Reset Form

Print and Reset Form

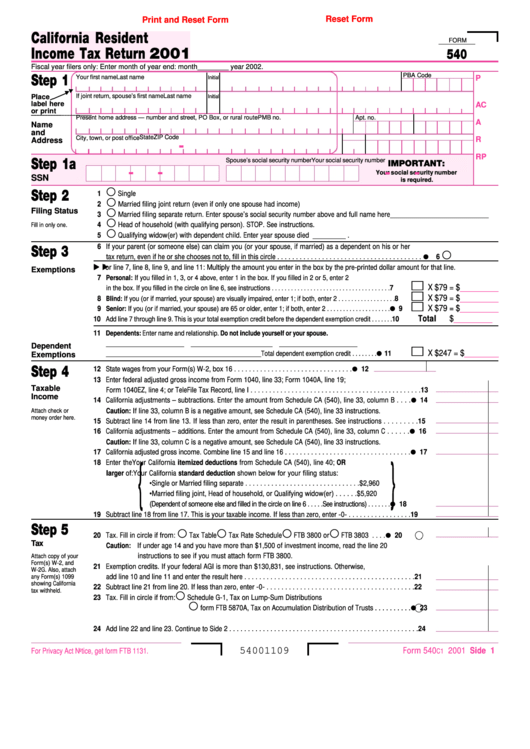

California Resident

FORM

Income Tax Return 2001

540

Fiscal year filers only: Enter month of year end: month________ year 2002.

PBA Code

Step 1

Your first name

Initial

Last name

P

If joint return, spouse’s first name

Last name

Place

Initial

label here

AC

or print

___________

___________

___________

___________

___________

Present home address — number and street, PO Box, or rural route

Apt. no.

PMB no.

A

Name

and

State

ZIP Code

City, town, or post office

R

Address

-

RP

Step 1a

Your social security number

Spouse’s social security number

IMPORTANT:

-

-

-

-

Your social security number

SSN

is required.

Step 2

1

Single

2

Married filing joint return (even if only one spouse had income)

Filing Status

3

Married filing separate return. Enter spouse’s social security number above and full name here ___________________________

4

Head of household (with qualifying person). STOP. See instructions.

Fill in only one.

5

Qualifying widow(er) with dependent child. Enter year spouse died _________ .

6 If your parent (or someone else) can claim you (or your spouse, if married) as a dependent on his or her

Step 3

¼

tax return, even if he or she chooses not to, fill in this circle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

For line 7, line 8, line 9, and line 11: Multiply the amount you enter in the box by the pre-printed dollar amount for that line.

Exemptions

7

Personal: If you filled in 1, 3, or 4 above, enter 1 in the box. If you filled in 2 or 5, enter 2

X $79 =

$_________

in the box. If you filled in the circle on line 6, see instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

X $79 =

$_________

8

Blind: If you (or if married, your spouse) are visually impaired, enter 1; if both, enter 2 . . . . . . . . . . . . . . . . . .

8

¼

X $79 =

$_________

9

Senior: If you (or if married, your spouse) are 65 or older, enter 1; if both, enter 2 . . . . . . . . . . . . . . . . . . . .

9

Total

$_________

10

Add line 7 through line 9. This is your total exemption credit before the dependent exemption credit . . . . . . .

10

11

Dependents: Enter name and relationship. Do not include yourself or your spouse.

______________________ _______________________ ______________________

Dependent

¼

X $247 =

$________

11

______________________ _______________________ Total dependent exemption credit . . . . . . . .

Exemptions

¼

Step 4

12 State wages from your Form(s) W-2, box 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13 Enter federal adjusted gross income from Form 1040, line 33; Form 1040A, line 19;

Taxable

Form 1040EZ, line 4; or TeleFile Tax Record, line I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

¼

Income

14 California adjustments – subtractions. Enter the amount from Schedule CA (540), line 33, column B . . . .

14

Caution: If line 33, column B is a negative amount, see Schedule CA (540), line 33 instructions.

Attach check or

money order here.

15 Subtract line 14 from line 13. If less than zero, enter the result in parentheses. See instructions . . . . . . . . . 15

¼

16 California adjustments – additions. Enter the amount from Schedule CA (540), line 33, column C . . . . . .

16

Caution: If line 33, column C is a negative amount, see Schedule CA (540), line 33 instructions.

¼

17 California adjusted gross income. Combine line 15 and line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

18 Enter the

Your California itemized deductions from Schedule CA (540), line 40; OR

{

{

larger of:

Your California standard deduction shown below for your filing status:

• Single or Married filing separate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $2,960

• Married filing joint, Head of household, or Qualifying widow(er) . . . . . . $5,920

¼

(Dependent of someone else and filled in the circle on line 6 . . . . . See instructions)

. . . . . . .

18

19 Subtract line 18 from line 17. This is your taxable income. If less than zero, enter -0- . . . . . . . . . . . . . . . . .

19

Step 5

¼

20 Tax. Fill in circle if from:

Tax Table

Tax Rate Schedule

FTB 3800 or

FTB 3803 . . . .

20

Tax

Caution: If under age 14 and you have more than $1,500 of investment income, read the line 20

instructions to see if you must attach form FTB 3800.

Attach copy of your

Form(s) W-2, and

21 Exemption credits. If your federal AGI is more than $130,831, see instructions. Otherwise,

W-2G. Also, attach

add line 10 and line 11 and enter the result here . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

any Form(s) 1099

showing California

22 Subtract line 21 from line 20. If less than zero, enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22

tax withheld.

23 Tax. Fill in circle if from:

Schedule G-1, Tax on Lump-Sum Distributions

¼

form FTB 5870A, Tax on Accumulation Distribution of Trusts . . . . . . . . . .

23

24 Add line 22 and line 23. Continue to Side 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

54001109

Form 540

2001 Side 1

For Privacy Act Notice, get form FTB 1131.

C1

1

1 2

2