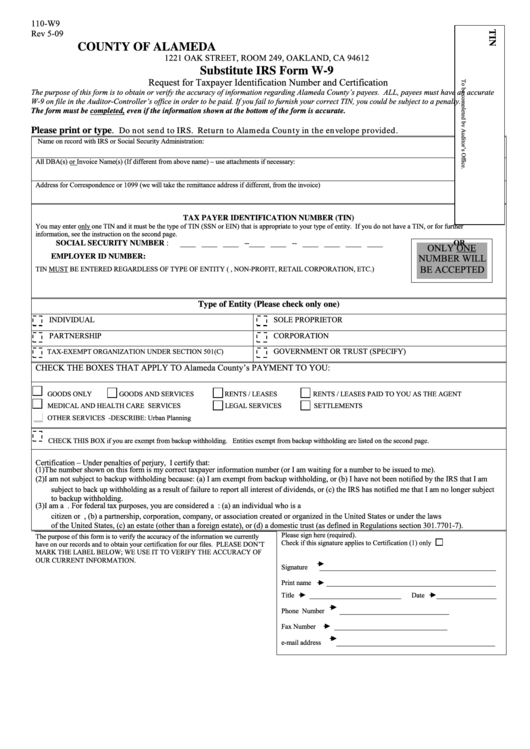

110-W9

Rev 5-09

COUNTY OF ALAMEDA

1221 OAK STREET, ROOM 249, OAKLAND, CA 94612

Substitute IRS Form W-9

Request for Taxpayer Identification Number and Certification

The purpose of this form is to obtain or verify the accuracy of information regarding Alameda County’s payees. ALL, payees must have an accurate

W-9 on file in the Auditor-Controller’s office in order to be paid. If you fail to furnish your correct TIN, you could be subject to a penalty.

The form must be completed, even if the information shown at the bottom of the form is accurate.

Do not send to IRS. Return to Alameda County in the envelope provided.

Please print or type.

Name on record with IRS or Social Security Administration:

All DBA(s) or Invoice Name(s) (If different from above name) – use attachments if necessary:

Address for Correspondence or 1099 (we will take the remittance address if different, from the invoice)

TAX PAYER IDENTIFICATION NUMBER (TIN)

You may enter only one TIN and it must be the type of TIN (SSN or EIN) that is appropriate to your type of entity. If you do not have a TIN, or for further

information, see the instruction on the second page.

SOCIAL SECURITY NUMBER :

____ ____ ____ -- ____ ____ -- ____ ____ ____ ____

OR

ONLY ONE

NUMBER WILL

EMPLOYER ID NUMBER:

BE ACCEPTED

TIN MUST BE ENTERED REGARDLESS OF TYPE OF ENTITY (I.E., NON-PROFIT, RETAIL CORPORATION, ETC.)

Type of Entity (Please check only one)

INDIVIDUAL

SOLE PROPRIETOR

PARTNERSHIP

CORPORATION

GOVERNMENT OR TRUST (SPECIFY)

TAX-EXEMPT ORGANIZATION UNDER SECTION 501(C)

CHECK THE BOXES THAT APPLY TO Alameda County’s PAYMENT TO YOU:

GOODS ONLY

GOODS AND SERVICES

RENTS / LEASES

RENTS / LEASES PAID TO YOU AS THE AGENT

MEDICAL AND HEALTH CARE SERVICES

LEGAL SERVICES

SETTLEMENTS

OTHER SERVICES - DESCRIBE: Urban Planning

CHECK THIS BOX if you are exempt from backup withholding. Entities exempt from backup withholding are listed on the second page.

Certification – Under penalties of perjury, I certify that:

(1) The number shown on this form is my correct taxpayer information number (or I am waiting for a number to be issued to me).

(2) I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the IRS that I am

subject to back up withholding as a result of failure to report all interest of dividends, or (c) the IRS has notified me that I am no longer subject

to backup withholding.

(3) I am a U.S. citizen or other U.S. person. For federal tax purposes, you are considered a U.S. person if you are: (a) an individual who is a U.S.

citizen or U.S. resident alien, (b) a partnership, corporation, company, or association created or organized in the United States or under the laws

of the United States, (c) an estate (other than a foreign estate), or (d) a domestic trust (as defined in Regulations section 301.7701-7).

Please sign here (required).

The purpose of this form is to verify the accuracy of the information we currently

Check if this signature applies to Certification (1) only

have on our records and to obtain your certification for our files. PLEASE DON’T

MARK THE LABEL BELOW; WE USE IT TO VERIFY THE ACCURACY OF

OUR CURRENT INFORMATION.

Signature

__________________________________________________

Print name

________________________________________________

Title

__________________________

Date

_________________

Phone Number

_______________________________

Fax Number

________________________________

e-mail address

_____________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2